You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economy 12 Years and $34 Billion Later, Canada's Trans Mountain Pipeline Expansion Is Set To Complete.

- Thread starter Arkain2K

- Start date

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

The $30-billion exodus: Foreign oil firms keep bailing on Canada's energy sector

The drumbeat of exits, rare for such a stable oil-producing country, adds an extra layer of gloom for an industry that accounts for about a fifth of Canada's exports

By Kevin Orland | August 22, 2019

The drumbeat of exits, rare for such a stable oil-producing country, adds an extra layer of gloom for an industry that accounts for about a fifth of Canada's exports

By Kevin Orland | August 22, 2019

Capital keeps marching out of Canada’s oil industry, with Kinder Morgan Inc.’s sale of its remaining holdings in the country on Wednesday adding to more than US$30 billion of foreign-company divestitures in the past three years.

Pembina Pipeline Corp., based in Calgary, is snapping up Kinder’s Canadian assets and a cross-border pipeline in a US$3.3-billion deal. For Houston-based Kinder, the deal completes an exit from a country that has frustrated more than a few companies — from ConocoPhillips and Royal Dutch Shell Plc to Marathon Oil Corp.

The drumbeat of exits, rare for such a stable oil-producing country, adds an extra layer of gloom for an industry that accounts for about a fifth of Canada’s exports. The energy sector — centred around Alberta’s oilsands — has struggled to rebound since the 2014 crash in global oil prices, with capital spending declining for five straight years and job cuts pushing the province’s unemployment rate above 6 per cent. Alberta is forecast to post the slowest growth of any region in Canada this year.

The situation isn’t likely to improve any time soon, with key pipelines like TC Energy Corp.’s Keystone XL and Enbridge Inc.’s expansion of its Line 3 conduit bogged down by legal challenges. The lack of pipelines has weighed on Canadian heavy crude prices for years, sending them to a record low late in 2018.

“If they thought things were getting better in Canada, they might hold on, but they don’t see things getting better,” Laura Lau, who helps manage more than $2 billion (US$1.5 billion) at Brompton Corp. in Toronto, said in an interview. “The pipeline situation is getting worse; everything is getting worse.”

Other recent major exits include ConocoPhillips’ US$13.2 billion sale of its oilsands and natural gas assets to Cenovus Energy Inc. in 2017, and Shell’s and Marathon’s sales of their stakes in an oil-sands project to Canadian Natural Resources Ltd. for about US$10.7 billion that same year. Canadian Natural also bought Oklahoma City-based Devon Energy Corp.’s Canadian heavy oil assets this year for US$2.79 billion. Norway’s Equinor ASA pulled out in 2016 after facing pressure at home to invest in lower-emission projects.

While a government curtailment program has boosted oilsands prices to more normal levels, the system has prevented companies from investing in new deposits. What’s more, the oilsands are often viewed by investors as a higher-cost jurisdiction that produces a lower quality of heavy crude. Those persistent drags are likely to keep Canadian assets at the top of international companies’ lists for potential disposal, Lau said.

Kinder Morgan is in many ways the perfect example of the troubles — including slow-moving regulatory processes, an active environmental movement, and a variety of inter-provincial squabbles. The company bought the Trans Mountain pipeline, which carries crude and other products from Edmonton to a shipping terminal in Vancouver, for about US$5.6 billion in 2005 in a bid to gain exposure to the oilsands — the world’s third-largest crude reserves.

But a plan to roughly triple the capacity of the line got bogged down amid opposition from indigenous groups, environmentalists and British Columbia’s government. Kinder threatened to scrap the expansion, which all but forced Prime Minister Justin Trudeau’s government to step in and buy the entire line for about US$3.45 billion last year.

Bad Signal

“When they sold Trans Mountain, there wasn’t much left, and it was just a matter of time for them to exit Canada completely,” Lau said. “But definitely another foreign company exiting Canada doesn’t send a good signal.”

Not all foreign operators have abandoned Canada. Exxon Mobil Corp. still has a sizable presence with its controlling stake in Imperial Oil Ltd., a $25-billion company. Shell, based in The Hague, still owns a refining complex and natural gas production in Alberta and British Columbia. France’s Total SA owns a portion of the Fort Hills mine, and Japanese and Chinese companies also have oilsands projects.

A potential catalyst for the sector could be the election of a Conservative government in Canada’s federal election in October, said Rafi Tahmazian, senior portfolio manager at Canoe Financial. That may change global investors’ perceptions about the support the industry would receive from the government.

