- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,163

An assertion is not a demonstration. When combined with the extremely low unemployment rate and extremely high real wages, the prime-age LFP approaching all-time highs is key info (if it were not so strong, one would question whether we have more room to grow).Prime-age LFP has barely moved the past 4 decades, it was higher during and after recessions and is a subset of total LFP which is almost 1 point lower. I'm not sure why you are dying on it's hill when it's shown to be increasingly poor at describing any economic situation in the past 40 years.

Premise is wrong. Real median wages are higher now than they were in January 2022.If composition was the whole case, explain why in January 2022 had low unemployment and higher real wages than we had in January 2024. January 2022 being almost two years after the pandemic layoffs. If the economy is booming, how come there is no real wage growth since then? Again, it points more towards a stagnant economy than a booming one. Booming economies grow, stagnant economies stay the same.

More generally, what it means to say that it's a composition issue is that when unemployment rises and is high, lower-paid workers are disproportionately likely to lose their jobs so even if everyone's wages individually stagnate, the median rises because of lower-paid workers dropping out from consideration. Then as the unemployment falls and becomes low (both the level and delta matter here), lower-paid workers return, and even if everyone is getting a raise, the median can fall. If you don't adjust for that factor, you end up falsely concluding the recessions are good for workers.

See above on this. What is your prediction about inflation over the next year?You haven't proven anything has been wrong with my imputed rent analysis. The Bureau for Economic Analysis resource I linked a few pages ago also agrees with me. And the reality of consumer debt also agrees with me, if real wage growth was so high, how come consumers are taking on so much additional debt? Especially when the number one debt asset by far is mortgages. And since number of mortgages are down sharply, the debt can be assumed to be non-mortgage related, which is especially bad.

Also please answer this: do you believe that the cost of housing increased by a total of 2% from 2021 to 2023, despite mortgage costs being up 33%?

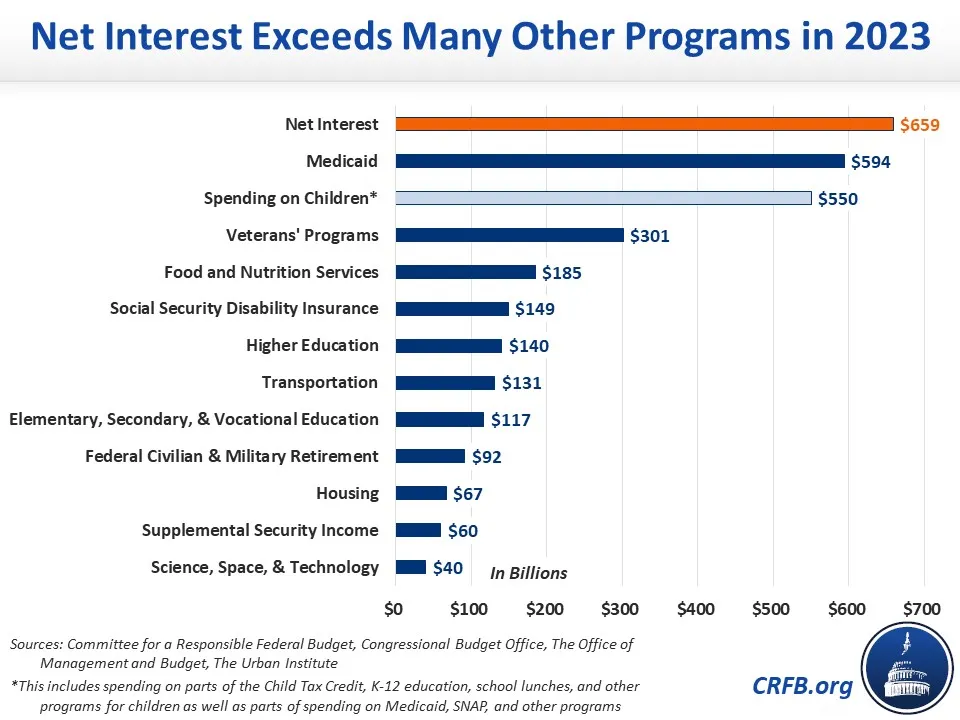

Ultimately this is going to be an argument of wait and see. In 2 years the effects of continued inflation and elevated interest rates are going to further propagate throughout the economy.