- Joined

- Jun 1, 2007

- Messages

- 37,171

- Reaction score

- 61,342

JFC I did!Notice that I asked two simple questions. You wrote this long, hackish response but you didn't answer either. Why is that?

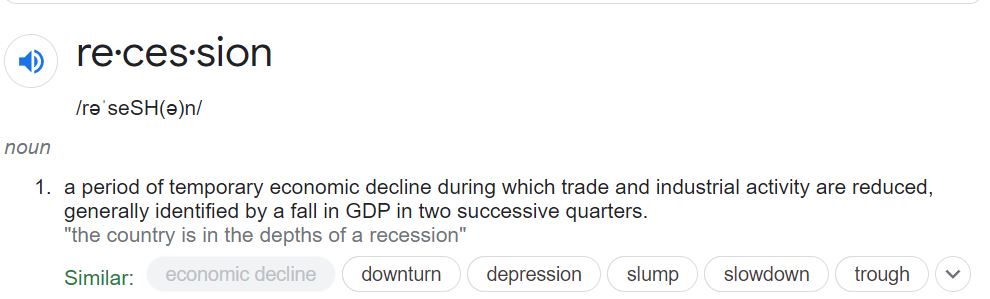

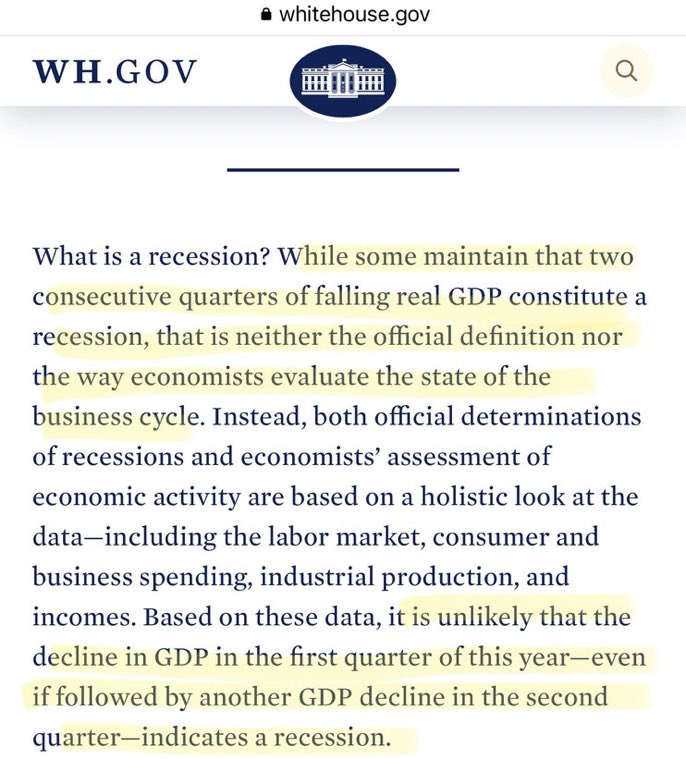

1. yes they are redefining the commonly held understanding of what a recession is to suit themselves.

If they weren’t trying to get ahead of it, they wouldn’t need to put out a statement saying, “yeah everyone and their mother knows it’s 2 consecutive quarters of negative GDP growth but actually it isn’t! Also inflation was because we’re doing so well!”