- Joined

- May 1, 2005

- Messages

- 46,217

- Reaction score

- 20,467

Years ago I got a weird rash on my arm and it wouldn't go away, it was an allergic reaction to something. I went to the derm and got some steroids for it. My wife saw the cream and only let me take it for like 3 days. I was like why, I have used Hydrocortisone before for maybe 5 days before when I would get dry skin in college. My wife, who is a scientist explained that you get addicted to topical steroids and it will eventually get really bad, to the point where you internal problems and can not make your own cortisone anymore.

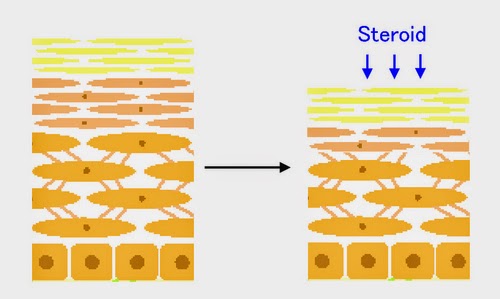

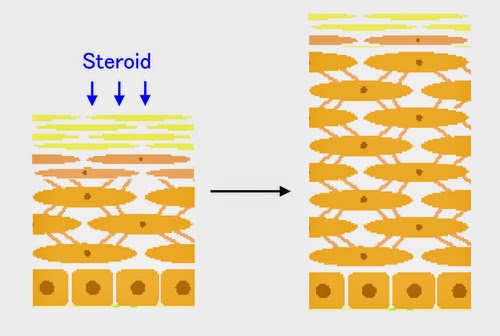

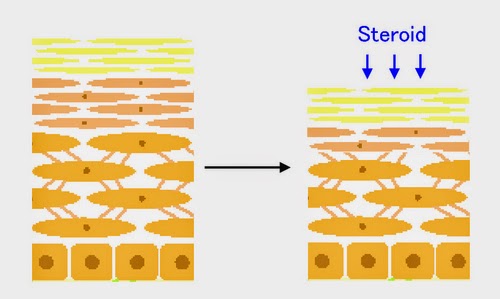

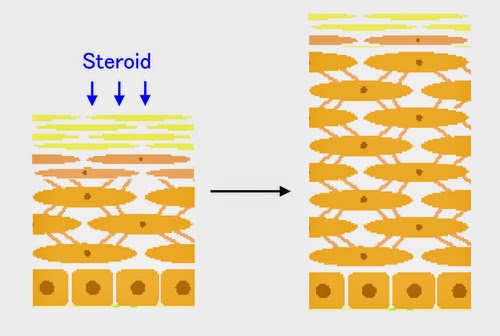

Steroids reduce inflammation

Take them too long and you get crazy withdrawls because you become addicted.

https://mototsugufukaya.blogspot.com/

https://en.wikipedia.org/wiki/Topical_steroid_withdrawal

Anyhow, sorry about that. Goggle or Reddit it more if you want to see some crazy pics of TSW.

I listened to https://podcasts.apple.com/us/podca...roke-the-american/id928933489?i=1000547158224 today.

I am no anti Fed guy. But the money supply and constant QE that seemingly doesn't end has made me concerned. The massive amounts of money created has basically all gone to assets and that has benefited the rich, and t has created massive debt bubbles. All the while destroying regular people's ability to earn money from savings and from bonds. Binds used to be what regular people bought, and rich people bought stocks.

The Taper tantrum occurred in 2013 when the Fed was trying to normalize rates. Basically stop QE

https://www.investopedia.com/terms/t/taper-tantrum.asp

The Repo market froze up, and I wrote in my stock notebook about something not being right and that a recession was coming back in late 2019.

https://finance.yahoo.com/news/repo-market-broken-fed-wants-202356690.html The Fed had to inject 400 billion to bail out hedge funds and it showed how severely addicted we had become to QE and that any sign of trying to return to normal has resulted in freakouts and not just from Trump. The whole assets system according to Christopher Leonard reacted so badly that the Fed had to reverse course and cut rates while the economy was doing well.

Like topical steroids, the system can not quit QE. TS are for short duration, if you use them too long, you can't just quit and are addicted to them. So instead of having had some problems in the recovery, we covered over our eczema with QE and kept putting more and more QE on, to the point where markets can't handle normal conditions. Like with TSW reg ski can't handle normal conditions anymore.

The longer you use TS, the longer it takes to recover from the addiction. Leaonard said that it would take probably 10 years for the Fed to unwind it's 9Trillion dollar balance sheet. That is a long withdrawl period and I see problems coming when that happens.

Or we can continue to use and depend on QE which will further warp the system even more.:

Btw I am a deficit hawk type and have been calling for reducing debt spending by 50 billion a year for quite a while.

Steroids reduce inflammation

Take them too long and you get crazy withdrawls because you become addicted.

https://mototsugufukaya.blogspot.com/

https://en.wikipedia.org/wiki/Topical_steroid_withdrawal

Anyhow, sorry about that. Goggle or Reddit it more if you want to see some crazy pics of TSW.

I listened to https://podcasts.apple.com/us/podca...roke-the-american/id928933489?i=1000547158224 today.

I am no anti Fed guy. But the money supply and constant QE that seemingly doesn't end has made me concerned. The massive amounts of money created has basically all gone to assets and that has benefited the rich, and t has created massive debt bubbles. All the while destroying regular people's ability to earn money from savings and from bonds. Binds used to be what regular people bought, and rich people bought stocks.

The Taper tantrum occurred in 2013 when the Fed was trying to normalize rates. Basically stop QE

https://www.investopedia.com/terms/t/taper-tantrum.asp

The Repo market froze up, and I wrote in my stock notebook about something not being right and that a recession was coming back in late 2019.

https://finance.yahoo.com/news/repo-market-broken-fed-wants-202356690.html The Fed had to inject 400 billion to bail out hedge funds and it showed how severely addicted we had become to QE and that any sign of trying to return to normal has resulted in freakouts and not just from Trump. The whole assets system according to Christopher Leonard reacted so badly that the Fed had to reverse course and cut rates while the economy was doing well.

Like topical steroids, the system can not quit QE. TS are for short duration, if you use them too long, you can't just quit and are addicted to them. So instead of having had some problems in the recovery, we covered over our eczema with QE and kept putting more and more QE on, to the point where markets can't handle normal conditions. Like with TSW reg ski can't handle normal conditions anymore.

The longer you use TS, the longer it takes to recover from the addiction. Leaonard said that it would take probably 10 years for the Fed to unwind it's 9Trillion dollar balance sheet. That is a long withdrawl period and I see problems coming when that happens.

Or we can continue to use and depend on QE which will further warp the system even more.:

Btw I am a deficit hawk type and have been calling for reducing debt spending by 50 billion a year for quite a while.