Hypothetical Scenario: Making Money from Tariff News

If someone knew in advance that:

Tariffs would be imposed on April 2, causing markets to fall, and

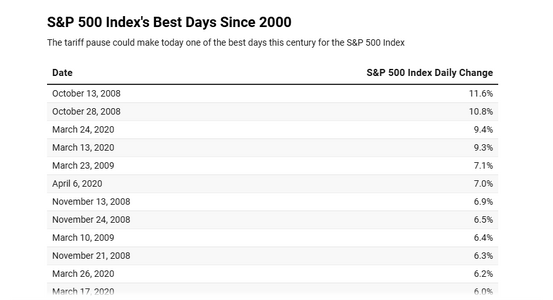

A 90-day pause (except China) would be announced on April 9, causing markets to rebound...

Then here’s how they could hypothetically profit:

Option 1: Short Selling Before Tariffs

Before April 2, they short-sell stocks or index funds (like the S&P 500).

Market drops after tariffs → they buy back cheaper → profit from the fall.

Option 2: Buy After Market Crash

Once the market drops due to tariffs, they buy in while prices are low.

When the 90-day pause is announced and the market rebounds, they sell at a higher price → profit.

Key Assumption:

This strategy requires foresight — or inside information — which, if obtained unlawfully, would be considered insider trading and is illegal.

Real World Example:

This is similar to what happens around:

Federal Reserve interest rate decisions

Earnings announcements

Geopolitical events

Traders and hedge funds try to anticipate these moves using data, trends, or — in some cases — even leaks (which can be illegal if not public).

Ethical & Legal Note:

If someone had non-public knowledge about Trump's exact tariff timeline, and traded on it, they could face SEC investigation for insider trading.