- Joined

- Jan 29, 2015

- Messages

- 62,769

- Reaction score

- 22

In an ideal America

What kind of steps are needed to make it an ideal America? What other features does an ideal America have?In an ideal America

Life isn’t black and white like you think it is. There are lots of colors in between. You honestly think people will quit their jobs in mass because they get a couple grand a month? I don’t know about you but a thousand or 2 thousand a month ain’t shit. I would literally take that money and save it for retirement. You need to expand your thinking

UBI is just undeserved welfare for the masses.

Who is going to work when they have a check every month for nothing?

yeah, undeserved

definitely not like mega corporations that make billions of dollars in profits and yet people little to no taxes and constantly get billions in handouts on top of paying very little taxes

you are a clown

Where are you getting this from? Your pro and con say the opposite thing and you're directly contradicting yourself. There are a number of different ways to fund a UBI. Acting like the only way you can fund it is by "taking money from the poor" is just silly.

- Universal Basic Income (UBI) takes money from the poor and gives it to everyone, increasing poverty and depriving the poor of needed targeted support.

Yeah, it's almost as if human life should be about something other than being a productive cog in an economic machine. Human beings have numerous different traits and attributes that are important for a meaning and fulfilled life, but the only attribute that capitalism selects for is economic productivity. We live in a highly advanced industrial era and there is an excess of abundance and resources to go around. Human beings should be free to develop their lives in the ways that they see fit, not stuck in a cubicle or on a fry cook line having their labor exploited for billionaires.

- UBI removes the incentive to work, adversely affecting the economy and leading to a labor and skills shortage.

Nonsense. We have trillions of dollars readily available for maintaining global imperialism and building machines for murdering each other. Government programs only suddenly become "too expensive" when they're programs aimed at actually improving peoples lives.

- UBI is too expensive.

I don't know about steps to take.What kind of steps are needed to make it an ideal America? What other features does an ideal America have?

I wouldn't quit working. But I would definitely quit working a mentally stressful professional job 40-60 hours a week for $80K or so. I would just go do something easy like flip burgers for 15-20 hours a week, and make $40K or so.Life isn’t black and white like you think it is. There are lots of colors in between. You honestly think people will quit their jobs in mass because they get a couple grand a month? I don’t know about you but a thousand or 2 thousand a month ain’t shit. I would literally take that money and save it for retirement. You need to expand your thinking