“The silver lining in this whole process is that Canada owns Canada again, and we got it pretty cheap,” Tahmazian said in an interview. “Now the question is can we take advantage of that by allowing ourselves a more friendly environment for foreign investment?”

https://business.financialpost.com/...il-firms-are-bailing-on-canadas-energy-sector

Last edited:

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

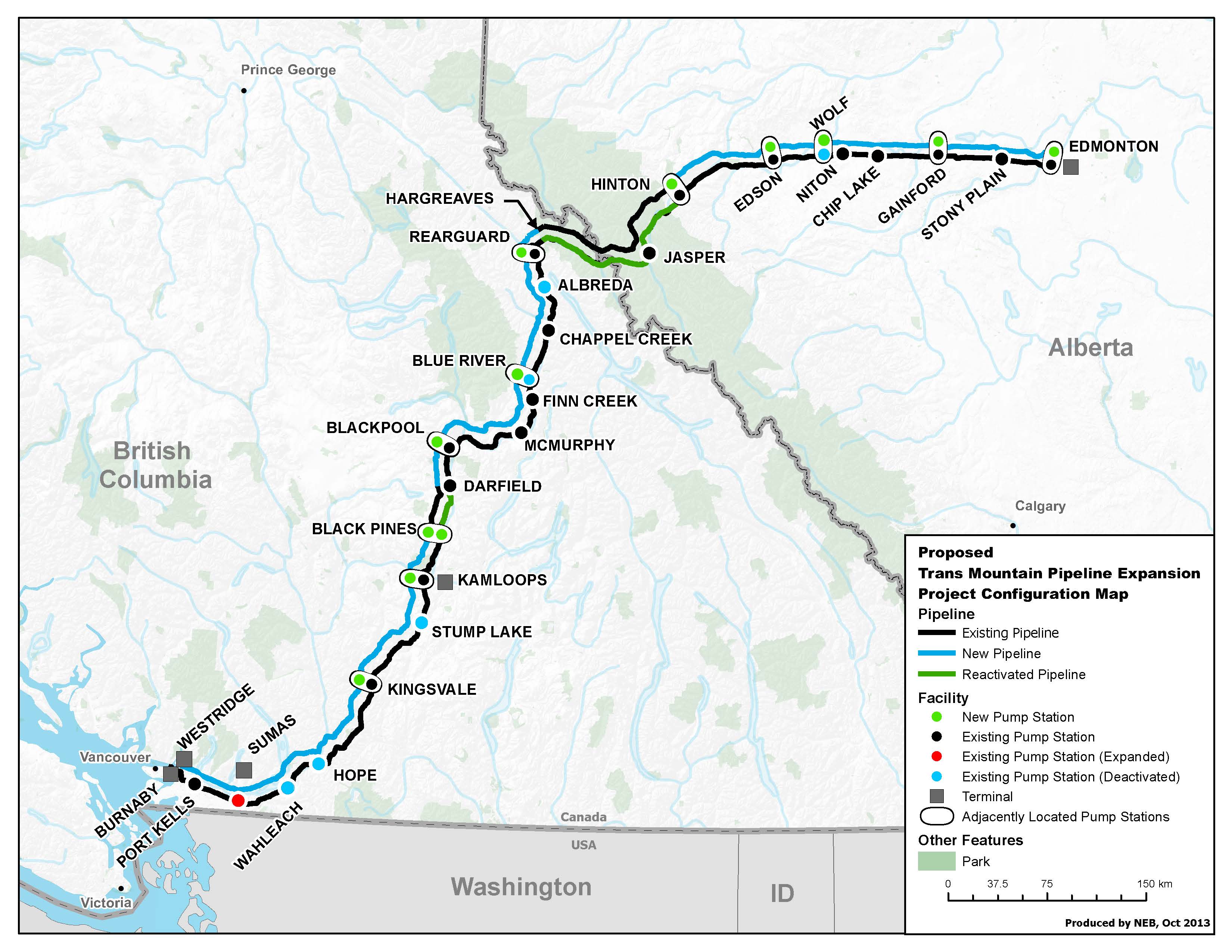

Trans Mountain Corp. officially marked the start of construction on the expansion of its pipeline. The company said it expects 4,200 workers to be employed along the pipeline route by the end of the year as they work to complete the project that will carry 890,000 barrels of oil per day from Alberta to the B.C. coast.

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Cost of Trans Mountain expansion soars to $12.6B

Figure includes $1.1B already spent on construction by previous owner of the project, Kinder Morgan

Vassy Kapelos, John Paul Tasker · CBC News · Posted: Feb 07, 2020

Figure includes $1.1B already spent on construction by previous owner of the project, Kinder Morgan

Vassy Kapelos, John Paul Tasker · CBC News · Posted: Feb 07, 2020

Trans Mountain CEO Ian Anderson announced Friday that the cost of building the pipeline expansion has soared from an initial estimate of $7.4 billion to $12.6 billion.

In a conference call with reporters, Anderson said increased material and labour costs are to blame for the cost overruns, along with years-long legal troubles and renewed Indigenous consultation efforts that also added to the final total.

Despite the sizeable increase from the initial 2017 cost estimate, Anderson said the project will be profitable because much of its capacity has already been sold to major oil producers like Suncor and Cenvous on 20-year contracts. He said the project will generate $1.5 billion a year in cash flow when it's fully operational.

While the project is owned by the federal government, Anderson said he's running the company as it were a private entity and the cost overruns would be incurred by any proponent building the expansion.

Anderson said recent legal victories at the Supreme Court of Canada and the Federal Court of Appeal have given the project greater legal certainty.

"I believe there's a path and that path is getting clearer each day," he said. "I'm confident the project itself remains very, very strongly economically viable.

"There isn't anyone who could picture the journey we've been on to get this project started and what it will take to get it constructed."

That $12.6 billion construction cost figure includes $1.1 billion already spent on construction by the previous owner of the project, Kinder Morgan, before Ottawa bought the project amid legal uncertainty.

Ottawa already spent $4 billion to buy the line

The construction cost is in addition to the more than $4 billion the federal government spent to purchase the existing pipeline and the expansion plans, and another $600 million Ottawa set aside for contingencies (called a reserve fund for "cost impacts"). Those sums bring the total cost of taxpayers' investment in Trans Mountain to more than $16 billion.

The August 2018 Federal Court of Appeal ruling that quashed cabinet's approval of the project was source of cost overruns.

As a result of that ruling, the government had to make a number of accommodations to Indigenous communities along the route and meet additional environmental standards — changes that added roughly $3 billion to the construction price tag.

"The project that we're all working on building today is not the project we originally envisioned and introduced in 2012," Anderson said.

Anderson said the project has more support from Indigenous communities than it did when it was first proposed. Fifty-eight Indigenous communities along the project's route have signed impact benefit agreements with the Crown corporation that cover financial incentives, job training, bursaries, pensions for Indigenous elders and funds for community infrastructure upgrades. These agreements will cost the proponent about $500 million.

The company also is running fibre optic cable along the pipeline's route to detect spills or other safety issues — which means its also bringing internet connections to communities that don't already have access.

Beyond Indigenous-related costs, Anderson said a new labour agreement with trade unions cost the project an additional $100 million a year, steel-related costs have spiked by $120 million, robust security along the route will cost an additional $190 million and state-of-the art spill-response technology will set the project back another $70 million. Financing the project will cost another $1 billion.

The company estimates the expansion will be up and running by December of 2022.

Finance Minister Bill Morneau said in media statement Friday that the project is still "commercially viable." He said Canada needs the expanded pipeline to get Alberta oil to lucrative markets in Asia where it can fetch prices closer to the going world rate.

"We believe Canada should get a fair price for its resources. Currently, almost all of our energy exports go to the United States and producers often have to sell at a discounted price," Morneau said.

He said the project will employ 5,500 at the peak of construction and will provide tens of millions of dollars in economic support to Indigenous communities.

During the federal election, the Liberals pledged to invest corporate tax revenue from the pipeline into cleaner sources of energy and projects that pull carbon out of the atmosphere — a promise Morneau reaffirmed Friday.

"The Trans Mountain expansion project will be an important driver in Canada's transition to a cleaner economy. Every dollar the federal government earns — from the annual corporate tax revenue estimated at $500 million as well as any profit from an eventual sale — will be invested in clean energy projects that will power our homes, businesses and communities for generations to come," Morneau said.

'Unacceptable'

Opposition MPs weren't happy with the project's rising cost.

"It didn't have to be this way. It's ridiculous. Not a single tax dollar should have been spent on the Trans Mountain expansion," said Conservative MP Shannon Stubbs, who called on the government to file monthly reports on the project's costs and progress.

"Because they, as of their own fault, made Canadians the owners of the pipeline. So it's on them to tell Canadians exactly how it's going to be built, when it's going to be in service, how much it's going to cost and who is going to own it in the long run."

NDP MP Alexandre Boulerice said the price is "unacceptable" and the project should be scrapped.

"It's a really bad investment because this is the kind of oil that has no future. So we are investing in something that in 10 years or 20 years will not run again," he said in an interview.

"We're asking the Liberals to change their mind and to come to the earth and to invest that kind of money to create good jobs in renewable energy."

The International Energy Agency projects that — if governments follow current stated policies — demand for oil will increase each year until it plateaus in the mid-2030s. By contrast, the IEA also projects that under a sustainable development scenario needed to avoid the worst effects of climate change that demand could drop off much quicker.

The federal government purchased the existing Trans Mountain pipeline for $4.5 billion in May of 2018, after the original proponent, Kinder Morgan, pulled out because of increased political and environmental opposition to the project.

The expansion would twin the existing pipeline, which runs more than 1,000 kilometres between Edmonton and Burnaby, B.C. It would triple the amount of bitumen flowing through the pipeline to nearly 900,000 barrels a day.

The project is also set to expand the terminal in B.C. and, as a result, tanker traffic is expected to increase by nearly seven-fold a month.

According to the federal government, the pipeline and terminal would produce 400,000 tonnes of greenhouse gas emissions a year, create 15,000 jobs during construction and generate about $47 billion in revenue for different levels of government over the first 20 years of its operation.

The company estimates the expansion will be up and running by December of 2022.

Finance Minister Bill Morneau said in media statement Friday that the project is still "commercially viable." He said Canada needs the expanded pipeline to get Alberta oil to lucrative markets in Asia where it can fetch prices closer to the going world rate.

