- Joined

- Jun 1, 2007

- Messages

- 37,247

- Reaction score

- 61,433

My goodness. I thought you couldn’t get any dumber, but then you respond with this.The goalposts have not been moved a single inch, the definitions are clear, you simply don't understand them

Yes, the US is a currency, gold, real estate and BTC aren't.

Who said it was illegitimate? its simply not a currency.

You are the one that keeps changing established definitions and moving the goalposts.

BTC is not used as "medium of exchange" anywhere, nobody is pricing anything in BTC which is the very definition of what a "medium of exchange is"

I am a Mesopotamian farmer, i want a slave, i sell crops for silver at a given SILVER price and then use that silver to buy a slave at a given SILVER price.

You use BTC to buy USD or another real currency or you sell BTC for a real currency.

Art? yes although has subjective value to the buyer

Gold? has practical use.

collectibles? again subjective value to buyer

Real Estate? practical use.

And an store of value all of those cost next to nothing to keep, Real Estate is probably the only one that carries a cost but then again you can rent Real Estate so it evens out.

- Currency trading is indeed for the most part gambling.

- Growth stock and Venture capitals are based on potential profits of the venture itself, if the venture fizzles out then yeah, its a loss.

-Gold has practical uses and costs next to nothing to keep.

Yup and the performance of the asset is 100% entirely dependent on people buying high and selling low, it by definition requires people to lose money.

Purchasing power isn't eroded by inflation, only if you are dumb enough to keep fiat money buried in the yard for decades.

Its the best asset, until it isn't.

You’re confusing rigidity with clarity. Definitions evolve as systems evolve. The internet wasn’t a “real marketplace” at first either, but here we are. Clinging to textbook definitions as if they’re immune to innovation is exactly why people miss paradigm shifts.

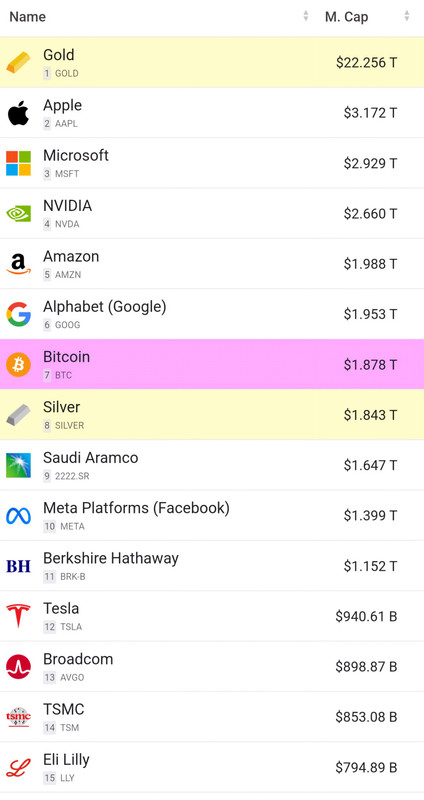

Gold and real estate aren’t currencies, but they have both functioned as stores of value and mediums of exchange historically. So has salt. So has cattle. Bitcoin is following a similar adoption curve — not as legal tender everywhere, but as an asset that’s increasingly used for payment, value transfer, and wealth preservation.

Saying nothing is priced in Bitcoin just isn’t accurate. There are thousands of merchants that accept it directly, from global brands to local shops. Entire economies like El Salvador are experimenting with it as currency. You can dismiss those as niche, but they’re real examples that contradict your claim. That’s how new systems start — gradually, then suddenly.

Your Mesopotamian analogy is colorful, but irrelevant. Ancient silver was valuable because people agreed on its weight and scarcity. That’s exactly how Bitcoin works! I don’t understand how you daily to see this. It is digitally scarce, globally verifiable, and trustless. You don’t have to like it, but you should at least understand the parallel.

As for your argument that Bitcoin is only profitable because someone loses money…again, that’s how all markets work.

Every buyer thinks they’re paying a fair price, and every seller thinks they’re getting one. Stocks, housing, gold, and even currency exchange function the same way. If you truly believe any appreciation-based asset is inherently exploitative, then you’re arguing against the entire concept of free markets.

Saying inflation doesn’t erode purchasing power unless you bury your cash is the stupidest thing I’ve ever heard. Inflation erodes purchasing power by definition. This is why a dollar in 1950 could buy 20 times more than it does now. It affects everyone, especially the lower and middle class. That’s not a theory, that’s economic math.

You’re welcome to keep believing the current system is perfect and Bitcoin is pointless. But if your whole argument is “because the textbook says so,” you’ve already lost the plot.

If you don’t want to call it a currency because it’s not fiat, fine. It’s closer to a commodity and may one day be a ubiquitous currency alongside fiat. I doubt that will happen. Maybe that’s why you’re so upset and keep showing your ignorance. If you are better calling it a commodity that is fine with me. It’s a 2 trillion dollar — soon to be 10 trillion dollar by market cap commodity. It’s not a Ponzi scheme.