- Joined

- Jun 26, 2012

- Messages

- 33,176

- Reaction score

- 49,079

U.S. economy shrank as consumers went on pre-tariff buying spree

Analysts noted that the weak economic report doesn't reflect overall consumer and business performance. Still, shock over Trump’s tariffs has begun to rattle data.

The U.S. economy contracted 0.3% in the first quarter of 2025, the first negative reading since 2022, according to an initial measurement released Wednesday by the Commerce Department.

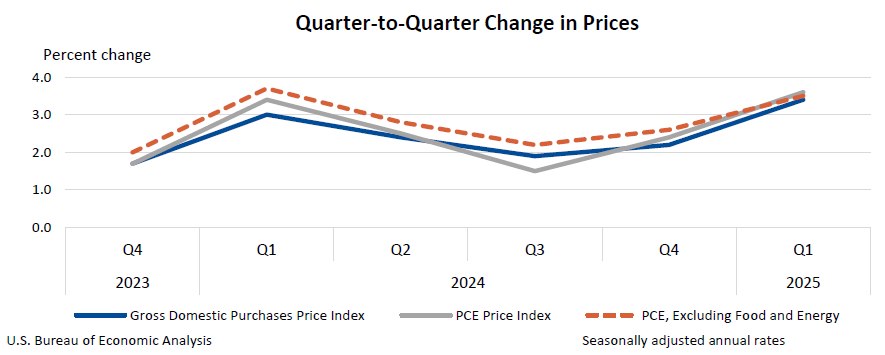

The decline in gross domestic product was fueled by a massive surge in imports, while other parts of the U.S. economy showed signs of slowing. Consumer spending climbed 1.8%, the weakest pace since mid-2023. The report also showed inflation remained firm.

Markets tanked in response. The broad S&P 500 declined as much as 1.6%, while the tech-heavy Nasdaq fell 2%. The Dow Jones Industrial Average lost nearly 600 points, or about 1.6%. Government bond yields climbed, suggesting weaker demand for U.S. debt.

And Q1 is before the April 2nd "Liberation day" fucked us. Q2 I don't think will be any better unless there's a hasty retreat from madness in May and June.

Prices going up again as well

Last edited: