- Joined

- Sep 25, 2009

- Messages

- 2,145

- Reaction score

- 2,437

I have been waiting for someone else to notice!

Dad bought gold and silver in the 70’s when it first became legal to own. By the time I was old enough to be aware of it, we missed the peaks of the early 80’s. My whole life I advised him to sell and invest in flashier and more profitable investments. (I am I to real estate). For years I though dad had picked a bad investment.

Now Dad is laughing all the way to the bank. His “I told you so” has been pretty epic. He bought it as a hedge against runaway inflation. His father had seen the hyper inflation in pre war Germany. Dad says this is only the start.

With the Brecs countries moving to gold and many national banks moving away from dollars it’s hard to see anything stopping this rise for another few years.

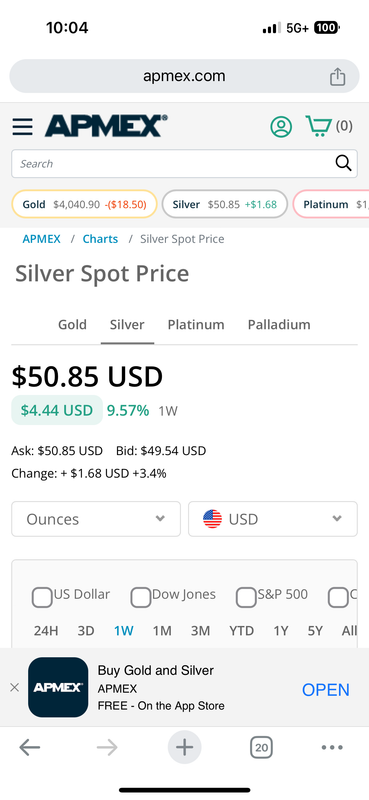

Question for the hive mind: at today’s prices if you were sitting on a fair amount of both metals, how would you move between them?

Do you think silver is going to do better than a 80/1 split (so trade gold for silver)

Or, is gold in a special place as a hedge given brecs buying and other factors (Trade the silver for more gold)?

Dad bought gold and silver in the 70’s when it first became legal to own. By the time I was old enough to be aware of it, we missed the peaks of the early 80’s. My whole life I advised him to sell and invest in flashier and more profitable investments. (I am I to real estate). For years I though dad had picked a bad investment.

Now Dad is laughing all the way to the bank. His “I told you so” has been pretty epic. He bought it as a hedge against runaway inflation. His father had seen the hyper inflation in pre war Germany. Dad says this is only the start.

With the Brecs countries moving to gold and many national banks moving away from dollars it’s hard to see anything stopping this rise for another few years.

Question for the hive mind: at today’s prices if you were sitting on a fair amount of both metals, how would you move between them?

Do you think silver is going to do better than a 80/1 split (so trade gold for silver)

Or, is gold in a special place as a hedge given brecs buying and other factors (Trade the silver for more gold)?