- Joined

- Jun 26, 2012

- Messages

- 30,843

- Reaction score

- 38,238

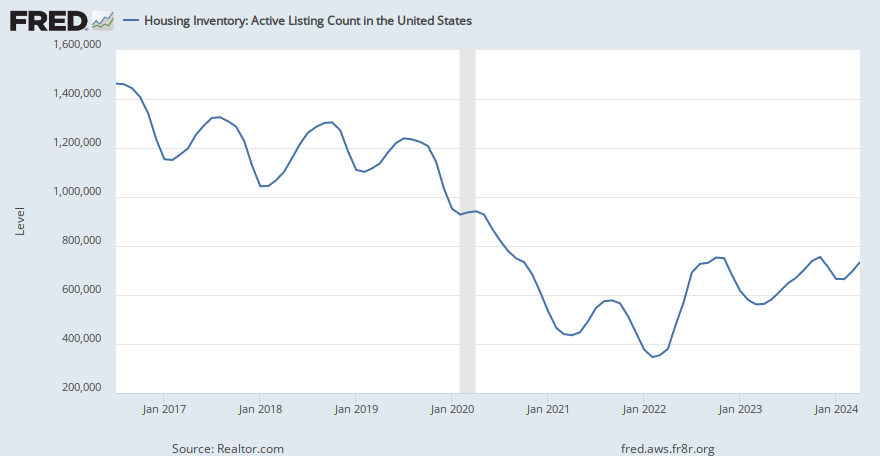

Housing supply is still very low. There’s not a ton of houses sitting. Demand is still higher than the typical “healthy” amount at these inflated prices. Prices are only going to keep going upWhat current issue? We have 2 generations that can't afford to buy houses. Tons of overpriced houses are just sitting.

https://www.dailymail.co.uk/news/ar...market-prediction-crash-Great-Depression.html

Housing Inventory: Active Listing Count in the United States

Graph and download economic data for Housing Inventory: Active Listing Count in the United States (ACTLISCOUUS) from Jul 2016 to Nov 2023 about active listing, listing, and USA.

fred.stlouisfed.org

Especially if interest rates drop in later half of 2024

...

...