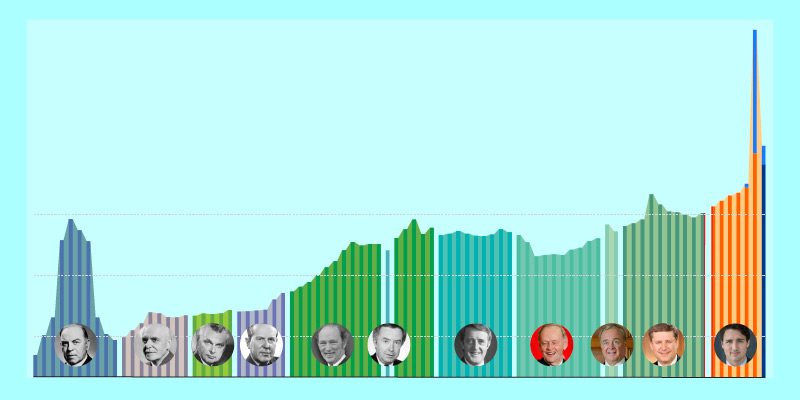

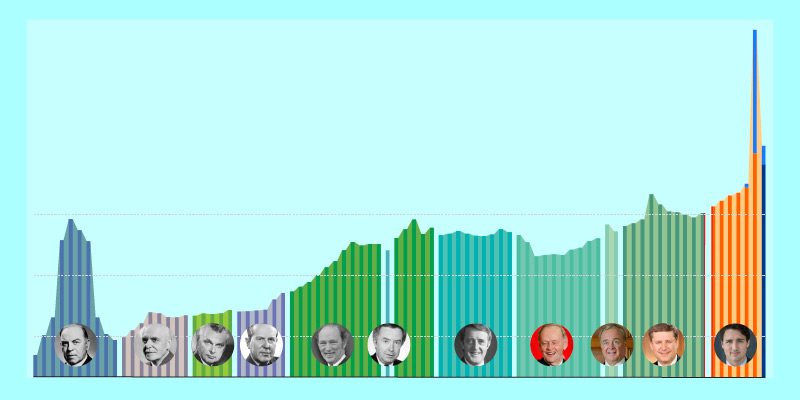

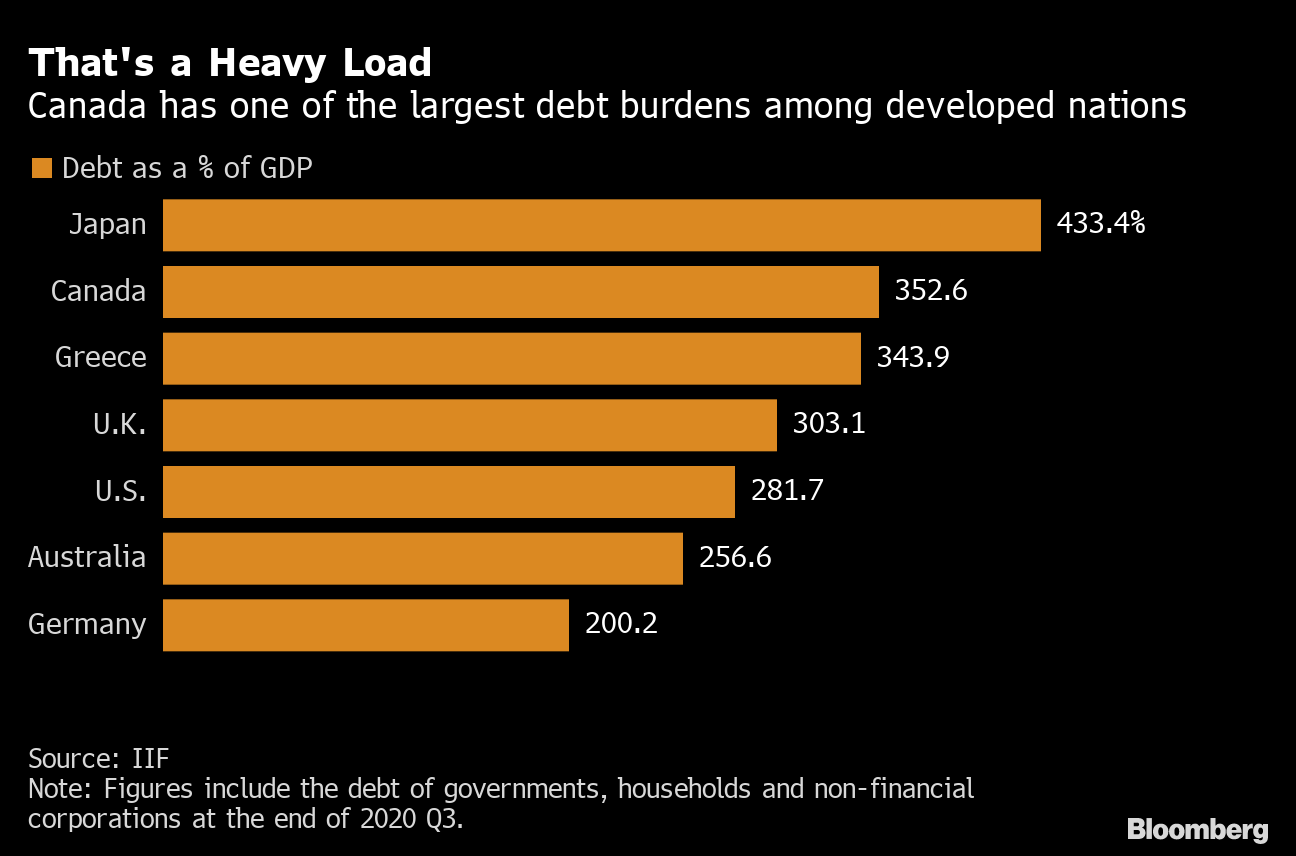

Fiscal Capacity

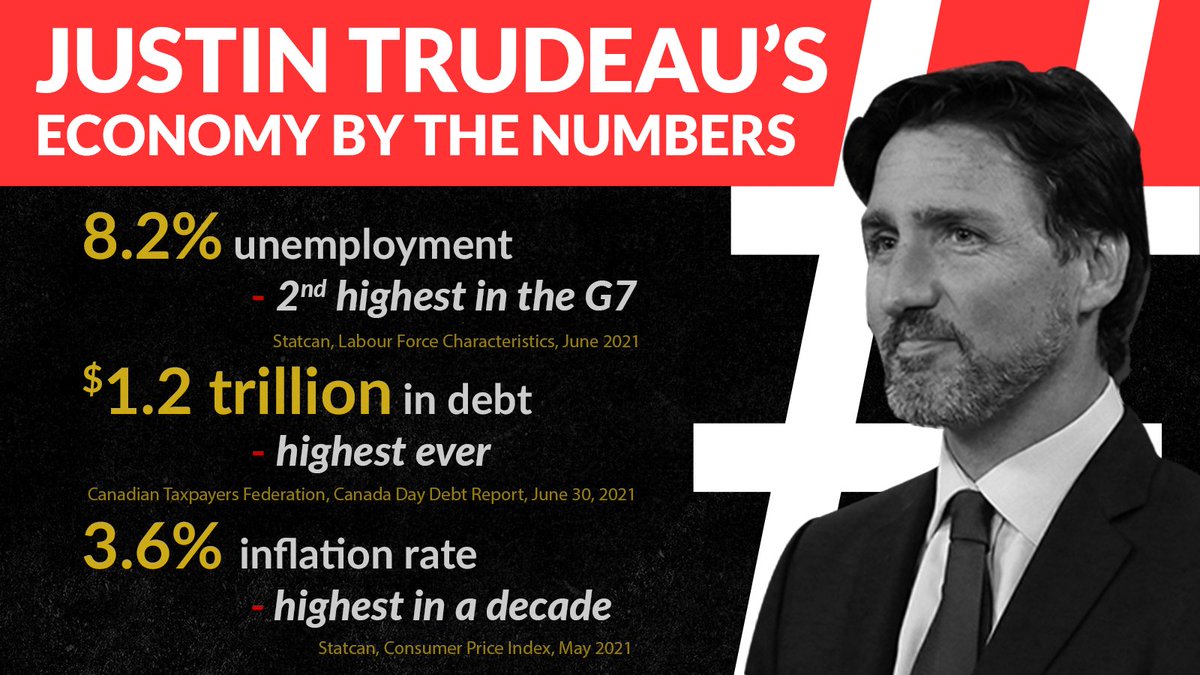

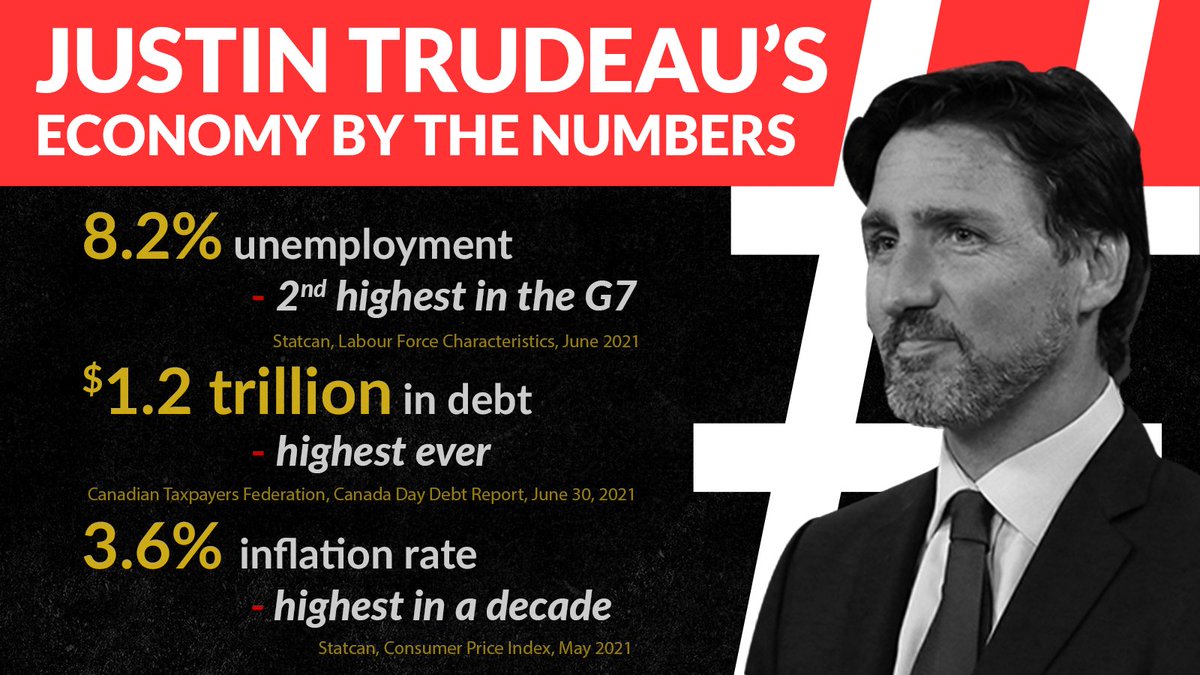

Economists give the prime minister high marks for acting quickly, but the end result has been an overshoot. Government transfers to households increased by C$119 billion in 2020 from a year earlier, versus a decline of just C$6 billion in regular income.

There’s still the prospect that some of the excess savings will flow back into the economy sooner than anticipated, fueling an even strong recovery in 2021.

Fourth-quarter growth was

stronger than anticipated, adding to optimism about a rebound fueled in part by climbing prices for oil, the country’s top export, though official data revealed some underlying problems as well. Both business investment and household consumption remain soft.