- Joined

- May 6, 2008

- Messages

- 22,616

- Reaction score

- 0

You're missing the point here.

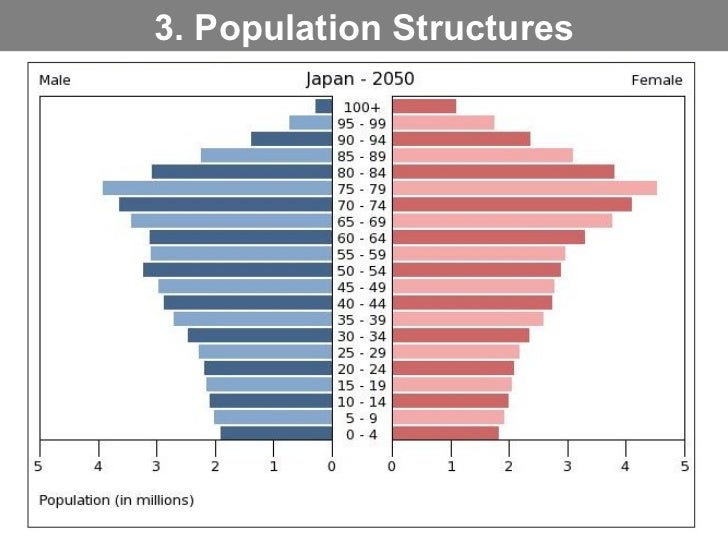

You're assuming that he's drawing a connection between the falling birth rates and shrinking workforce relative to an aging population and the long term economic burden that will fall on the working population in the future. You're also assuming that he's paying any attention to the economics of financing the current system and what happens when they can no longer do so at future population levels. Lastly, you forget that he's probably assuming that almost none of the immigrants/refugees will assimilate into the population and meaningfully contribute to the tax base over the next 10 years.

i think he probably gets it, but just doesnt want to.

i do think reasonable discussions can be held about how many people a country can assimilate, or even what types of people are likely to be difficult to assimilate. but the notion that immigration, or accepting refugees, is a completely selfless act by many of these countries, is completely untrue imo. idk why this elderly support problem isnt in the conversation more.