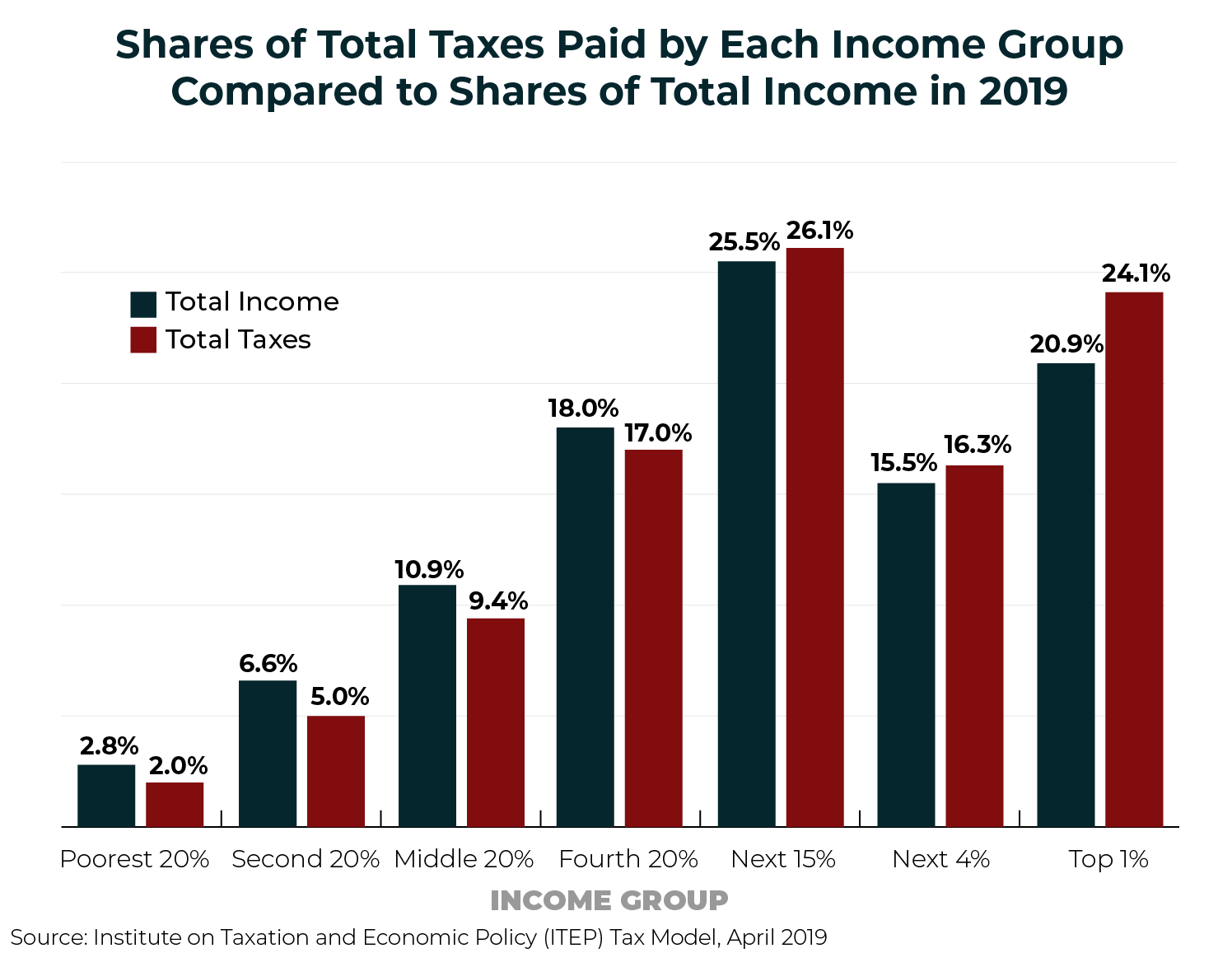

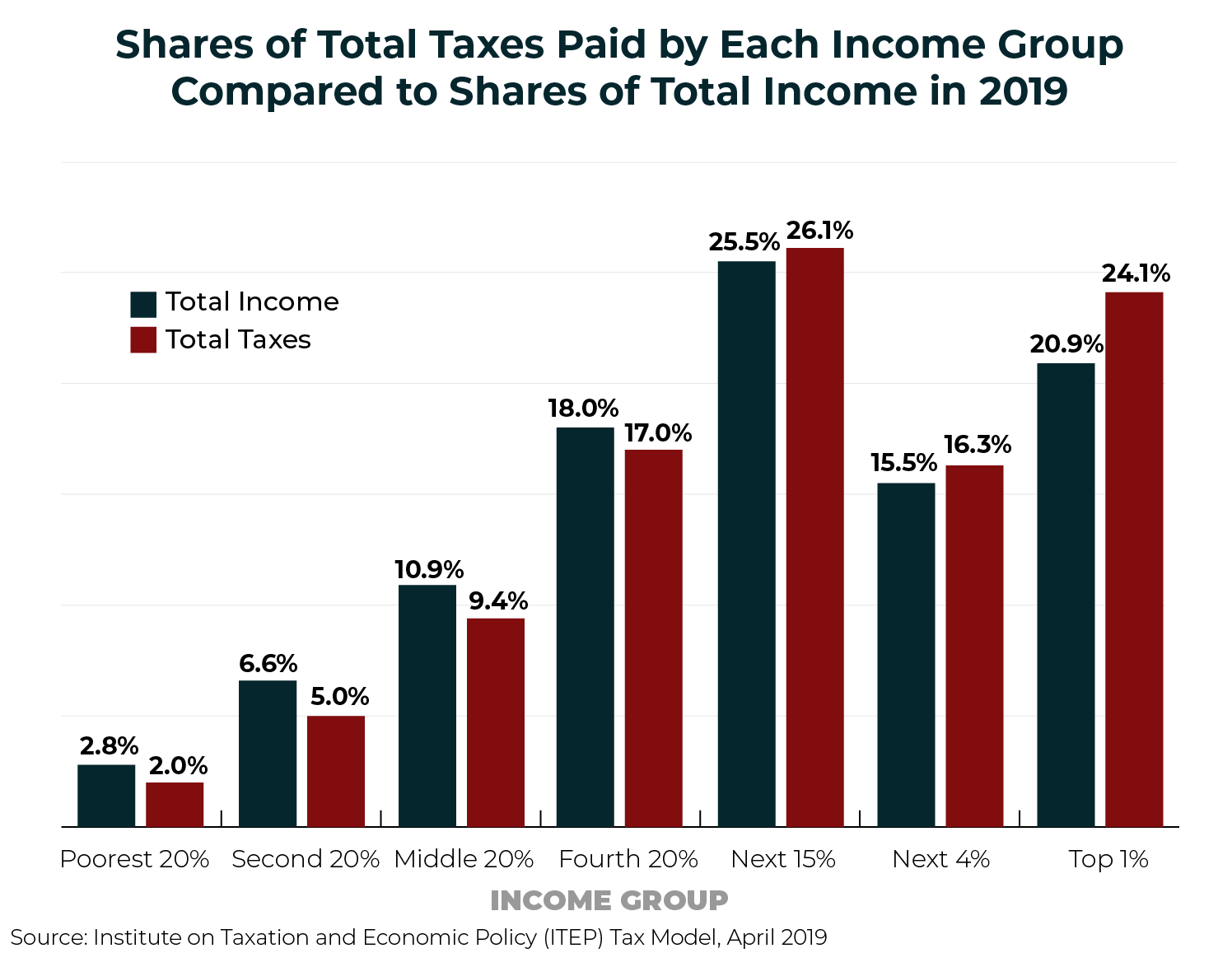

Yeah these are high income individual earners paying those taxes, not corporations.Correct me if I'm wrong, but don't a small portion of upper income earners pay a majority of the taxes - taking the U.S. as an example? How do corporations fit into that? I think I've seen @JudoThrowFiasco talk about this. Could someone who knows a bit on this clarify? Sadly, I'm largely ignorant and haven't looked beyond talking points.

(for reference, article below talking about upper income earners - still interested in how corporations fit into this)

Top 3% of U.S. Taxpayers Paid Majority of Income Tax in 2016

https://www.bloomberg.com/news/arti...xpayers-paid-majority-of-income-taxes-in-2016

You start banning travel, control who can or can't leave the country, etc. Why does this sound familiar?Also, if implemented as a non global system, this will undoubtedly place a greater tax burden on the wealthy. I don't have a problem with that in principle but, since (insert country trying the UBI) isn't the only game in town, how do we stop the golden geese paying for it from flying to the other country down the street where they're not trying UBI?

Yeah these are high income individual earners paying those taxes, not corporations.

Besides that, the truly ultra rich elite don't really make an income. They have hundreds of millions or billions of dollars from inheritance/investment/etc/etc and they only pay capital gains, because they don't actually earn an income from doing anything.

Also, your statistic is incorrect.

The top 1% paying 24% in taxes because they're making the lions share of the income.

