You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economy GOP back to Inflation worries. "Hyperinflation" (Update: 2022 Inflation Highest in 40 Years)

- Thread starter Oceanmachine

- Start date

- Joined

- Feb 12, 2008

- Messages

- 63,411

- Reaction score

- 49,229

- Joined

- Nov 12, 2005

- Messages

- 138,839

- Reaction score

- 42,144

Time to stock up. Lmao

As a border line poor person, I am quite concerned about the next winter and how I'm going to keep my house warm.

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

You need to stop thinking of collapse predictions as actual attempts at prognostication. They are actually utopian daydreaming, and far too optimistic.

If people would just admit that, it would be easier. Goes back to the point we've discussed before about how in America, everyone has to claim to be liberal.

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

As a border line poor person, I am quite concerned about the next winter and how I'm going to keep my house warm.

What does it usually cost, and what are you concerned that it will be?

- Joined

- Nov 12, 2005

- Messages

- 138,839

- Reaction score

- 42,144

Last year we bought a half tank for less than 300, I honestly don't recall the exact price. I'm concerned we see it go back up to 4+ dollars per gallon like it was during the Obama admin and fear it may be even more.What does it usually cost, and what are you concerned that it will be?

- Joined

- Apr 27, 2006

- Messages

- 31,651

- Reaction score

- 12,226

Any commodity that has not been made cheaper to make by automation is massively more expensive than it was a few years ago.

Inflation calculations lie to you because they don't factor in decreased manufacturing costs due to improvements in process and technology.

Inflation calculations lie to you because they don't factor in decreased manufacturing costs due to improvements in process and technology.

- Joined

- Sep 3, 2014

- Messages

- 31,707

- Reaction score

- 84,808

It always astounds me that anyone falls for such obviously poor reasoning. "Some prices have risen more than average, therefore the average is wrong!" Do people apply that to other areas of life? "The liberals say that Mike Trout is hitting .355, but he was 0-for-3 last night, which proves that can't be true!" How can someone function in ordinary life operating on such a low level?

Your analogy about Mike Trout is wrong. His batting average as a whole would be dropping to make align it with reality.

