- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Russia’s invasion of Ukraine could make many, many things more expensive - especially gas

By Emily Stewart Feb 24, 2022

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/70546742/1372403391.0.jpg)

By Emily Stewart Feb 24, 2022

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/70546742/1372403391.0.jpg)

https://www.vox.com/the-goods/22949683/russia-ukraine-gas-prices-oil-inflation-stock-marketThe backdrop of global and domestic inflation in the United States was already worrying. Now, Russia’s invasion of Ukraine stands to potentially make the situation worse.

The conflict has roiled global markets in recent days, causing stock market turmoil, sending oil prices higher, and injecting even more uncertainty into an already off-balance worldwide economy. It’s also sparked concerns that inflation, already running hot, could run even hotter. In the United States, the Consumer Price Index, which measures the average change in prices consumers pay for goods and services, was up by 7.5 percent over the past year in January. That’s a 40-year high. The hope was that inflation would soon start to come down, and that factors driving it, such as high gas prices and supply chain woes, would finally pass. Now, it appears that the situation could be quite the opposite.

“What we’re observing is essentially an energy price shock and a financial markets shock that comes on the back of this already concerning inflation environment, an environment in which global supply chains are already stressed and in which there is already some degree of uncertainty as to the outlook,” said Gregory Daco, chief economist at EY-Parthenon. “It’s not just a shock in isolation, it’s a shock in that context.”

