As usual excellent substantive post by you without the condescending attitude from the likes of JVS so thank you.

Cheers!

Down to business though, the relative attractiveness of US debt to the rest of the world is just a stay of execution; not a saving grace. We're more leveraged than anyone.

We're not all that differentiated in terms of leverage to the big European nations and half as leveraged as Japan. So actually, if you consider it from a balance sheet perspective, the US is not only running similar leverage but has a much more healthy economy... AND you're telling me you can clip 200+ bps over those other developed nations? The US also has incredible national wealth to draw from if revenue is indeed an actual issue (as long as the GOP doesn't get its wish to drown the Govt. in a bathtub). What you're actually telling me right now with prices is that a good bit of European debt and Japanese debt is actually more valuable right now than tsys - that's just nonsense. Frankly, there's still tremendous demand for tsys on the secondary market and zero evidence that the market is sick of them. Pensions, foundations, endowments, insurance companies...etc. all need allocation to highly rated, highly liquid sov. debt - the greenback is basically cash with yield that keeps up with inflation and it's traded as such.

I'm not saying that debt wouldn't reach an unreasonable level of yearly outlays... that would obviously squelch critical investment from public into private and in support of critical social systems that do indeed greatly aid the productivity and financial soundness of millions of Americans. But again - we're not talking about blowing up our debt, but gradually paying it down.

Keep in mind the average household debt now is better than it was preceding the '08 crisis, but its still very high by historical standards. Moreover, this isn't a household problem as much as its an institutional problem... which just ends up affecting us anyway.

Correct:

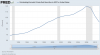

But there's actually a more nuanced way to look at it and yes - the above is a good trend and somewhat high by historical standard but this isn't about historical standard as much as it is about the direction and rate. Take for example this - part of what's happening is also that people are generally making more money while also deleveraging:

The first is a measure of total household debt to GDP but the immediate above is more indicative of how much more flexible households are comparatively.

Private outstanding debt to GDP has also been falling and looks a lot like Household debt to GDP even with lower interest rates. We definitely saw a debt binge by the frackers and they will no doubt get hammered and have been getting hammered by lower oil prices but oil will eventually go back up a little and lots of shale oil will come back online.

The trajectory of oil and commodities isn't weird though if you acknowledge that there wasn't any fundamental recovery to begin with. Those sectors were only the benefit of the loose monetary policy, and now they've popped. The rest of the sectors riding off of their growth will follow just like with the real estate misallocation leading up to the last crisis.

Disagree... there definitely was and has been a fundamental recovery. I'm sure you'll chalk that up to expansion of the Fed's balance sheet but again, there's no lack of demand for the USD or tsys and why wouldn't the Fed expand its balance sheet in a time of crisis when everyone is starving for tsys?

As Warren Buffet recently pointed out in his annual letter, the US economy is better than ever... it's robust, vibrant, more free than most, has highly favorable tax treatment for large corporations, is incredibly innovative, growing in real and nominal terms, has low unemployment and has come through a full on financial calamity all the while, household and private debt have been falling. Clearly, there's going to be a need to slow things down, quell a little inflation, let things flush out and then lower rates again:

Regarding oil though.. my reference was more of a historical one. Typically oil lags stocks and bonds in the cycle... however, more recent developments have complicated it. Oil is very much a financial asset, traded and speculated upon more than ever at this point. It's also highly affected by real physical developments around the world regarding drilling and extraction techniques. That fundamental change in the supply and demand balance has thrown things and they're trying to find a balance. One thing that's lesser known is that inflation adjusted oil back in the 80's and 90's isn't that much higher than current prices... if you lay oil against CPI ex-energy and food, it's clear that while adjusted, oil may be lower than historical mean but it's not nearly as dramatic as it appears. Sorry I don't have the figures in front of me but the inflation adjusted average back to 86' is something like $45 a barrel.

Those developments in oil can hurt our fracking industry but it's more of a disaster for EM nations who are losing their power as a result.... again, the US wins out because of its flexibility, diversification and vibrance - shale can turn right back on at $55-$60 a barrel and once against push oil lower. In the meantime, the US is continuing to increase energy independence and lowering private and household debt - count me in on that.