- Joined

- Sep 23, 2020

- Messages

- 9,922

- Reaction score

- 12,720

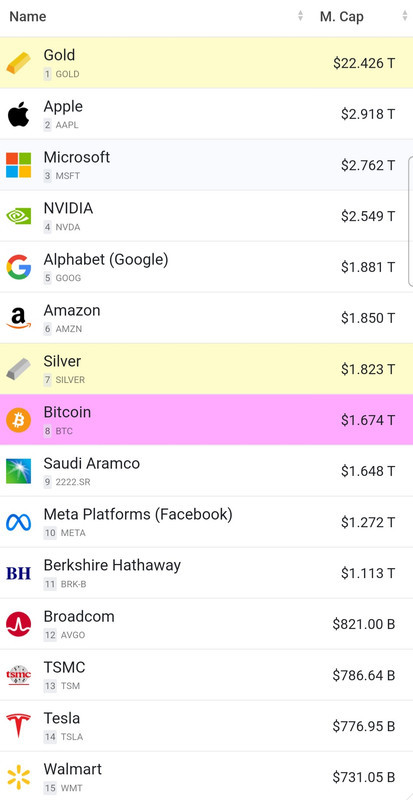

As gold returns to prominence and the dollar continues to plunge, we are heading into what I call 'hyperstagflation'. High inflation and very little growth (with my inflation calculations we are contracting). Unfortunately, for the U.S. and the world in general, we are in economic 'zugzwang'. In chess that means whatever move you make it gets worse from here. It doesn't matter who is in the White House but the economic system is in the process of being sent to the scrap bin. When we look back on the 21st century, it will be known as the golden century. The worldwide economic system will once again be reliant on gold. The citizens of the world might be placed on and accept a 'unicurrency' but make no mistake about it that gold is moving to the forefront.

www.kitco.com

www.kitco.com

Admittedly, Schiff and others in the gold space have been wrong about the timing for many years (I have been wrong as well but not as bad as Schiff). The important thing to focus on is that the premise has always been correct. The paper currency system is on borrowed time. Even if it stands it will be in a weakened, very fragile state.

I can see a future where cryptocurrencies are part of the system as well, especially bitcoin.

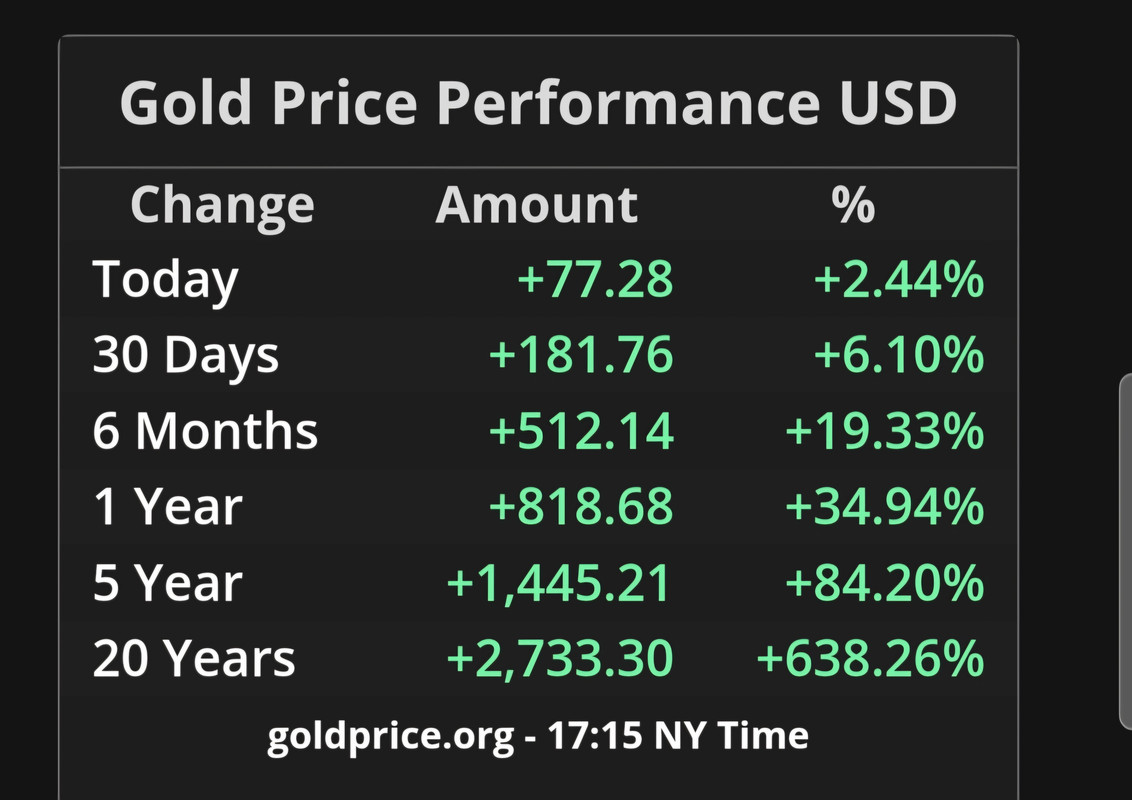

SInce 2000:

Dow: ~425

S&P: ~495%

Gold: ~1171%

Silver: ~614%

Am I missing something?

Discuss

Stagflation worse than the 1970s is here – ‘day of reckoning’ for U.S. dollar: Peter Schiff

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Admittedly, Schiff and others in the gold space have been wrong about the timing for many years (I have been wrong as well but not as bad as Schiff). The important thing to focus on is that the premise has always been correct. The paper currency system is on borrowed time. Even if it stands it will be in a weakened, very fragile state.

I can see a future where cryptocurrencies are part of the system as well, especially bitcoin.

SInce 2000:

Dow: ~425

S&P: ~495%

Gold: ~1171%

Silver: ~614%

Am I missing something?

Discuss

Last edited: