- Joined

- Mar 7, 2006

- Messages

- 24,681

- Reaction score

- 51,092

What if we globally decide to forgive all debt and start over

This could be pitched in conjunction with all new central bank digital currencies as the replacement.

What if we globally decide to forgive all debt and start over

I think I’ve made 10 threads since joining Sherdog and this is my first on the debt crisis.

I don’t like Trump. This is beyond parties. But, by all means, just keep on keeping on.

It’s circular.I keep the inflation is transitory thing but are people really arguing that it's not? It's going to increase, plateau, return to normal expectations. Short term effects will happen, long term effects will follow, market behaviors will return to pre-inflation behaviors once inflation expectations return to prior expectation levels.

I know I said I don't have answers right now but short term inflation actually reduces the real world value of our debt. Pair it with proper deficit and spending management policies and we have a net positive. Long term effects are less clear since the cost of borrowing might arise if inflation expectations remain high but with proper monetary policy that can be accounted.

What am I missing?

Not for me. It’s always a concern.Sure it's beyond parties but only seems to be a concern when democrats have the presidency.

Not for me. It’s always a concern.

Well, a driving factor here, imo, is the false belief that we can simply fund infinite growth if we cut tax revenue sufficiently for the upper income. I know you're not making a partisan thread and my response isn't meant to be partisan but that policy direction is a huge part of the problem.So money is real, but an infinitely growing debt isn’t a legitimate concern because we can just keep printing money.

I think the assumption that increasing taxes at this point would solve the issue. Increasing taxes may be necessary, but the cat is out of the bag. Even with increased taxes and reduced spending, the high interest rates and rate of spending is still too high to ever be addressed.Well, a driving factor here, imo, is the false belief that we can simply fund infinite growth if we cut tax revenue sufficiently for the upper income. I know you're not making a partisan thread and my response isn't meant to be partisan but that policy direction is a huge part of the problem.

We cut tax revenue hoping that it would spur the growth needed to pay the debts we were incurring and it never materialized. I've always been a fan of more fiscally responsible spending but we have to accept that we need more tax revenue.

I know that there are dueling opinions on this but I think the CBO's conclusions were that we had less money with the cuts than we would have had without them. Which often gets lost in arguments of "Look, more total dollars." $10 is better than $9 but not if you could have had $11. And that's meaningful when we're already in deficit spending.

So money is real, but an infinitely growing debt isn’t a legitimate concern because we can just keep printing money.

I keep the inflation is transitory thing but are people really arguing that it's not?

It's going to increase, plateau, return to normal expectations. Short term effects will happen, long term effects will follow, market behaviors will return to pre-inflation behaviors once inflation expectations return to prior expectation levels.

I know I said I don't have answers right now but short term inflation actually reduces the real world value of our debt. Pair it with proper deficit and spending management policies and we have a net positive. Long term effects are less clear since the cost of borrowing might arise if inflation expectations remain high but with proper monetary policy that can be accounted.

What am I missing?

No offense but that's simply not a realistic take on the subject. At the simplest level, we'll still be able to borrow money (sell Treasuries and other other securities), just at less attractive rates than currently. But even that is too simplistic a response to the subject.

It's not automatically circular. Which is why I said, pair it with smart revenue and spending decisions and it can be a net positive. The 2nd half is hard to do but it's not impossible.It’s circular.

You want inflation to debase the debt but then raise interest rates which increase the debt.

I think the assumption that increasing taxes at this point would solve the issue. Increasing taxes may be necessary, but the cat is out of the bag. Even with increased taxes and reduced spending, the high interest rates and rate of spending is still too high to ever be addressed.

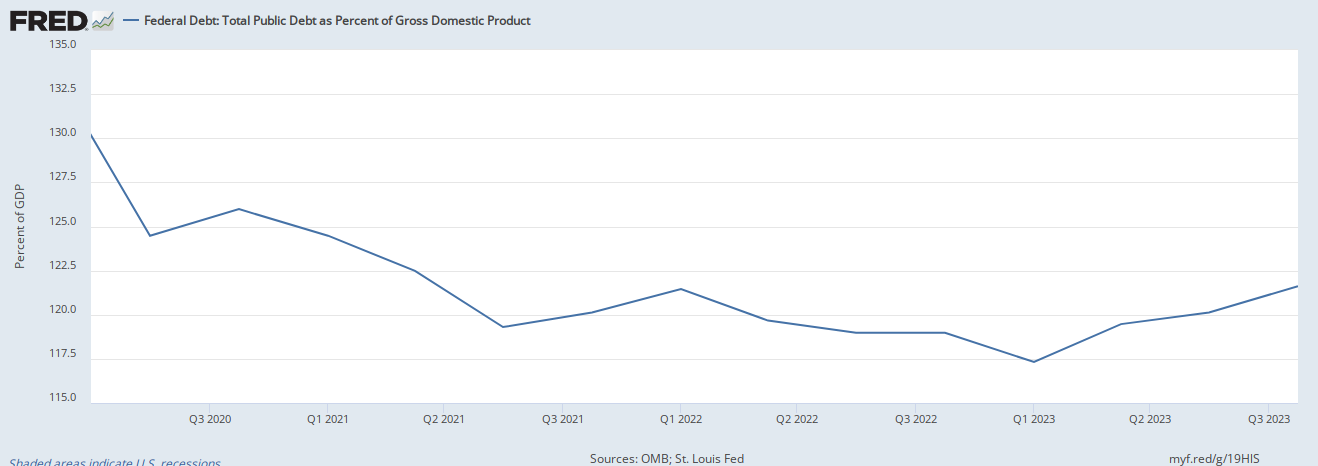

Jack says it’s not an issue. US debt to gdp ratio is 122% and rising. At what point does the debt to GDP ratio become an issue?

I don't think taxes and spending cuts will solve it either but I don't think it's the issue that people think it is. I laid out the outline of my thoughts why earlier in the thread.I think the assumption that increasing taxes at this point would solve the issue. Increasing taxes may be necessary, but the cat is out of the bag. Even with increased taxes and reduced spending, the high interest rates and rate of spending is still too high to ever be addressed.

Jack says it’s not an issue. US debt to gdp ratio is 122% and rising. At what point does the debt to GDP ratio become an issue?

Thank goodness you're not the only person in this thread.Soo... at even worse interest rates than currently.

Eventually will be getting financing at the 30% from the sketchy used car lots.

Anyone ever just gone 'money isn't real, stuff the consequences' and just gone balls deep in spending as much as humanly possible?

Thanks, Edgelord. Despite me saying it’s both parties issue you must default to your only tired move.

Or, you know, just raise taxes a little bit on rich people and corps, instead of making grandma wait tables until she’s old enough to be president.raise the age of social security

So no blowback at the guy blaming bidenflation?I think I’ve made 10 threads since joining Sherdog and this is my first on the debt crisis.

I don’t like Trump. This is beyond parties. But, by all means, just keep on keeping on.

Republicans talk about debt, but all their proposals increase it. Here's what the front-runner is talking about:

https://www.washingtonpost.com/business/2023/09/11/trump-tax-cuts-2024/

So raising taxes on the poor, but then offsetting the gains with another cut for corporations and rich individuals. No one who actually cares about debt is going to support that. And remember when Democrats pushed for a revenue increase without tax hikes by just doing a better job of catching rich tax cheats? The GOP and amoral hacks like the TS were screaming bloody murder.