- Joined

- Sep 22, 2019

- Messages

- 2,438

- Reaction score

- 4,930

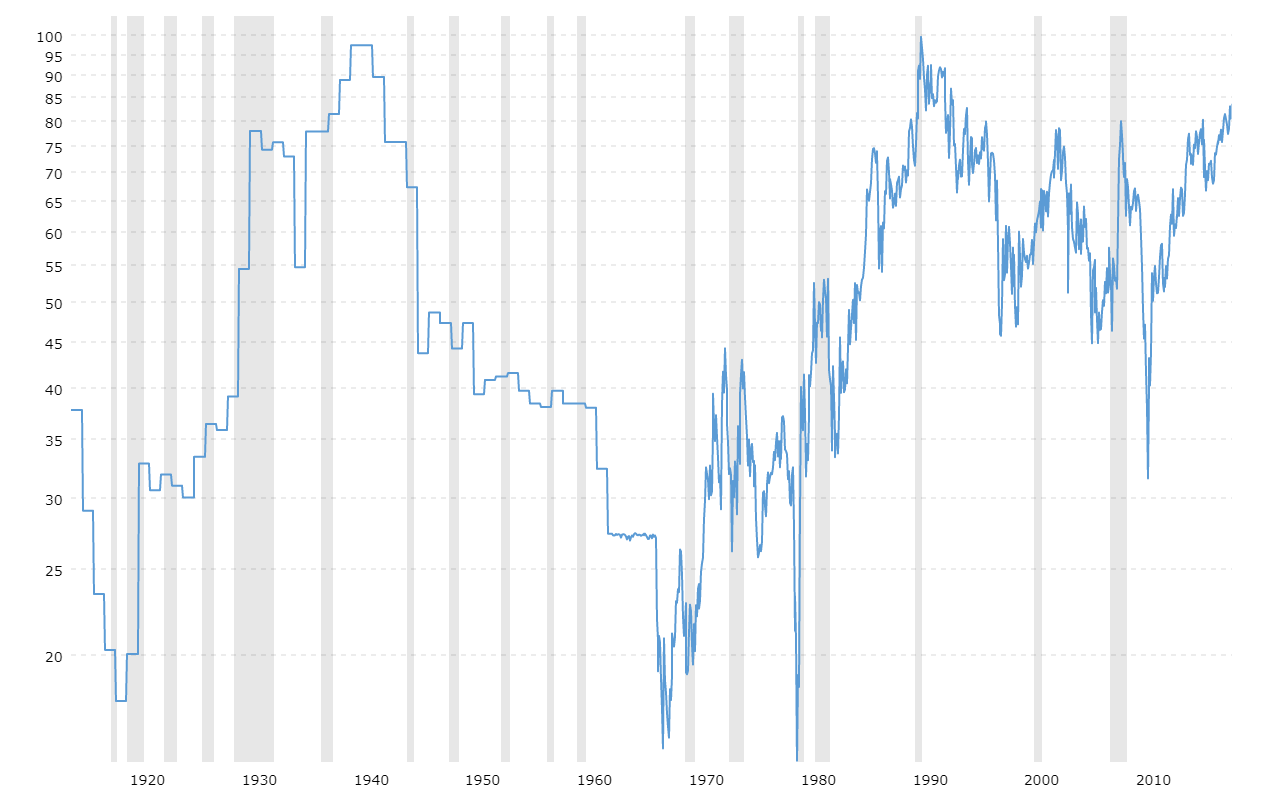

When you see lines of retail buying anything, its time to gtfo

Gold's price is plunging. Here's why (and what investors should do next).

Gold prices are tumbling as market dynamics shift. Here's what's happening and how investors should respond.www.cbsnews.com

People saw the peak and sold

Nothing drastic like the headlines are making it seem, gold still at 4,000 an ounce and just erasing the gains of the last two weeks as people profited