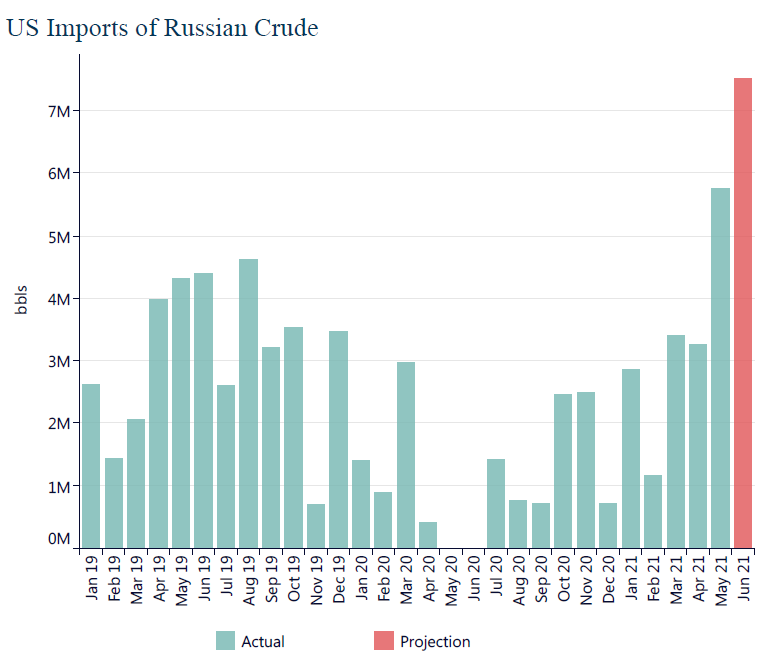

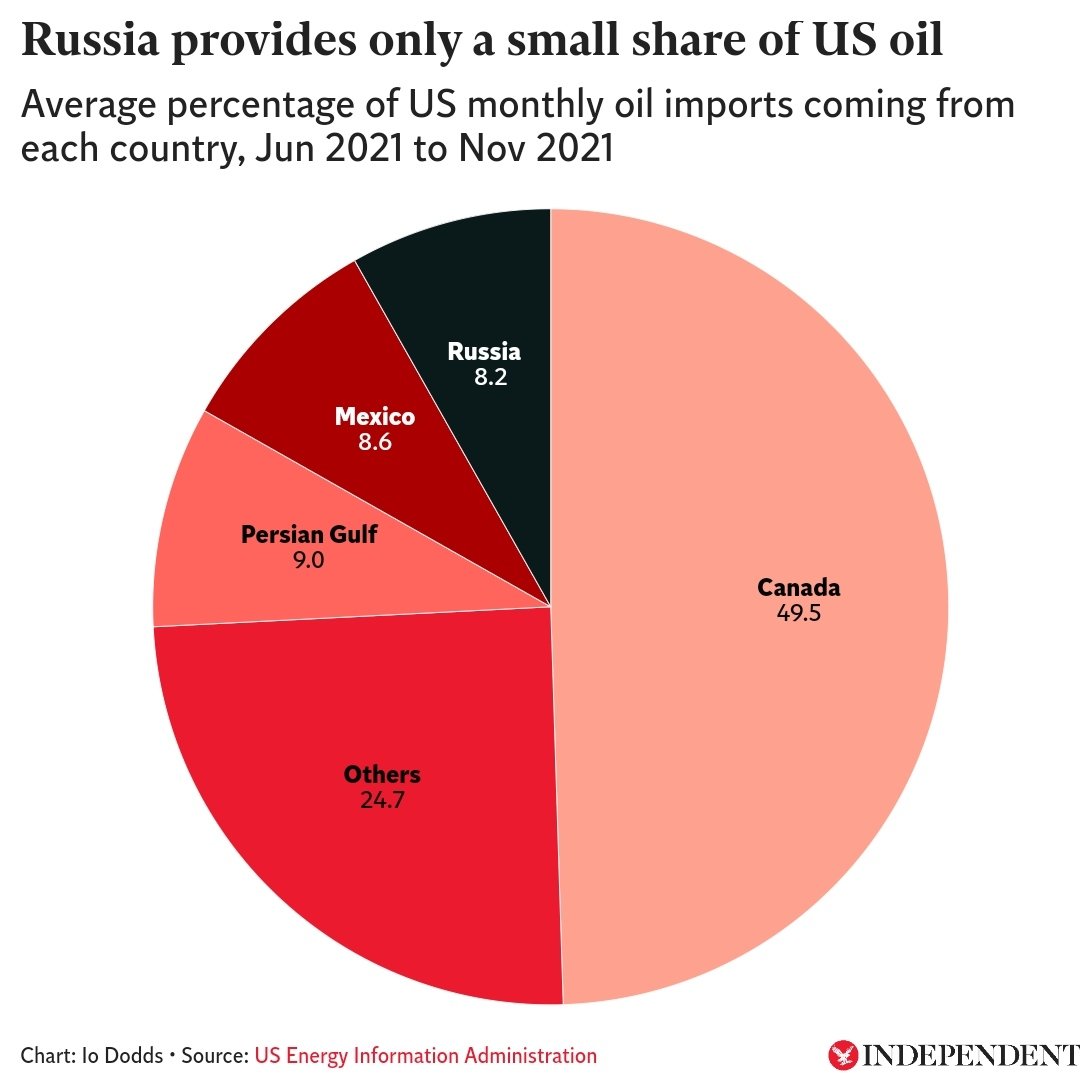

Russia is one of the biggest oil and gas producers in the world, and any disruptions stand to have a major impact on prices. Earlier in February, JPMorgan analysts projected that disruptions to oil flows from Russia could push oil prices to $120 per barrel. (For context, oil was priced in the $60 per barrel range a year ago, and started 2020 in the $70s and $80s.) Oil has already jumped above $100 a barrel, the first time it’s done so since 2014, though it’s since come back down.

“The concern is that Russia would somehow curb oil exports if they really feel backed into a corner,” said Patrick De Haan, head of petroleum analysis at GasBuddy. He noted that Russia delayed shipments of natural gas last fall when Germans delayed the approval of the Nord Stream 2 pipeline from Russia to Europe. “Who knows? Maybe Russia will do that again with oil,” he said. “That’s certainly a nightmare situation, but it could happen.”

Americans — already dealing with high gas prices and annoyed at the rising costs of heating their homes — are in for a bumpy ride. Gas prices matter not just for people filling up the tanks of their cars but also because of shipping and transportation. The conflict could also translate to high diesel prices and jet fuel for airplanes. “The inflation machine is just not going to slow down,” De Haan said.

