- Joined

- Jan 21, 2020

- Messages

- 9,620

- Reaction score

- 5,659

Go

How much should people pay?

Based on your countrys currency etc

How much should people pay?

Based on your countrys currency etc

What I lay out below is a thought experiment; don't stumble across the numbers if they irritate you and try to go with the thought experiment.

My general question is if you would be willing to pay more taxes if you could directly influence where they go.

So let's assume your tax rate is around 30%. Now the proposal goes like this: You pay 2.5% (or so) more in taxes. However, you get to allocate these 2.5% and an additional 2.5% (in other words: 5 percentage points of your 32.5% tax rate or about 15% of the total tax you pay) the way you like.

For example, if you earn 75,000$ a year, you would pay 22,500$ in tax but you would opt for the "democratic" tax scheme and therefore pay 24,375$.

However, only 20,985$ directly goes to the state. The other 3,750$ you can freely allocate.

For example, if you are a space exploration guy like me, you give a high share of it to NASA (or whatever your state's space agency is called).

If you believe veterans get not enough respect, you can allocate money to government programs that do something for them.

If you believe abstinence programs are underfunded, you give them your money.

And so on.

1) What do you think of the general idea?

2) If you do disagree with any proposal that includes "paying more tax", what do you think of the general idea of democratic tax allocation I laid out above?

How much should people pay?

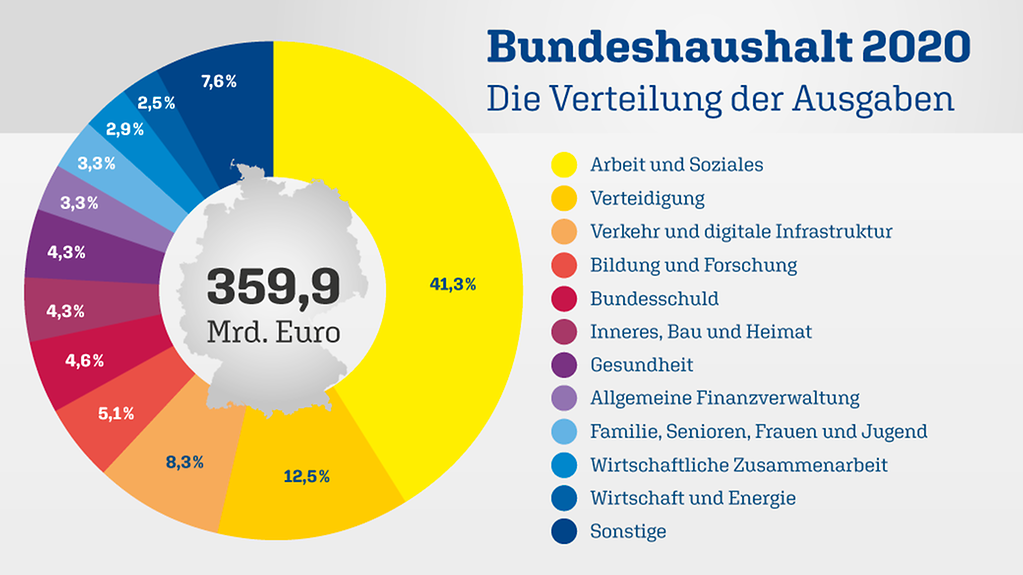

Interesting but can you list a structure? Not hypothethical. So you are in Germany

How would you change Germays current tax structure.

I am curious what people have to say and if anyone in the War Room wants to pay more.

This.Depends what the taxes go to

- zakat - one of the five pillars of Islam. Only imposed on Muslims, it is generally described as a 2.5% tax on savings to be donated to the Muslim poor and needy. It was a tax collected by the Islamic state.

- jizya - a per capita yearly tax historically levied by Islamic states on certain non-Muslim subjects—dhimmis—permanently residing in Muslim lands under Islamic law, the tax excluded the poor, women, children and the elderly.

- kharaj - a land tax initially imposed only on non-Muslims but soon after mandated for Muslims as well.

- ushr - a 10% tax on the harvests of irrigated land and 10% tax on harvest from rain-watered land and 5% on Land dependent on well water. The term has also been used for a 10% tax on merchandise imported from states that taxed the Muslims on their products. Caliph `Umar ibn Al-Khattāb was the first Muslim ruler to levy ushr.

The taxes stipulated by Islamic law generally did not generate enough revenue even for the limited expenditures made by pre-modern governments

and rulers were forced to impose additional taxes, which were condemned by the ulema.

That is a good point but to be fair his suggestion calls for people to choose among government programs for funding which is more a restriction. The money isn't going to a charity, it goes to the government still you just get to choose which agency or program gets funded.This already effectively exists via deductible gift recipients.

Let's say my marginal tax rate is say 50%.

I make a $10,000 gift to an eligible charity. I claim a tax deduction and save $5,000 tax. Effective paying $5,000 to direct $10,000 to a cause of my choosing.

Why don't we start by taking a lesson from the time period when America's middle class was actually thriving and expanding?

I think you are trying to be funny but coming from you, it sounds honestMe paying no taxes and everyone else's taxes going to me.