- Joined

- Jan 2, 2015

- Messages

- 16,979

- Reaction score

- 13,868

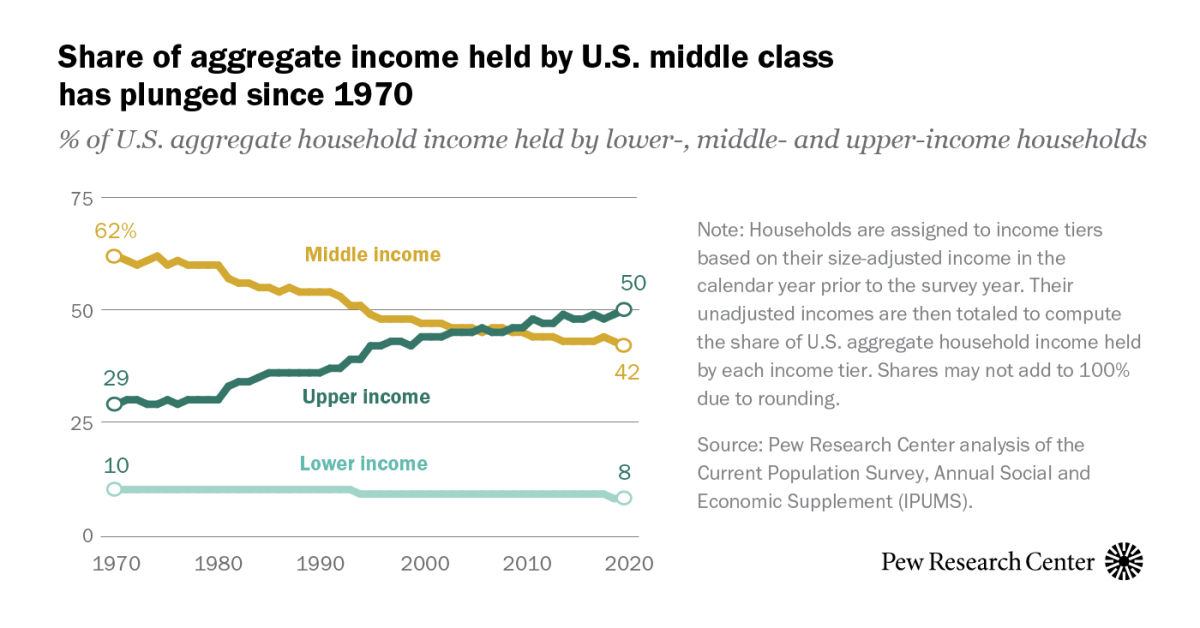

Licking the ultra wealthy's nuts just makes you look like a giant cuck. It's almost the most emasculating thing you could do.Too bad you don't get to decide who gets to exist then, I guess.

You'll have to just work harder and stop eyeing other people's money.

And by billionaires not existing, I mean taxing them to the point where they're not billionaires not what you seem to be suggesting. There is no case for someone needing that kind of money nor "earning" it.