- Joined

- Jan 17, 2010

- Messages

- 4,522

- Reaction score

- 5,485

Michael Wayland@MIKEWAYLAND

A BYD Seagull small electric car is on display during the 20th Shanghai International Automobile Industry Exhibition at the National Exhibition and Convention Center (Shanghai)

Vcg | Visual China Group | Getty Images

LIVONIA, Mich. – A small electric vehicle is having a big impact on the global automotive industry.

It’s not the EV itself that’s making waves but its price — and its potential to disrupt domestic auto industries around the world.

The China-built BYD Seagull, a small all-electric hatchback, starts at just 69,800 yuan (or less than $10,000), and reportedly banks a profit for the increasingly influential Chinese automaker.

That latter point — EV profits where U.S. automakers have mostly failed to turn any — combined with the expansion of Chinese automakers into Europe, Latin America and elsewhere has automotive executives and politicians, from Detroit and Texas to Germany and Japan, on edge.

The Seagull could be a “clarion call for the rest of the auto industry,” said Terry Woychowski, a former General Motors executive who now serves as president of automotive at engineering consulting firm Caresoft Global. “It’s a significant event.”

Though the Seagull isn’t yet sold on U.S. soil, BYD is expanding its vehicles globally, and some believe it’s only a matter of time before more China-made vehicles arrive in the U.S.

There’s fear among global automakers that Chinese rivals like the Warren Buffett-backed BYD could flood their markets, undercutting domestic production and vehicle prices to the detriment of their own auto industries.

“The introduction of cheap Chinese autos — which are so inexpensive because they are backed with the power and funding of the Chinese government — to the American market could end up being an extinction-level event for the U.S. auto sector,” the Alliance for American Manufacturing, a U.S. manufacturing advocacy group, said in a report last month.

BYD sold 1.57 million battery EVs last year, up from just 130,970 all-electric vehicles in 2020. That sales growth was enough to surpass Tesla to become the world’s largest producer of electric vehicles in late 2023.

The rise of BYD and other Chinese automakers led Tesla CEO Elon Musk in January to warn that Chinese automakers will “demolish” global rivals without trade barriers.

Bernstein reports BYD’s growth, including sales of non-EVs, has come by shipping more vehicles outside China: Overseas markets accounted for about 10% of BYD’s more than 3 million sales last year, doubling that share from the beginning of the year.

BYD did not respond for a request for comment.

The Seagull, also known as the BYD Dolphin Mini in Latin America, is slightly smaller than GM’s now-discontinued Chevrolet Bolt EV.

Its reported range of up to roughly 190 miles on a single charge (or 250 miles for certain models), is below that of many EVs on sale today in the U.S. but in line with many first-generation all-electric vehicles. The vehicle’s top speed of about 80 mph and just 74 horsepower dwindle in comparison with most EVs currently on sale in the U.S.

But its primary differences come in the construction, batteries and sourcing of parts, according to Caresoft.