https://www.bls.gov/news.release/cpi.nr0.htm

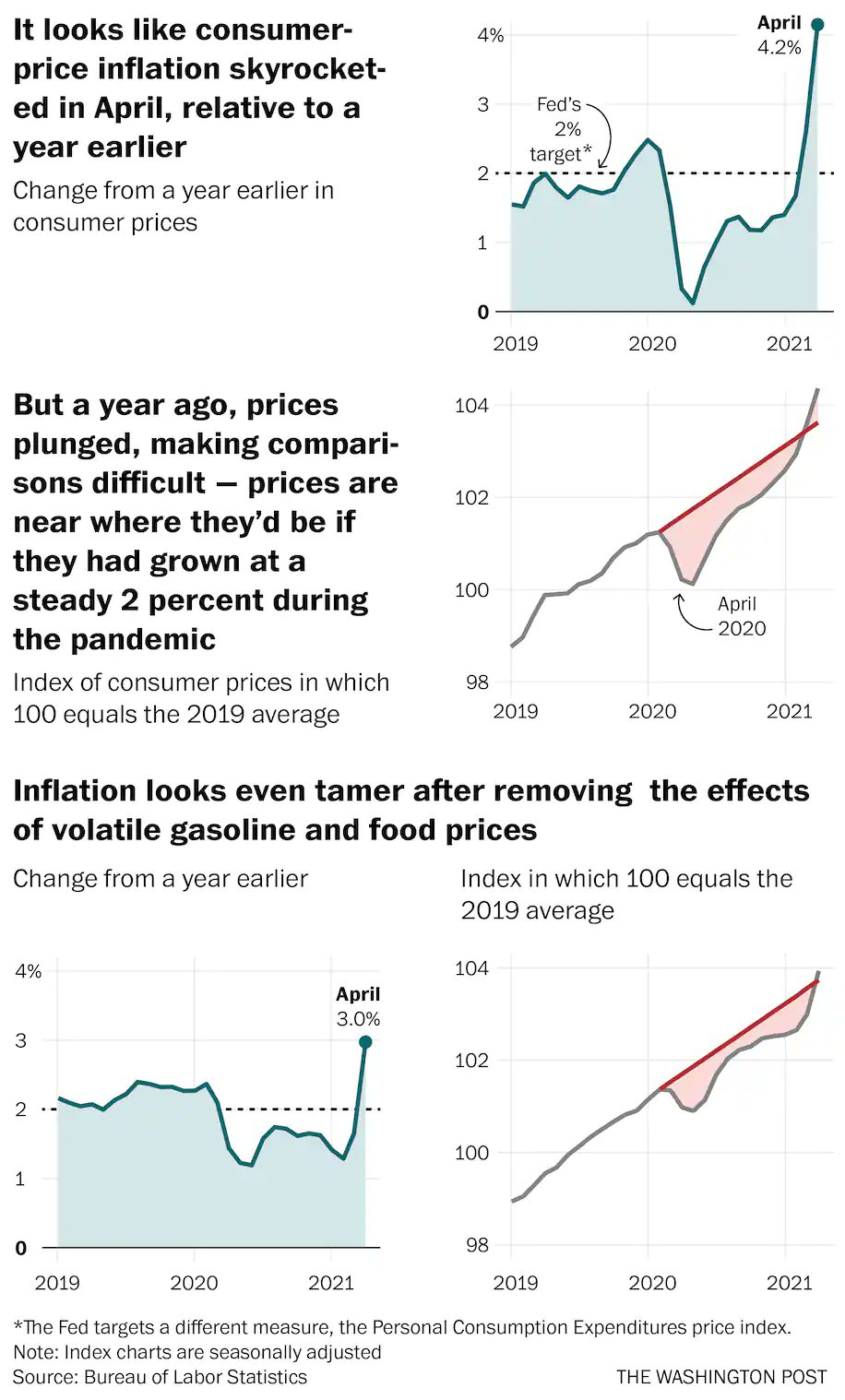

The Labor Department reported that the Consumer Price Index, including housing and energy costs, rose 4.2% from where it was a year ago.

The prediction by Economists was only a 3.6% increase. Inflation rose by 0.8% in April alone.

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

Last year we bought a half tank for less than 300, I honestly don't recall the exact price. I'm concerned we see it go back up to 4+ dollars per gallon like it was during the Obama admin and fear it may be even more.

You can open a free brokerage account and put a little in PXE. If gas prices rise, your investment will do well and help you pay for the costs. If they don't, you could lose money on the investment but at least your energy costs will be down. Very unlikely that gas prices will hit $4/gallon by the end of the year, though.

Any commodity that has not been made cheaper to make by automation is massively more expensive than it was a few years ago.

Inflation calculations lie to you because they don't factor in decreased manufacturing costs due to improvements in process and technology.

I don't think that's true or relevant to inflation. Official measures tend to overstate inflation because they don't properly account for substitution and technological improvement.

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

Your analogy about Mike Trout is wrong. His batting average as a whole would be dropping to make align it with reality.

Um, right. An average includes the 0-for-3 day and other days. Point is that some elements of a set can be above or below average, which doesn't mean that the average is wrong.

The Labor Department reported that the Consumer Price Index, including housing and energy costs, rose 4.2% from where it was a year ago.

The prediction by Economists was only a 3.6% increase. Inflation rose by 0.8% in April alone.

Right, but that's off a dip in the yr-ago period. That's the point of looking at the two-year average. If you think inflation will eventually be high, that's almost certainly wrong, but we'll have to wait and see (and I'm willing to bet you). If you're thinking that the current level is high, that's just an error.

- Joined

- Nov 12, 2005

- Messages

- 138,839

- Reaction score

- 42,144

I work and pay my bills and live relatively comfortably. I, like the majority of lower middle class folks don't have "what if" money.You can open a free brokerage account and put a little in PXE. If gas prices rise, your investment will do well and help you pay for the costs. If they don't, you could lose money on the investment but at least your energy costs will be down. Very unlikely that gas prices will hit $4/gallon by the end of the year, though.

I don't think that's true or relevant to inflation. Official measures tend to overstate inflation because they don't properly account for substitution and technological improvement.

