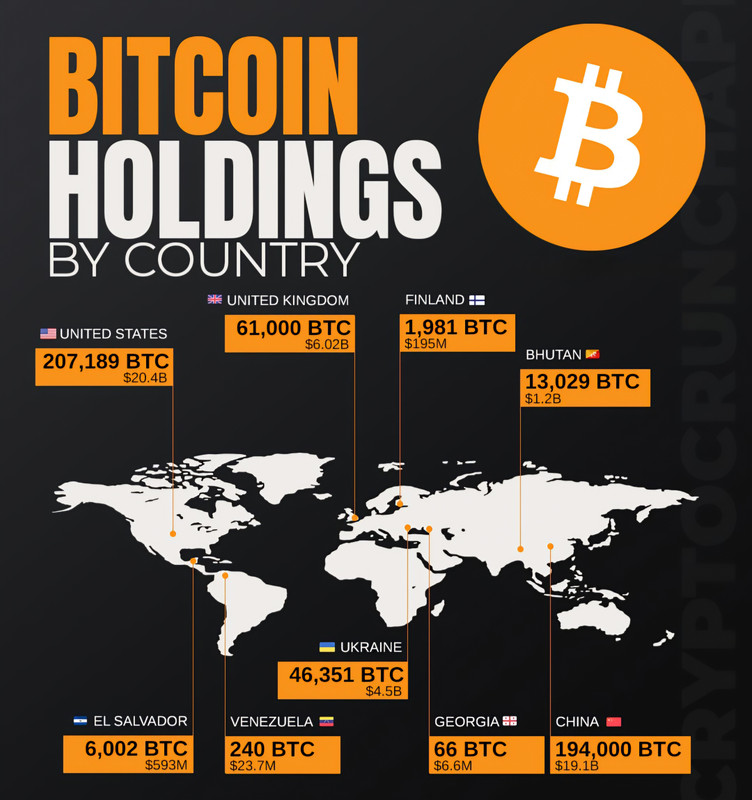

Bitcoin, not Crypto. A decentralized fixed supply, absolute scarcity. It's also no less (if not more) divisible, durable, fungible, and portable in addition to being censorship resistant. But that's neither here nor there from a nation-state perspective, and it certainly isn't helpful to look at it as adversarial to the USD given the status it holds as the world's reserve currency. It's a commodity, and the purpose of the US Gov holding it would be in the form of reserve capital. Are we thinking the speculative "bubble" bursts before or after it flips Gold (which I hold and love) as the most valuable asset in the world? Traders are thirsty for government and institutional adoption, HODLers take their bags offline into cold storage 10 million Sats at a time and don't give a shit. Neither does BTC.