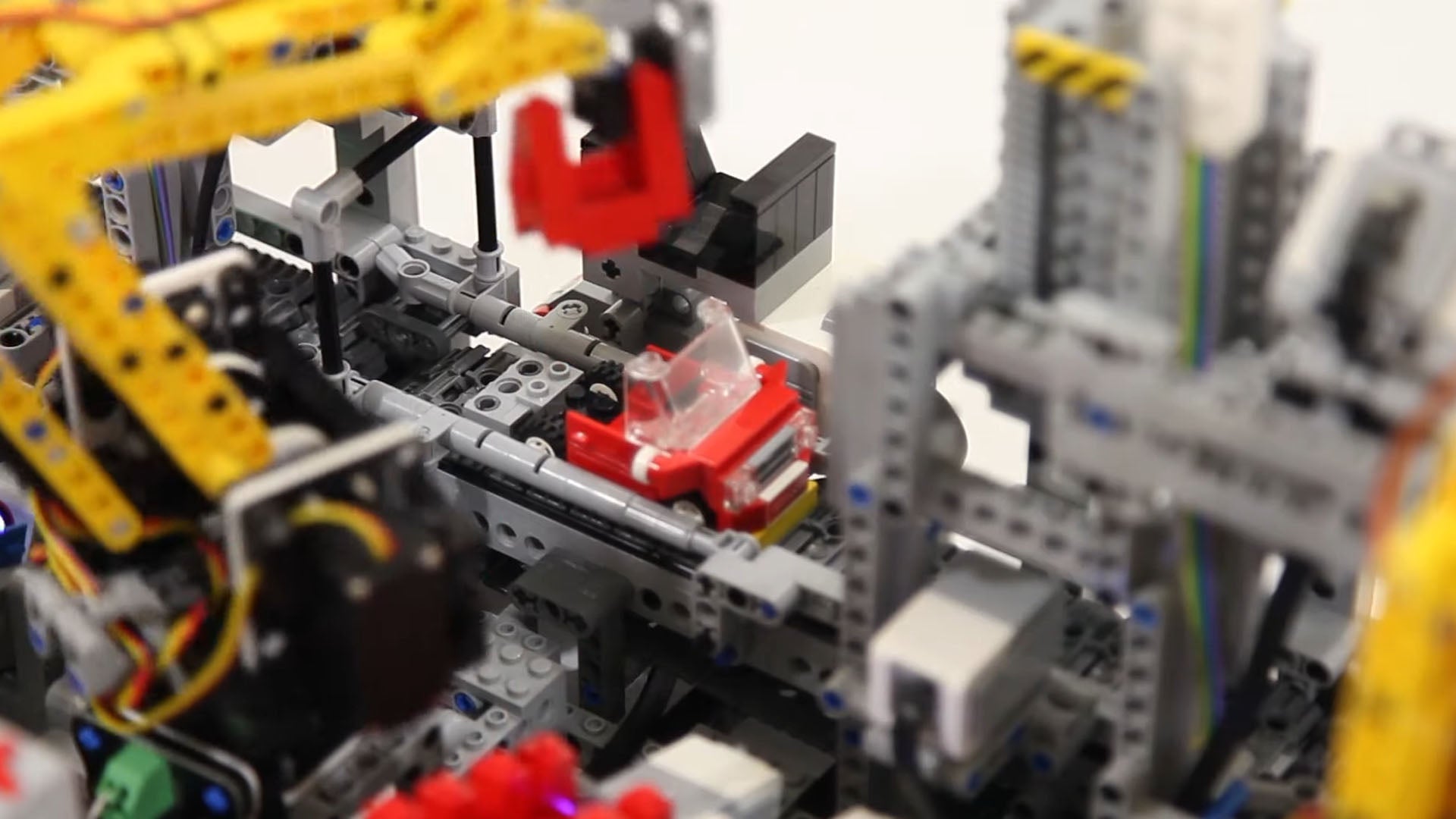

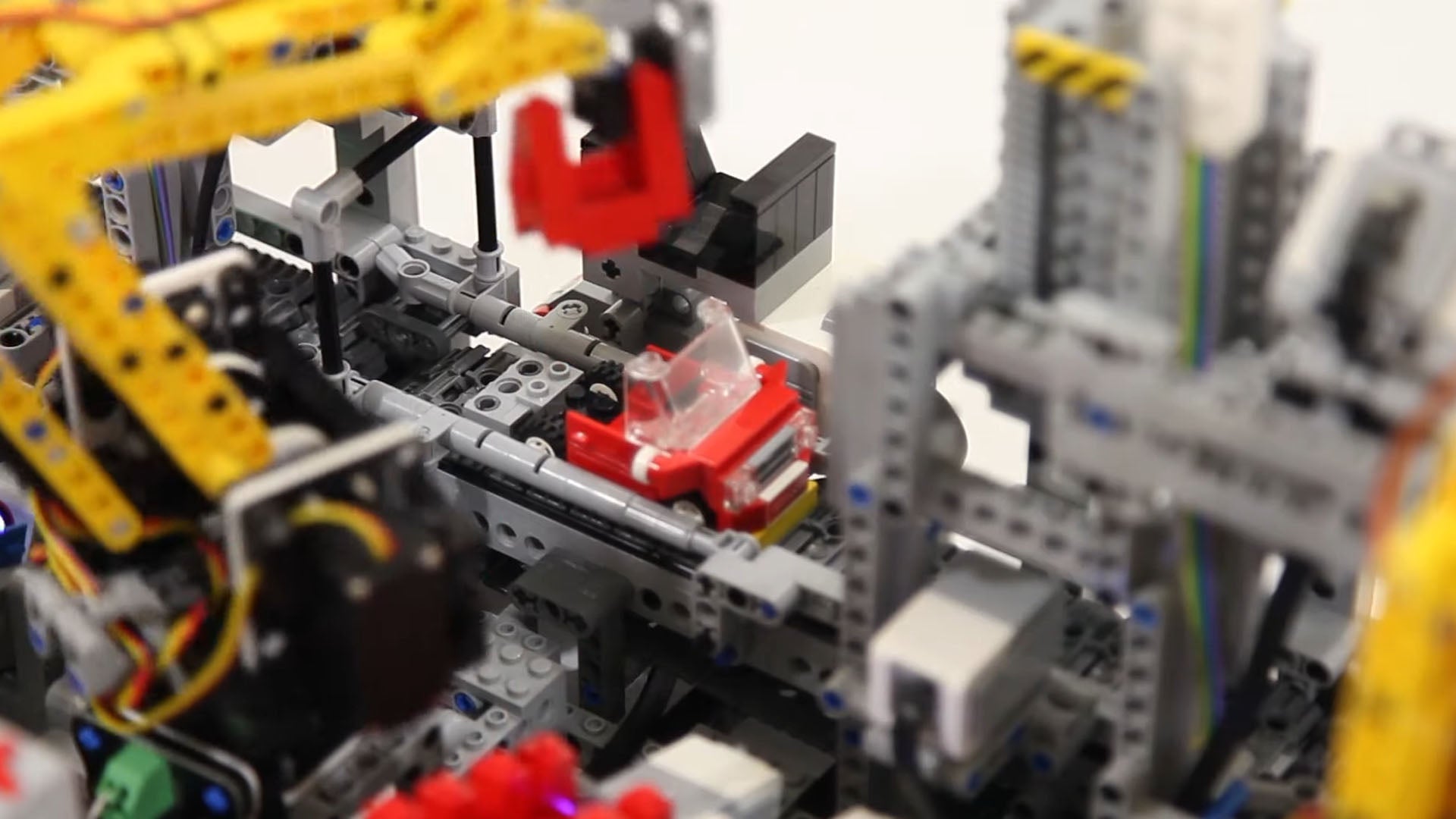

The consulting firm tore apart the BYD Seagull piece by piece to benchmark the small EV against vehicles from other startups and traditional automakers. The Livonia, Michigan-based company, with several offices across the globe, has torn down and benchmarked more than 30 China-built EVs from the likes of BYD, Nio, XPENG and others.

Caresoft digitally and physically analyzes every part of a vehicle, from bolts and latches to seats, motors and battery casings. It then determines how its clients – mainly automakers and suppliers – can improve efficiencies and cut costs in their products.

Its initial study of the BYD Seagull found it to be efficiently and simplistically designed, engineered and executed, but with unexpected quality and anticipated reliability.

“What they did do is done very well,” Woychowski said. “It’s efficiently done.”

For the price it’s a well-equipped vehicle. (BYD even lowered the starting price of the vehicle by 5% earlier this month, down from a roughly $11,000 price earlier this year.)

Despite the cheap price, the company still makes “some money” on the Seagull or at a minimum breaks even, Caresoft CEO Mathew Vachaparampil said during an automotive conference hosted by the Chicago Federal Reserve in January.

For BYD to sell the Seagull in the U.S., it would have to meet U.S. federal vehicle requirements that would add additional costs to the car. But the EV could likely still arrive on U.S. shores for tens of thousands of dollars cheaper than the current average price of an EV in the U.S., which Cox Automotive reports is more than $52,000.

BYD last month announced it would begin selling the Seagull/Dolphin Mini EV in Mexico for 358,800 pesos (or about $20,990).

BYD has found success in its battery technology; internal sourcing, also known as vertical integration; and production of parts, according to Caresoft. Most notable is BYD’s development of lower-cost battery technologies that are far cheaper to manufacture than lithium-ion batteries commonly used in U.S. EVs.

BYD, which stands for Build Your Dreams, first pioneered its “Blade” battery technologies in smartphones and has since grown into one of China’s most well-known automakers.

