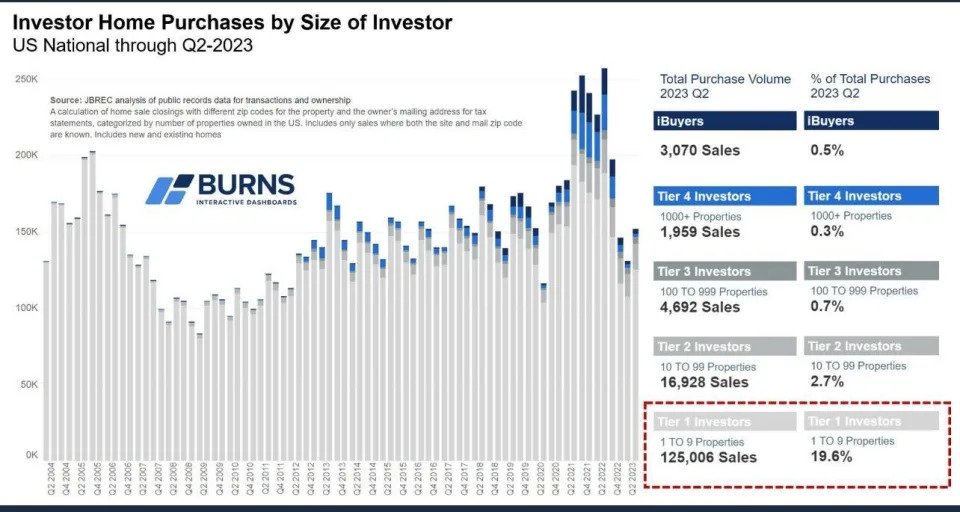

Corporate investors account for only a fraction of the housing stock, in fact its about 2.5% at its highest which is 1/10th the number you cited

The vast majority of investors are small ones, so called "mom and pop" investors

The people buying these properties are usually older homeowners who have extra cash to invest in a 2nd rental property. These people got an influx of cash with the COVID bucks and then used the low interest rate to buy up homes and drive the prices up beyond the reach of first time buyers during the pandemic. The fact that 30% of homes are owned by investors is not in and of itself the problem though, its the fact that there is low housing stock so only older, financially secure households have the money to invest in housing. These small investors overlap with the boomer homeowner that tries to block any multifamily housing in their area. They already own their own home and because of this try to block new housing to protect their home value while also buying up the remaining SFH stock to rent out. Quite the diabolical plan if you ask me.