Again returning to the topic, these are high earning individuals, not corporations.

Better a clown than a leech with no pride or work ethic.yeah, undeserved

definitely not like mega corporations that make billions of dollars in profits and yet people little to no taxes and constantly get billions in handouts on top of paying very little taxes

you are a clown

You start banning travel, control who can or can't leave the country, etc. Why does this sound familiar?

Interesting. Could you break down why the Bloomberg article's numbers are incorrect and the numbers from ITEP's tax model are for me? I'm not an economist or anything, and this stuff is a bit out of my area of expertise. I wasn't really endorsing those numbers so much as displaying some of the types of talking points that I can neither verify or deny in an informed way.

Also, noted on the corporations. Any idea how corporations fit into the whole scheme? That was one of my original questions.

The Institute on Taxation and Economic Policy is a non-profit, non-partisan think tank that works on state and federal tax policy issues.

The corporate income tax raised $297.0 billion in fiscal 2017, accounting for 9 percent of total federal revenue.

Of course they would. I would. If you hand everything to everyone, what incentive do they have to go out and earn anything? I'm not going to my 9-5 job anymore if I'm getting a couple of grand a month to sit on my ass.

I could live pretty comfortably off of two grand a month. On top of that, I would probably qualify for other social assistance as well.

I'm educated, make a good income and pay my fair share of taxes.Better a clown than a leech with no pride or work ethic.