Its focus on vehicle efficiencies is reminiscent of U.S. EV leader Tesla, which has likewise been able to drive down the cost of its vehicles over the years.

Traditional automakers are only now attempting to emulate some of Tesla’s processes such as its gigacasting manufacturing process and vertical integration of crucial parts such as motors, batteries and other components. Tesla is also quick to adapt.

The Tesla Model 3, for example, no longer has a floor. Instead, the car’s highly protected battery case takes the place of a traditional vehicle body at the base. That type of change, enacted at Tesla over the last several years, wouldn’t typically take place at a traditional automaker until a full redesign of a vehicle.

BYD is similarly quick to adapt. The company has quickly rolled out new and updated products. It’s also rapidly established manufacturing, as it has its eyes set on factories in Thailand, Brazil, Indonesia, Hungary, Uzbekistan and, potentially, Mexico.

Add in other advantages such as government support, lower labor costs and rising production capacity, and the company poses a growing threat to global counterparts.

While China’s automakers expand, America’s traditional automakers have shrunk in both their domestic market and China.

Their decline in the U.S. has come with the arrival of Japanese automakers such as Toyota Motor, Nissan Motor and Honda Motor, as well as, more recently, South Korean auto giant Hyundai Motor and its Kia unit.

The so-called Big Three U.S. automakers — GM, Ford and Chrysler, now owned by Stellantis — have watched their U.S. market share deteriorate from 75% in 1984 to about 40% in 2023, according to industry data.

Politicians in the U.S., concerned about their local auto industries, have taken aim at Chinese imports and lawmakers in Europe have launched a probe into the rise of China-made EVs.

“We are very concerned about China bigfooting our industry in the United States even as we are building up now this incredible backbone of manufacturing,” Energy Secretary Jennifer Granholm said March 6 during a discussion panel at an Axios event.

Republican Sen. Marco Rubio of Florida has proposed sharply boosting tariffs on Chinese vehicle imports by $20,000 per vehicle to stop the country “from flooding U.S. auto markets.”

Currently, Chinese-built EVs are subject to a 27.5% tariff when imported into the U.S. That includes a 2.5% tariff that generally applies to imported cars plus an additional 25% tariff introduced by the Trump administration in 2018 on China-made vehicles.

Chinese automakers could still build in Mexico, though, and import vehicles to the U.S. from there through the USMCA, formerly the North American Free Trade Agreement, or NAFTA.

However, former President Donald Trump – the front-runner among Republicans in the 2024 presidential race – on Saturday suggested instituting a 100% tariff on cars made in Mexico by Chinese companies, should he be elected to a second term.

“What we’ve seen over time is automotive manufacturers eventually enter all the markets that matter … Ultimately the Chinese will come to the U.S.,” said Marin Gjaja, chief operating officer for Ford’s EV unit, during a recent interview with CNBC.

Gjaja said while Ford can’t control regulations or Chinese expansion, it can “get really, really competitive on the technologies that customers want” and get more efficient to win customers.

To compete with Chinese brands such as BYD, Woychowski contends traditional automakers must learn, unlearn and change quickly.

He said companies such as the Detroit automakers each have a century of procedures, standards and other workflows that they must rethink to better compete against Chinese automakers before vehicles such as the BYD Seagull land on U.S. shores.

“You have to learn. You have to unlearn and you have to do it quickly,” he said. “Because you’ve been doing something for 100 years, doesn’t mean you should keep doing it. It’s no longer appropriate.”

– CNBC’s Evelyn Cheng and Dylan Butts contributed to this report.

https://www.cnbc.com/2024/03/22/byd-seagull-ev-puts-global-auto-execs-politicians-on-edge.html

- The China-built BYD Seagull, a small all-electric hatchback, starts at just 69,800 yuan (or less than $10,000), and reportedly banks a profit for the increasingly influential Chinese automaker.

- There’s fear among global automakers that BYD and other Chinese rivals could flood their markets, undercutting domestic production and vehicle prices.

- “Ultimately the Chinese will come to the U.S.,” said Marin Gjaja, chief operating officer for Ford’s EV unit, during a recent interview with CNBC.

A BYD Seagull small electric car is on display during the 20th Shanghai International Automobile Industry Exhibition at the National Exhibition and Convention Center (Shanghai)

Vcg | Visual China Group | Getty Images

LIVONIA, Mich. – A small electric vehicle is having a big impact on the global automotive industry.

