- Joined

- Aug 2, 2014

- Messages

- 2,151

- Reaction score

- 221

it's a monster dude. done so many x's in the last few months. need to take profits though otherwise it will retrace. now it's going up hard. I see 1 dollar plus.Hell yeah

it's a monster dude. done so many x's in the last few months. need to take profits though otherwise it will retrace. now it's going up hard. I see 1 dollar plus.Hell yeah

Picked up some small bags of ADA, XCM, HBAR, and SEI

Will add more XRP once it dips a bit further

ETH was knocking on $3700, but looks like it’s consolidating towards $3500 now

WILD(wilder world)

ADA and SEI great buys imoPicked up some small bags of ADA, XCM, HBAR, and SEI

Will add more XRP once it dips a bit further

ETH was knocking on $3700, but looks like it’s consolidating towards $3500 now

Fuck SEI. We need to make our own DEI coin

ADA and SEI great buys imo

The PTSD is real broWhy is this thread so dead everyone should be sending each other signals so we can all make money you greedy bastards lol there's enough out there for all of us

Sherbros, this is the next big one. Buy now. Monday it is going to the moon!

I'm going to sell at $1.

Then I'll be able to afford this Ferrari I've been leasing.

Sherbros, this is the next big one. Buy now. Monday it is going to the moon!

I'm going to sell at $1.

Then I'll be able to afford this Ferrari I've been leasing.

The posters on the ETH Reddit sub are pretty aggressive (delusional?) with their price targets lol

15k, 20k, 35k

Here I am just waiting for 4k to retrace

It’ll prob happen this week (knock on wood)It's going to happen It's just a matter of when I'm willing to bet that ETH surpasses 4k in the next week to month

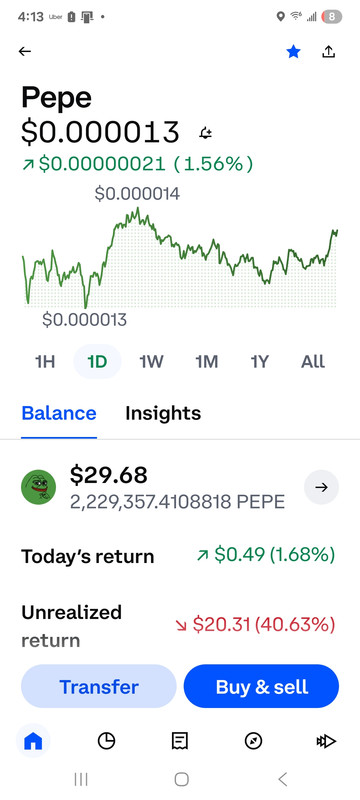

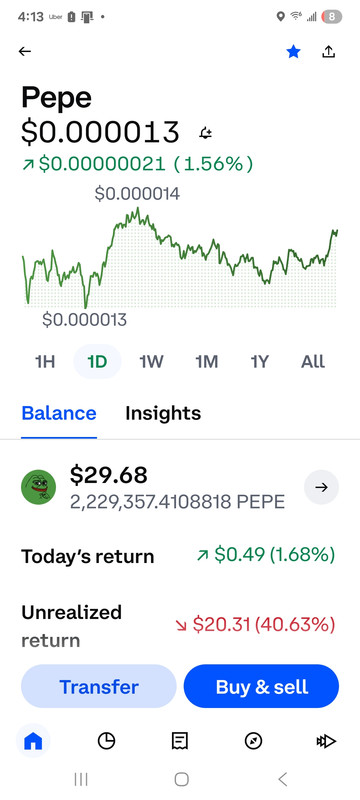

I own a fuckload of PEPE cause I kept buying it and buying it as a joke, if it hits one dollar apiece I'll be close to finally maybe almost getting outta the red

For my crypto beginners — this chart is from DEXTOOLS.IO and it’s used for trading. If you’re not using charts like this, you’re basically investing blind.

Let me explain real quick:

This is the 15-minute chart — that means each candle represents 15 minutes of price action. This helps you see short-term moves, which is crucial for finding the best entry and exit points.

That fx symbol is where you add indicators like RSI, MACD, and volume — tools that help you read the market before you throw money into a coin.

RSI (Relative Strength Index) — This tells you if a token is overbought or oversold:

• RSI above 70 = might be time to sell

• RSI below 30 = might be time to buy

Right now, RSI is around 55, which means we’re in a neutral zone, but we’re leaning bullish.

The arrow pointing up? That’s a trader guessing the price could go higher from here — based on the RSI trend, volume bounce, and past price movement.

⸻

Let’s talk strategy:

There’s two types of people in this space:

Day Traders & Swing Traders — they jump in based on hype or quick price movement. Some make quick flips. But many buy the top, panic sell the dip, and repeat. A lot of them don’t use charts — they just follow emotions and Twitter posts.

Long-Term Holders (HODLers) — they DCA in slowly, study the charts, follow fundamentals, and buy when the market is down. They’re calm, calculated, and don’t get caught up in the noise. They’re playing the long game.

⸻

Bottom line:

If you’re buying coins without checking the chart, that’s like buying a house without looking at the neighborhood.

You’re guessing.

You’re gambling.

And that’s how most people lose money in crypto.

Use tools like DEXTOOLS.IO to find smart entries, avoid chasing pumps, and move with purpose — not emotion.

This is chess, not checkers