"We believe Canada should get a fair price for its resources. Currently, almost all of our energy exports go to the United States and producers often have to sell at a discounted price," Morneau said.

https://www.cbc.ca/news/politics/vassy-trans-mountain-pipeline-1.5455387

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Canada closes the door on new federal funding for Trans Mountain as project costs surge

Construction costs have surged by 70 per cent to $21.4 billion

By Kevin Carmichael | Feb 18, 2022

Construction costs have surged by 70 per cent to $21.4 billion

By Kevin Carmichael | Feb 18, 2022

Finance Minister Chrystia Freeland, facing a gigantic bill from the federal government’s COVID-19 rescue effort, said the Trans Mountain pipeline will receive no more federal funding, even though the Crown corporation that owns the pipeline revealed on Feb. 18 that construction costs have surged by some 70 per cent.

“There will be no additional public money invested in TMC,” or Trans Mountain Corp., the company the federal government created when it bought the pipeline in 2018, Freeland said at a press conference. “TMC will secure necessary funding to complete the project through third-party financing, either in the public debt markets or with financial institutions.”

Prime Minister Justin Trudeau’s government bought Trans Mountain from Kinder Morgan Inc. for $4.5 billion to keep the project alive. It would expand capacity to 800,000 barrels per day from 300,000, and give oil producers in Alberta a meaningful connection to Asian markets, which should result in higher prices. The oilpatch currently is at the mercy of conditions in the United States, and transportation bottlenecks tend to depress prices by creating a glut of Canadian bitumen.

“The Trans Mountain Expansion will ensure Canada receives fair market value for our resources,” said Freeland, adding that BMO Capital Markets and TD Securities, hired to offer Bay Street counsel, have both advised that the project remains commercially viable and that financing can be easily arranged.

“Our government acquired TMC and the Trans Mountain Expansion project in 2018 because we knew that it was a serious and necessary investment,” Freeland said. “This project is in the national interest and will make Canada and the Canadian economy more sovereign and more resilient.”

It might, but at an ever increasing cost. Trans Mountain chief executive Ian Anderson said in a statement that costs have increased to $21.4 billion from $12.6 billion at the time of the company’s previous update. Anderson cited delays caused by the pandemic and the November floods in the Hope, Coquihalla, and Fraser Valley areas as partially responsible for the cost overrun.

“The progress we have made over the past two years is remarkable when you consider the unforeseen challenges we have faced including the global pandemic, wildfires and flooding,” said Anderson. “At every step of the way, we have found solutions and responded. As a result, the project is advancing with significantly improved safety and environmental management, and with a deep commitment to ensure this project is being built the right way.”

Anderson said the target date for “mechanical completion” was the third quarter of 2023.

“Notwithstanding the cost increase and revised completion schedule, the business case supporting the project remains sound,” he said.

The oilpatch also remains supportive of the project. Suncor Energy Inc. chief executive Mark Little said the pipeline is crucial to the country and sector.

“While like everyone we are disappointed in the increased costs and schedule of the TransMountain project, we remain fully supportive of this world-class infrastructure project which is vital to Canada’s long-term economic success and energy security,” he said.

“The 2021 B.C. floods were a reminder of how critical this energy infrastructure is to both the security of energy supply to British Columbians and access for Canadian resources to global markets.”

Freeland’s decision to quickly shut the door on even the possibility that the federal government might come to Trans Mountain’s aid reflects the difficult fiscal situation in which she finds herself after two years of generously helping households and businesses survive the pandemic.

The federal budget deficit narrowed to $73.7 billion between April and November, compared with $232 billion in the same period a year earlier, but net debt remained elevated at $1.2 trillion, according to the Finance Department’s latest accounting.

https://financialpost.com/commoditi...ing-for-trans-mountain-as-project-costs-surge

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Poll shows 68% of Canadians oppose government writedown on Trans Mountain pipeline

By Nia Williams | October 24, 2023

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5GJSMBA3HFL7VKADLD65BBT2S4.jpg)

By Nia Williams | October 24, 2023

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5GJSMBA3HFL7VKADLD65BBT2S4.jpg)

https://www.reuters.com/business/en...writedown-trans-mountain-pipeline-2023-10-24/More than two-thirds of Canadians oppose the federal government taking a multibillion-dollar writedown on the Trans Mountain oil pipeline, a survey showed on Tuesday, a dilemma for Prime Minister Justin Trudeau's Liberals as they look to sell it ahead of an election expected by 2025.

Ottawa has sunk roughly C$35 billion ($25.6 billion) into the Trans Mountain oil pipeline, which the federal government bought in 2018 to ensure a controversial expansion project known as TMX went ahead.

TMX will nearly treble the pipeline's capacity to 890,000 barrels per day and improve access to Asian markets when it starts shipping crude oil early next year. But the project cost has more than quadrupled from its original budget and analysts say the government will likely have to take a significant haircut on its investment.

Finalising that loss ahead of an election that must take place by autumn 2025 looks set to antagonise voters, many of whom are struggling with Canada's rising cost of living and high interest rates.

The Nanos survey found 68% of respondents opposed or somewhat opposed Ottawa writing off between C$15 billion and C$20 billion of the debt incurred by Trans Mountain Corp (TMC), the government-owned corporation building the expansion.

"In the context of people worrying about paying for groceries and paying for their rent and mortgage, writing off that debt is going to be political jeopardy for the Liberals," said Nik Nanos, founder of Nanos Research.

The survey was commissioned by West Coast Environmental Law, which works with Indigenous communities against oil pipelines and tanker projects in British Columbia.

Its findings come as Canada's government spending watchdog warned on Tuesday that for a second year TMC's year-end financial statements disclosed "significant uncertainty" about the corporation's ability to continue operating.

In a report on financial audits of federal organizations for this fiscal year ended March 31, Canada's Office of the Auditor General said the uncertainty was related to the corporation's ability to fund the remaining construction costs of TMX and to make necessary payments on its existing debt.

TMC's credit facility with a group of Canadian financial institutions, guaranteed by the federal government, has a borrowing limit of C$16 billion.

The pipeline is a key conduit shipping crude from Alberta to Canada's Pacific Coast and the expansion will be a huge boost to oil producers by opening up refining markets in Asia and the U.S. West Coast.

Six in 10 Canadians surveyed said it should be mostly oil companies responsible for funding TMX, while nearly half of respondents said the federal government was going in the wrong direction on the project.

"The federal government has spent reams of political and financial capital on TMX, but Canadians do not support billions of dollars in additional subsidies to the oil and gas companies," said Eugene Kung, a staff lawyer with West Coast Environmental Law.

($1 = 1.3681 Canadian dollars)

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Indigenous ownership of Trans Mountain must be 'material,' says prospective bidder

'There's no reason ... why it can't be 100 per cent owned by Indigenous people'

Amanda Stephenson · CBC News · Posted: Oct 20, 2023

'There's no reason ... why it can't be 100 per cent owned by Indigenous people'

Amanda Stephenson · CBC News · Posted: Oct 20, 2023

https://www.cbc.ca/news/canada/calg...line-expansion-indigenous-ownership-1.7003773As the federal government begins its efforts to sell the Trans Mountain pipeline, the director of one of the groups seeking to buy a stake says nothing less than "material" ownership by Indigenous people is acceptable if Ottawa is serious about reconciliation.

"It's got to be a minimum of 30 per cent in my view, period. Because anything less than that doesn't really [represent] that place at the table," said Stephen Mason, managing director of Project Reconciliation, in a recent interview.

"There's no reason, in my opinion, why it can't be 100 per cent owned by Indigenous people."

The Trans Mountain pipeline is Canada's only pipeline system that transports oil from Alberta to the West Coast. It is currently owned by the federal government, which bought the pipeline in 2018 to help ensure a planned expansion would be completed after previous owner Kinder Morgan Canada Inc. threatened to scrap the project.

However, Ottawa has been clear from the start that it does not wish to be the long-term owner of the pipeline. With the expansion project now nearing completion, the federal government has launched the first phase of what is expected to be a two-part divestment process.

The first phase involves talks — which have already begun — with more than 120 Western Canadian Indigenous communities whose lands are located along the pipeline route, to find out if any of them are interested in acquiring an equity stake.

Ottawa to help communities access capital

While it's not clear what size of stake is available during this first phase of negotiations, Mason — whose group is not participating in the first round — said he has heard that number could fall between 20 and 40 per cent, and that the federal government will support Indigenous communities with the purchase by helping them to access capital.

The second phase of the divestment process will involve the consideration of commercial offers for the remaining stake in the pipeline.

Mason's Project Reconciliation, an initiative that has lined up its own financing for a Trans Mountain bid in an effort to secure Indigenous economic participation in the pipeline, intends to participate at that stage.

Another group, a partnership formed by Western Indigenous Pipeline Group and its industry partner, Pembina Pipeline Corp., has also expressed interest in the commercial phase of negotiations, but did not respond to an interview request.

Groups with Indigenous involvement are very welcome to participate in the second phase, said a federal source with knowledge of the plan, speaking on condition of anonymity. That won't preclude any major pipeline or infrastructure company from making an offer, though.

But Mason said this must not be a situation where corporate interests acquire the bulk of the pipeline equity and Indigenous people are left with the scraps.

"Can there be room for another partner in this, like another big pipeline company or another major asset management company? Well, sure. This project is big enough," he said.

"The key point is, (Indigenous ownership) needs to be material. And in this case, 30 per cent is too small."

Project Reconciliation's aim is not to own a stake in Trans Mountain directly, but to facilitate the transaction for Indigenous communities and assist in the financial and technical administration of the ownership partnerships.

Once the transaction is completed, Project Reconciliation will operate essentially like a portfolio manager, charging annual management and administrative fees based on the pipeline's projected earnings.

Indigenous communities would also have a governance position through Trans Mountain Corp.'s board of directors, under the Project Reconciliation proposal.

Capital costs have ballooned

Mason declined to speculate publicly on what the present value of the Trans Mountain pipeline actually is. Though bought by the federal government for $4.5 billion, the capital costs of the pipeline's expansion project have ballooned to more than $30 billion due to construction-related challenges.

Mason said any prospective buyer will only offer a price that can be supported by the pipeline tolls — the fees oil shippers pay to move oil on the pipeline. Those tolls are the way the pipeline earns revenue, and are currently being negotiated with oil companies.

But Mason said regardless of how the numbers settle out, the sale of Trans Mountain will be one of the largest commercial transactions in Canadian history.

It may also become the largest Indigenous equity ownership purchase this country has ever seen, in financial terms. Currently, a $1.1-billion deal signed last fall that saw Enbridge Inc. sell an 11.57 per cent interest in seven northern Alberta pipelines to 23 First Nation communities holds the record as Canada's largest energy-related partnership between a private company and Indigenous people.

"This is not a conversation, in my view, where the Indigenous ownership (in Trans Mountain) is going to be just 10 per cent," Mason said.

"This is going to be transformative."

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Pembina Pipeline CEO wants more certainty before making offer for stake in Trans Mountain

Sale expected to be one of the largest commercial transactions in Canadian history

By Amanda Stephenson · The Canadian Press · Posted: Nov 03, 2023

https://www.cbc.ca/news/canada/calgary/pembina-pipeline-needs-trans-mountain-certainty-1.7018429

Sale expected to be one of the largest commercial transactions in Canadian history

By Amanda Stephenson · The Canadian Press · Posted: Nov 03, 2023

The CEO of Pembina Pipeline Corp. says the company needs more certainty over timing, regulations and costs related to the Trans Mountain expansion project before deciding whether to make an offer for an equity stake in the pipeline.

The Calgary-based pipeline company formed a partnership in 2021 with Western Indigenous Pipeline Group for the purpose of pursuing an Indigenous-led equity stake in Trans Mountain.

That partnership, called Chinook Pathways, is one of just two entities — the other is a group called Project Reconciliation — that has publicly expressed commercial interest in the federal government's pipeline divestment process.

Ottawa bought the Trans Mountain pipeline, Canada's only pipeline system that transports oil from Alberta to the west coast, in 2018 to ensure a planned expansion would be completed after previous owner Kinder Morgan Canada Inc. threatened to scrap the project.

But the federal government has always stated it does not wish to be the long-term owner of the pipeline, and recently launched the first phase of what is expected to be a two-part divestment process.

Pembina Pipeline CEO Scott Burrows told analysts on a third-quarter conference call Friday that neither Pembina nor Chinook Pathways are eligible to participate in this first phase, which involves talks with more than 120 Indigenous nations located along the Trans Mountain route to see if any of them are interested in an equity stake.

Phase 2 will involve the consideration of commercial offers for the remaining stake in the pipeline, but Burrows said the timing of that is unclear.

He added that there are still many unknowns surrounding the Trans Mountain expansion project, which is still under construction and expected to be complete sometime early next year.

"Based on public information, the earliest the divestment of the asset could likely occur is the end of 2024, and there appears to be outstanding regulatory, construction and tolling issues that pose further schedule, costs and timing uncertainties," Burrows said.

"Pembina, like any other prudent commercial purchaser, requires the many outstanding issues related to the project to crystallize in order to prudently and appropriately assess the opportunity and determine next steps."

The sale of Trans Mountain is expected to be one of the largest commercial transactions in Canadian history.

Yet there is uncertainty around what the present value of the Trans Mountain pipeline actually is. Though bought by the federal government for $4.5 billion, the capital costs of the pipeline's expansion project have ballooned to more than $30 billion due to construction-related challenges.

In addition, Trans Mountain is currently negotiating with oil companies the pipeline tolls — fees oil shippers pay to move oil on the pipeline. Those tolls are the way the pipeline earns revenue, and will have a direct impact on the amount a prospective buyer is willing to pay.

It's also unclear how large an equity stake might be sold to Indigenous communities during Phase 1 of the process.

There is also uncertainty around the expansion project's completion time frame. Though Trans Mountain Corp., the Crown corporation behind the project, successfully argued for regulatory permission for a route deviation earlier this fall to address construction challenges related to the construction of a tunnel in B.C., the project continues to face hurdles in its final stretch.

This week, the Canada Energy Regulator issued a temporary stop-work order on the project due to what it said was Trans Mountain's environmental non-compliance related to a wetland near Abbotsford, B.C.

The regulator has ordered Trans Mountain Corp. to stop work in the area until the issues are corrected and the company submits a safety inspection and report.

Pembina Pipeline Corp. on Thursday reported record adjusted earnings of $1.02 billion for the third quarter of 2023.

The company said based on these results, it is raising its full-year earnings guidance range for 2023 to between $3.75 billion and $3.85 billion, up from a previous estimate of $3.55 billion to $3.75 billion.

https://www.cbc.ca/news/canada/calgary/pembina-pipeline-needs-trans-mountain-certainty-1.7018429

Last edited:

- Joined

- Jan 15, 2009

- Messages

- 27,027

- Reaction score

- 22,144

Ugh, Canada should be filthy rich with their endless resources and relatively small population. Everyone could be living comfortably. But no. Environmentalist assholes will keep them from using their bountiful resources.

Just endless lumber that grows back and massive oil. Use it!

Just endless lumber that grows back and massive oil. Use it!

