Well, kind of. But that doesn't have anything to do with what I said. I said that the U.S. barely taxes the middle class, and that's a big part of why we can't afford the kinds of services that a lot of other developed countries have. What I said is true and an important thing for the left to think about (to get programs that leftists want, they have to break that resistance to taxing the middle class rather than playing into it). Why should that subject me to personal attacks?

That's just not true, though. Look at ETRs up and down the income scale in America. That's very obviously true if we're just talking about income taxes, but it's also still true including all taxation. Maybe the one kernel of truth there is that high earners (top 10%) who aren't at the tippy top have a total burden that is relatively higher than people who are at the top.

Rightists want to cut income taxes, especially the top rate, because they know that rich people pay most of them. And, yeah, they want to offset that someone with stuff like sales taxes and tariffs. But you're not seeing rightists pushing for higher income taxes on anyone.

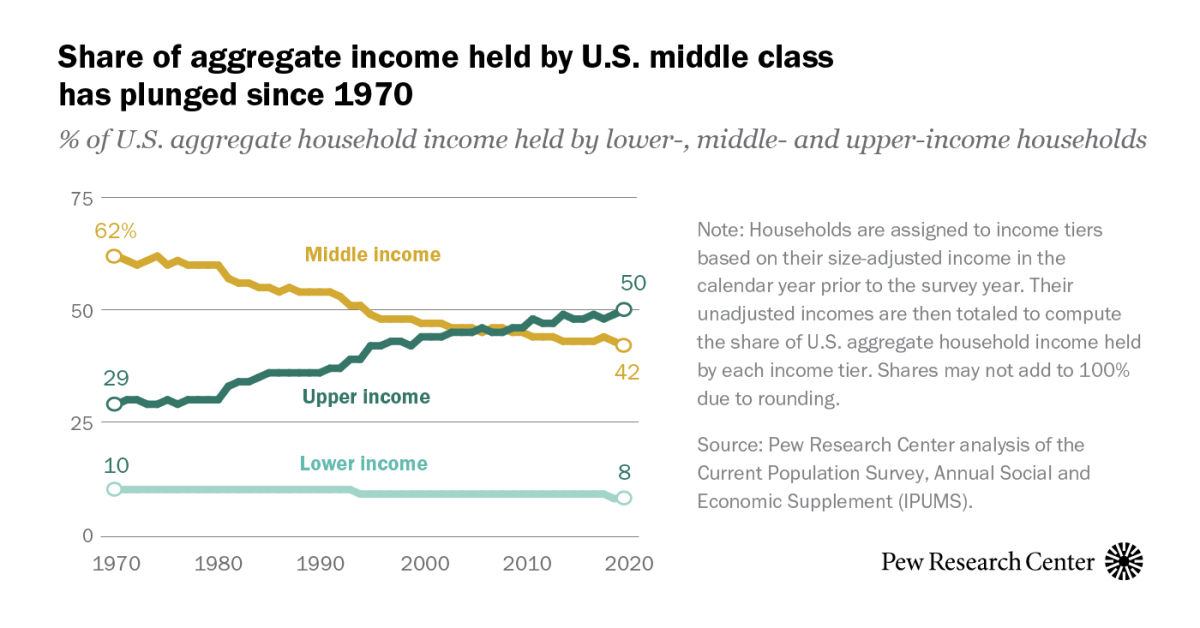

We lost the most robust iterations of social programs alongside with HUGE cuts of the corporate tax rates, not solely because of cuts in tax rates that effect the working class. It's just a weird contention make KNOWING where the most money that could be taxed is in the US, because its NOT the incomes of the working class. And each time the "trickle-down" d*ckheads take power and de-regulate + depower Unions + cut taxation that effects the wealthy, we go headlong into some economic crisis that Democrats usually end up having to clean up...which ALSO involves subsidization (bailouts).

Anyone who has income that is "unrealized capital gains" and who is less effected by regressive State taxes (paired with the fact that many States are now waving corporate taxes entirely and funding that with HIGHER sales taxes) have a distinct advantage of percent of their income going to taxes:

A recent study finds that the Forbes 400 paid an effective tax rate of 8.2 percent over recent years—lower than many middle-class Americans.

www.americanprogress.org

Oh we dont see rightists pushing for that do we?

"Project 2025’s tax plan includes an “intermediate tax reform” that includes changes to tax brackets and corporate tax cuts that would shift the tax burden toward middle-income households. And the “fundamental tax reform” it proposes would replace all individual income and corporate taxes with consumption taxes.

Specifically, Project 2025’s tax reform plan would:

Enact a two-income tax bracket system that would raise taxes by $3,000 for the median family of four—which makes about $110,000 a year—and raise taxes by $950 for the typical single-person household, which makes about $40,000 a year. (see Appendix for state-specific data)

Provide an average $1.5–2.4 million tax cut for the 45,000 U.S. households making more than $10 million annually from the combination of the “two-bracket” system and cuts to taxes on the wealthy’s investment income.

Cut the corporate tax rate to 18 percent, which amounts to a $24 billion tax cut for the Fortune 100.

Replace all individual and corporate income taxes with a consumption tax in the long term. This could take the form of a value-added tax well above 45 percent, which would produce an enormous one-time burst of inflation and raise prices.

The shift toward a flat consumption tax while eliminating income taxes would lead to an average $5,900 tax increase for the middle 20 percent of households and an average $2 million tax cut for the top 0.1 percent.

Project 2025’s new tax bracket system, however, represents an enormous shift of the tax burden from wealthy tax filers to middle-income tax filers. This is because the two current bottom brackets (10 percent and 12 percent) are lower than the 15 percent tax bracket proposed by Project 2025. This effectively raises the tax rate on a married couple’s income between about $30,000 and $120,000 and on a single filer’s income between about $15,000 and $60,000. Higher-income tax filers, on the other hand, would get a tax cut, as the proposed 30 percent tax bracket is lower than the current 32 percent, 35 percent, and 37 percent brackets that much of their income falls into.*

The end result of these changes would be a tax increase for middle-class households. The median family of four made about $110,000 in 2022 and would experience about a $3,000 tax increase from this change. They would experience a tax increase in all 50 states outside of Washington, D.C., where the median family of four—making $195,000 in income—would experience a tax cut. In addition, the median one-person household made about $40,000 in 2022 and would experience a $950 tax increase under the plan. They would also experience a tax increase in all 50 states, as well as Washington, D.C. (see Appendix)

Project 2025 also “eliminates most deductions, credits and exclusions.” The calculations above do not include the effects of removing these tax provisions since it is not known which ones Project 2025 would eliminate and many middle-income households do not use many of them, such as the mortgage interest deduction, since they take the standard deduction. If Project 2025 were to eliminate the child tax credit and earned income tax credit, the tax increases on low- and middle-income families would be even larger."