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

I work and pay my bills and live relatively comfortably. I, like the majority of lower middle class folks don't have "what if" money.

How about this: I'll bet you $150 vs. your sig for two months and a thread on why you were wrong that average per-gallon gas prices in Maine won't be at $4 on whatever date you pick (when you'd be likely to buy your tank). That way, there's no financial risk for you and you won't be cold even if you're right.

- Joined

- Jun 13, 2005

- Messages

- 66,129

- Reaction score

- 37,455

Didn't austerity work incredibly well for Germany? Meanwhile, irresponsible spending unraveled Greece.These are neoliberals the same types who would support European austerity

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

Inflation has been in the post for a long fucking time.

What does that expression mean?

- Joined

- Jul 6, 2007

- Messages

- 20,120

- Reaction score

- 6,324

What does that expression mean?

On it's way.

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

On it's way.

I don't think so. We've been struggling with low inflation for a while, and it's been kind of a challenge to figure out how to break that, or at least to muster the political will to really try. I think we are now on the verge of a real economic boom, which will put some pressure on inflation, though that will just lead to Fed tightening (I think because we've been below target, they might tolerate a period of being slightly above target, as they've now indicated that they are going to treat the target like a target rather than like a ceiling). But that's a long way from the kind of rank nonsense we see in these threads. I'm saying it could have a period of being around 3% before coming down. We're not going to see it soar or run out of control without a truly unprecedented boom along with an extremely complacent Fed.

- Joined

- Jul 6, 2007

- Messages

- 20,120

- Reaction score

- 6,324

I don't think so. We've been struggling with low inflation for a while, and it's been kind of a challenge to figure out how to break that, or at least to muster the political will to really try. I think we are now on the verge of a real economic boom, which will put some pressure on inflation, though that will just lead to Fed tightening (I think because we've been below target, they might tolerate a period of being slightly above target, as they've now indicated that they are going to treat the target like a target rather than like a ceiling). But that's a long way from the kind of rank nonsense we see in these threads. I'm saying it could have a period of being around 3% before coming down. We're not going to see it soar or run out of control without a truly unprecedented boom along with an extremely complacent Fed.

Well, I'd be happy to be wrong about that. But I don't see any strong evidence that the absurdly low interest rates we've enjoyed for a while now are going to change, and I'm not convinced current inflation is an honest reflection of that.

As a freight broker, I am perhaps more acutely aware of the effect fuel prices have on good prices and inflation. The largest purchasers and users of fuel in the country do not pay pump prices. Their fuel prices are locked in weeks and in some cases months in advance. They are going up over the next several months, regardless of what happens at the pump. And so will the prices for everything. But even if you went to UPS's website, you would see that their ground fuel surcharge is .75% more than it was just 2-3 months ago.

- Joined

- Oct 30, 2004

- Messages

- 95,963

- Reaction score

- 35,164

Well, I'd be happy to be wrong about that. But I don't see any strong evidence that the absurdly low interest rates we've enjoyed for a while now are going to change, and I'm not convinced current inflation is an honest reflection of that.

Interest rates have reflected markets, though. In fact, the issue we've had is that even as low as they can go, evidence has suggested that they're still higher than they should be, which is why fiscal policy has been needed to boost demand. We are, for the first time in a long while, now looking at a situation where the fiscal-policy boost will be more than sufficient, which is why for the first time in a while, raising rates will likely be the indisputably correct call (we had a period of tightening that was controversial, and while I was OK with it, in retrospect, it might have been premature--and I think policymakers should and will be careful to avoid that possible mistake again).

- Joined

- Jan 20, 2007

- Messages

- 31,984

- Reaction score

- 11,774

Just a dip in the year-ago period. But what I've actually been asking for is for anyone who is predicting inflation to say what they think it will be and bet on it because I suspect that on some level at least, it's just bullshit (that is, people don't really think that inflation is going to be high).

Lol. Like clockwork

Latest posts

-

-

PWD PWD 1231: 6'3", 240, 9 inches IWGP World Champ Edition

- Latest: Pittie Petey

-

-

Social Oh look another Nazi MAGA text thread has been released

- Latest: GreatSaintGuillotine