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

LOL, thought this is amusing for the Canadian bros:

John Horgan will be joining the board of Elk Valley Resources, which is in the process of being spun off from Vancouver-based Teck Resources Ltd. and will focus on coal that is used to make steel.

This is the same John Hogan who dragged the B.C. government through numerous legal battles against the Trans Mountain pipeline.

Former B.C. premier John Horgan’s first job after officially resigning his seat in the B.C. legislature will be with a coal-producing business.

Horgan, who was premier from 2017 until November 2022, follows other former B.C. leaders in moving on to board positions in high profile industries and companies.

He will be joining the board of Elk Valley Resources, which is in the process of being spun off from Vancouver-based Teck Resources Ltd. and will focus on coal that is used to make steel.

Horgan was the B.C. NDP’s mining and energy critic before he was premier. He was the first B.C. NDP leader to win two terms and oversaw the province’s handling of the COVID-19 pandemic and its responses to the extreme heat wave and catastrophic floods in 2021.

Canadian author and University of B.C. climate justice professor Naomi Klein posted a comment on Twitter that she is “happy to be the knee to his jerk” after Horgan conceded in a media interview that there may be a “knee-jerk” reaction to his move to coal.

Horgan told The Globe and Mail that there’s a difference between coal used to make electricity and coal use for metallurgy and while there are better ways to generate electricity, there are not yet better ways to make steel. Horgan said he will be making sure the company is meeting its obligations to workers, to First Nations, to the environment and to shareholders, according to the Globe.

Following the Money: Former B.C. Premier and Anti-Trans Mountain Activist John Horgan to Join Board of New Coal Business

By Joanne Lee-Young | April 5, 2023

John Horgan will be joining the board of Elk Valley Resources, which is in the process of being spun off from Vancouver-based Teck Resources Ltd. and will focus on coal that is used to make steel.

This is the same John Hogan who dragged the B.C. government through numerous legal battles against the Trans Mountain pipeline.

Former B.C. premier John Horgan’s first job after officially resigning his seat in the B.C. legislature will be with a coal-producing business.

Horgan, who was premier from 2017 until November 2022, follows other former B.C. leaders in moving on to board positions in high profile industries and companies.

He will be joining the board of Elk Valley Resources, which is in the process of being spun off from Vancouver-based Teck Resources Ltd. and will focus on coal that is used to make steel.

Horgan was the B.C. NDP’s mining and energy critic before he was premier. He was the first B.C. NDP leader to win two terms and oversaw the province’s handling of the COVID-19 pandemic and its responses to the extreme heat wave and catastrophic floods in 2021.

Canadian author and University of B.C. climate justice professor Naomi Klein posted a comment on Twitter that she is “happy to be the knee to his jerk” after Horgan conceded in a media interview that there may be a “knee-jerk” reaction to his move to coal.

Horgan told The Globe and Mail that there’s a difference between coal used to make electricity and coal use for metallurgy and while there are better ways to generate electricity, there are not yet better ways to make steel. Horgan said he will be making sure the company is meeting its obligations to workers, to First Nations, to the environment and to shareholders, according to the Globe.

Following the Money: Former B.C. Premier and Anti-Trans Mountain Activist John Horgan to Join Board of New Coal Business - Canadian Energy News, Top Headlines, Commentaries, Features & Events - EnergyNow

John Horgan will be joining the board of Elk Valley Resources, which is in the process of being spun off from Vancouver-based Teck Resources Ltd. and will focus on coal that is used to make steel. This is the same John Hogan who dragged the B.C. government through numerous legal…

energynow.ca

Last edited:

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

$34B Trans Mountain expansion pipeline begins filling with oil with first shipments before Canada Day

After 12 years and $34 billion, the Trans Mountain expansion project is nearing the finish line

Kyle Bakx · CBC News · Posted: Mar 21, 2024The odyssey of developing and building the Trans Mountain expansion project in Western Canada is finally nearing the finishing line as sections of the pipeline begin filling with oil.

The first export shipment will happen before Canada Day, the federal Crown corporation said, although Alberta's premier expects it could become operational as soon as May.

The Trans Mountain is Canada's only oil pipeline to the West Coast. The project will transport oil from Alberta to the West Coast and triple the amount of crude that is shipped on an existing pipeline, from 300,000 barrels per day to 890,000 bpd.

Canadian oil prices are expected to increase once the new project is completed. Court challenges, regulatory hurdles, multiple protests and constant delays are all part of the history of the project, which began more than a decade ago.

Then there's the cost.

When the federal government stepped in to purchase the project six years ago and rescue it from life support, the estimated price tag was $7.4 billion. Today, expenses are $34 billion.

'What a long, strange trip it's been'

On stage Wednesday at the CERAWeek energy conference in Houston, Trans Mountain chief financial officer Mark Maki used a bit of humour when describing the project's past, knowing full well how eye-popping the cost escalation and multiple setbacks have been for Canadian taxpayers and the industry alike.

"I reflect on some lyrics from a Grateful Dead song: 'What a long, strange trip it's been.' Twelve years from beginning to in-service. That's too long," he said, drawing laughter from the crowd, before he proceeded to list the many challenges such as the regulatory process, the pandemic, floods and wildfires.