It’s not the EV itself that’s making waves but its price — and its potential to disrupt domestic auto industries around the world.

The China-built BYD Seagull, a small all-electric hatchback, starts at just 69,800 yuan (or less than $10,000), and reportedly banks a profit for the increasingly influential Chinese automaker.

That latter point — EV profits where U.S. automakers have mostly failed to turn any — combined with the expansion of Chinese automakers into Europe, Latin America and elsewhere has automotive executives and politicians, from Detroit and Texas to Germany and Japan, on edge.

The Seagull could be a “clarion call for the rest of the auto industry,” said Terry Woychowski, a former General Motors executive who now serves as president of automotive at engineering consulting firm Caresoft Global. “It’s a significant event.”

Though the Seagull isn’t yet sold on U.S. soil, BYD is expanding its vehicles globally, and some believe it’s only a matter of time before more China-made vehicles arrive in the U.S.

There’s fear among global automakers that Chinese rivals like the Warren Buffett-backed BYD could flood their markets, undercutting domestic production and vehicle prices to the detriment of their own auto industries.

“The introduction of cheap Chinese autos — which are so inexpensive because they are backed with the power and funding of the Chinese government — to the American market could end up being an extinction-level event for the U.S. auto sector,” the Alliance for American Manufacturing, a U.S. manufacturing advocacy group, said in a report last month.

BYD sold 1.57 million battery EVs last year, up from just 130,970 all-electric vehicles in 2020. That sales growth was enough to surpass Tesla to become the world’s largest producer of electric vehicles in late 2023.

The rise of BYD and other Chinese automakers led Tesla CEO Elon Musk in January to warn that Chinese automakers will “demolish” global rivals without trade barriers.

Bernstein reports BYD’s growth, including sales of non-EVs, has come by shipping more vehicles outside China: Overseas markets accounted for about 10% of BYD’s more than 3 million sales last year, doubling that share from the beginning of the year.

BYD did not respond for a request for comment.

How the Seagull stacks up

Driving the Seagull is no different than driving the Chevrolet Bolt, Nissan Leaf or BMW i3. It accelerates quickly. It’s quiet. It has nice-looking screens and a mix of plastic and soft touch points, including sporty and comfortable seats.The Seagull, also known as the BYD Dolphin Mini in Latin America, is slightly smaller than GM’s now-discontinued Chevrolet Bolt EV.

Its reported range of up to roughly 190 miles on a single charge (or 250 miles for certain models), is below that of many EVs on sale today in the U.S. but in line with many first-generation all-electric vehicles. The vehicle’s top speed of about 80 mph and just 74 horsepower dwindle in comparison with most EVs currently on sale in the U.S.

But its primary differences come in the construction, batteries and sourcing of parts, according to Caresoft.

The consulting firm tore apart the BYD Seagull piece by piece to benchmark the small EV against vehicles from other startups and traditional automakers. The Livonia, Michigan-based company, with several offices across the globe, has torn down and benchmarked more than 30 China-built EVs from the likes of BYD, Nio, XPENG and others.

Caresoft digitally and physically analyzes every part of a vehicle, from bolts and latches to seats, motors and battery casings. It then determines how its clients – mainly automakers and suppliers – can improve efficiencies and cut costs in their products.

Its initial study of the BYD Seagull found it to be efficiently and simplistically designed, engineered and executed, but with unexpected quality and anticipated reliability.

“What they did do is done very well,” Woychowski said. “It’s efficiently done.”

For the price it’s a well-equipped vehicle. (BYD even lowered the starting price of the vehicle by 5% earlier this month, down from a roughly $11,000 price earlier this year.)

Despite the cheap price, the company still makes “some money” on the Seagull or at a minimum breaks even, Caresoft CEO Mathew Vachaparampil said during an automotive conference hosted by the Chicago Federal Reserve in January.

For BYD to sell the Seagull in the U.S., it would have to meet U.S. federal vehicle requirements that would add additional costs to the car. But the EV could likely still arrive on U.S. shores for tens of thousands of dollars cheaper than the current average price of an EV in the U.S., which Cox Automotive reports is more than $52,000.