According to AAA, the average price of gas nationally is $3.54 a gallon, up significantly from $2.66 a year ago. That number now stands to climb even higher, especially as the summer months approach, which will put more people on the road.

Joe Brusuelas, chief economist at accounting and consulting firm RSM, told CNN that the Russia-Ukraine conflict could push inflation to 10 percent year over year, driven in part by gas. By his calculation, an increase in oil prices to $110 could increase consumer prices by 2.8 percent over the course of a year. Alan Detmeister, an economist at UBS, told the New York Times that if oil hits $120 per barrel, inflation could get to 9 percent in the coming months.

“It becomes a question of: How long do oil prices, natural gas wholesale prices stay elevated?” he told the Times. “That’s anybody’s guess.”

President Joe Biden has promised to try to protect Americans from a spike in gas prices, but his options are limited, if there are any at all, according to De Haan. “The president has insinuated that he’s got it, he’s going to do everything he can, but he doesn’t have anything else in the closet to do,” he said. Striking a new nuclear deal with Iran could help, but it’s no silver bullet, nor is it clear it’s very likely to happen. “It’s no Russia, in terms of oil supply.”

Higher oil prices could also weigh on economic growth. People and companies having to spend more on oil and gas could dampen spending in other areas, and that could cut into GDP.

There are other areas where the Russia-Ukraine conflict could show up in consumer prices. Russia is the largest wheat exporter in the world. As the Times notes, Russia and Ukraine make up 30 percent of global wheat exports, and Ukraine is also a major exporter of corn, barley, and vegetable oil. Disruptions to any of that could lead to disruptions in the commodities markets, therefore pushing up prices eventually at the grocery store. Bloomberg reports that the Biden administration isn’t yet going to impose sanctions on Russia that would impact aluminum, which would throw a wrench in the global supply, though aluminum and metal prices have already gone up.

“It’s a combination of a set of commodities that are being produced either in Ukraine or Russia that have been affected,” Daco said. He warned that if further sanctions are imposed on Russia, it could affect aluminum and commodities prices even more. “It’s a wide spectrum of agricultural, energy, and other commodities.” Thus far, the US has not put sanctions on commodities, though it has on major Russian banks. Europe and the United Kingdom have imposed sanctions as well, and more are likely on the way.

Reuters reports that the White House has warned the microchip industry about the possibility that Russia will curb access to some of the materials it sources from Ukraine and Russia and to look into diversifying the supply chain. A chip shortage and kinks in the semiconductor supply chain have contributed to higher prices and challenges across a number of industries, including cars and phones.

To be sure, there’s still plenty of uncertainty around what will happen in the Russia-Ukraine conflict and its economic consequences. Brusuelas told MarketWatch that the inflationary pressures depend “on the severity of sanctions and what happens on the ground.” However, he said inflation is probably not going away anytime soon.

In the United States, this will be a headache for the Federal Reserve, which is already on track to likely start to raise interest rates in an effort to combat inflation and otherwise roll back some supports for the economy.

“Energy prices mean that inflation is going to stay well above the Fed’s target in 2022, and that’s going to stiffen the Fed’s resolve to normalize monetary policy this year,” Bill Adams, chief economist for Comerica Bank, told Vox. “Inflation was drastically above the Fed’s target in 2021 and had looked like it was about to slow in 2022, but the surge in energy prices caused by the invasion is going to keep inflation higher for longer.”

Adams did, however, note that the US economy is quite strong at the moment, despite inflation. Jobs are coming back, and supply chain problems are being worked out.

“The big picture is that the US economy is strong and is well-positioned to absorb a shock like higher energy prices or disruptions to commodity supply from the Russia-Ukraine war,” he said. “We’re in a better position to absorb this shock than, for example, in 2006-2007 when energy prices were jumping but consumer balance sheets were much more stressed than they are today.”

Still, for Americans already navigating inflation, the current crisis is likely going to push prices up before they come down.