BYD last month announced it would begin selling the Seagull/Dolphin Mini EV in Mexico for 358,800 pesos (or about $20,990).

BYD has found success in its battery technology; internal sourcing, also known as vertical integration; and production of parts, according to Caresoft. Most notable is BYD’s development of lower-cost battery technologies that are far cheaper to manufacture than lithium-ion batteries commonly used in U.S. EVs.

BYD, which stands for Build Your Dreams, first pioneered its “Blade” battery technologies in smartphones and has since grown into one of China’s most well-known automakers.

Its focus on vehicle efficiencies is reminiscent of U.S. EV leader Tesla, which has likewise been able to drive down the cost of its vehicles over the years.

Traditional automakers are only now attempting to emulate some of Tesla’s processes such as its gigacasting manufacturing process and vertical integration of crucial parts such as motors, batteries and other components. Tesla is also quick to adapt.

The Tesla Model 3, for example, no longer has a floor. Instead, the car’s highly protected battery case takes the place of a traditional vehicle body at the base. That type of change, enacted at Tesla over the last several years, wouldn’t typically take place at a traditional automaker until a full redesign of a vehicle.

BYD is similarly quick to adapt. The company has quickly rolled out new and updated products. It’s also rapidly established manufacturing, as it has its eyes set on factories in Thailand, Brazil, Indonesia, Hungary, Uzbekistan and, potentially, Mexico.

Add in other advantages such as government support, lower labor costs and rising production capacity, and the company poses a growing threat to global counterparts.

Growing concerns

BYD’s rise comes at a precarious time for global auto industry dynamics.While China’s automakers expand, America’s traditional automakers have shrunk in both their domestic market and China.

Their decline in the U.S. has come with the arrival of Japanese automakers such as Toyota Motor, Nissan Motor and Honda Motor, as well as, more recently, South Korean auto giant Hyundai Motor and its Kia unit.

The so-called Big Three U.S. automakers — GM, Ford and Chrysler, now owned by Stellantis — have watched their U.S. market share deteriorate from 75% in 1984 to about 40% in 2023, according to industry data.

Politicians in the U.S., concerned about their local auto industries, have taken aim at Chinese imports and lawmakers in Europe have launched a probe into the rise of China-made EVs.

“We are very concerned about China bigfooting our industry in the United States even as we are building up now this incredible backbone of manufacturing,” Energy Secretary Jennifer Granholm said March 6 during a discussion panel at an Axios event.

Republican Sen. Marco Rubio of Florida has proposed sharply boosting tariffs on Chinese vehicle imports by $20,000 per vehicle to stop the country “from flooding U.S. auto markets.”

Currently, Chinese-built EVs are subject to a 27.5% tariff when imported into the U.S. That includes a 2.5% tariff that generally applies to imported cars plus an additional 25% tariff introduced by the Trump administration in 2018 on China-made vehicles.

Chinese automakers could still build in Mexico, though, and import vehicles to the U.S. from there through the USMCA, formerly the North American Free Trade Agreement, or NAFTA.

However, former President Donald Trump – the front-runner among Republicans in the 2024 presidential race – on Saturday suggested instituting a 100% tariff on cars made in Mexico by Chinese companies, should he be elected to a second term.

“What we’ve seen over time is automotive manufacturers eventually enter all the markets that matter … Ultimately the Chinese will come to the U.S.,” said Marin Gjaja, chief operating officer for Ford’s EV unit, during a recent interview with CNBC.

Gjaja said while Ford can’t control regulations or Chinese expansion, it can “get really, really competitive on the technologies that customers want” and get more efficient to win customers.

To compete with Chinese brands such as BYD, Woychowski contends traditional automakers must learn, unlearn and change quickly.

He said companies such as the Detroit automakers each have a century of procedures, standards and other workflows that they must rethink to better compete against Chinese automakers before vehicles such as the BYD Seagull land on U.S. shores.

“You have to learn. You have to unlearn and you have to do it quickly,” he said. “Because you’ve been doing something for 100 years, doesn’t mean you should keep doing it. It’s no longer appropriate.”

– CNBC’s Evelyn Cheng and Dylan Butts contributed to this report.

https://www.cnbc.com/2024/03/22/byd-seagull-ev-puts-global-auto-execs-politicians-on-edge.html