Currently, less than 25 per cent of the pipeline is filled with oil, said Maki, in sections of where construction took place several years ago.

He suggests there should be a post-construction cost review to see what lessons can be learned about developing large-scale projects in Canada.

"It is expensive to do the project right. That's what it costs to build infrastructure," he said, in an interview with CBC News in Houston.

Pipelines cross long distances, and can impact several Indigenous communities and develop previously untouched land.

"For all those reasons, we have to understand better, whoever you are, what it really is going to cost to build infrastructure."

The final price tag, he said, could still change as remaining work is completed. The company has said it will need approximately three months following the completion of construction before it can provide a definitive cost estimate.

On Wednesday, Bloomberg reported a Chinese state-owned company, Sinochem Group, had purchased one of the first crude cargoes to move through the new pipeline.

Construction crews have focused recently on overcoming difficulties drilling through rock in B.C.'s Fraser Valley between Hope and Chilliwack and pulling the pipe into the hole.

The final piece of pipe is expected to be installed in the next few weeks, said Maki. Next steps include work on some above ground facilities, the testing and inspection process, and satisfying some regulatory requirements.

Despite all the issues over the years, Maki is adamant the project will have a positive impact on the oilpatch, the economy, Indigenous communities and government coffers.

"We're happy. We're getting to the end and that's a reason to be proud and we're doing something that I think is good for the country," he said.

Opposition to the project

Some environmental critics have argued the project will impact waterways and marine animals, while promoting expansion of the oil industry. The national regulator has previously said the project would cause "significant adverse environmental effects" on the southern resident killer whale population, while also highlighting the potential of a pipeline leak or tanker spill.

The expansion is expected to result in a seven-fold increase in the number of oil tankers traveling through the waters around Vancouver and Victoria.

Trans Mountain has support from dozens of Indigenous communities along the pipeline route, but others have been strongly opposed, even launching years-long court challenges. At one point, the project was halted because of a lack of consideration of Indigenous concerns.

Expanding domestic oil production

This year, Canada is expected to lead the world in oil production growth."It's going to make a big difference to our producers. It's going to make a big difference to us as a government since we charge our royalties based on [oil prices]," said Alberta Premier Danielle Smith, in an interview in Houston.

Prime Minister Justin Trudeau made the right decision to purchase the project six years ago, she said.

"I'm pleased that they stepped in to de-risk and finish the project," said Smith, adding how Ottawa ideally would have supported other pipelines to ensure they, too, were built, such as Energy East and Northern Gateway.

A complete Trans Mountain expansion will increase the amount of pipeline export capacity, although industry leaders say any spare space will be filled.

"Some were wondering, 'When TMX is done, will Enbridge not have as much supply going through its pipes?' We're hitting records. I expect that you'll see all of our assets continue to be used," said Enbridge's CEO Greg Ebel.

Some analysts have said the country's export pipelines could be full again in a few years, continuing the growing oil production in Western Canada.

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Canada's Trans Mountain Pipeline Will Shake Up Pacific Oil Markets

Mar 25, 2024

The Canadian government's new Trans Mountain Pipeline (TMX) expansion project is nearly complete, and it will load its first export cargo within months. When it enters service, according to analysts Poten & Partners, it will reshape the Pacific tanker market.

The TMX project was a long time coming. 12 years ago, Kinder Morgan proposed to build a parallel pipeline alongside the existing Trans Mountain line. The new pipe would triple its capacity from 300,000 bpd to nearly 900,000 bpd. The estimated cost as of 2016 was about US$7 billion.

However, the TMX expansion quickly hit roadblocks. British Columbia's provincial government opposed the project, as did many local indigenous communities and environmental groups. To ensure that the pipeline was completed for oil producers in Alberta, the Canadian government bought Trans Mountain from Kinder Morgan in 2018 for US$3.3 billion. Under government management, the price of construction soared to US$9 billion in 2020, then US$15 billion by 2022. The final as-built price came in this year at about US$23 billion.

The line's completion opens up new markets for Canadian tar sand oil producers, who have had limited options for overseas sales. Canadian crude exports have been locked into the U.S. market by infrastructure limitations for decades.

Now that it is complete and filling with oil, shipping and energy interests are watching closely to see what TMX's extra 600,000 barrels per day of heavy crude will do to the Pacific market. According to Poten, the new Canadian supply will compete with other sources of foreign oil in the U.S. West Coast market. (The Alaska North Slope crude supply - which is delivered to West Coast refiners by a purpose-built Jones Act fleet - has a firmly established place in the market and is unlikely to be displaced anytime soon, Poten said.) Whatever does not go to the West Coast will be shipped to Asian markets, and the split is not yet certain.

The navigation restrictions at the terminal in Vancouver will have a unique impact, according to Poten. Only Aframaxes can make the transit to and from the loading pier, so cargoes will be limited to about 600,000 barrels per vessel. This means that the terminal will need to load about one tanker every day to keep up with the pipeline's capacity. The demand signal for an extra tanker every day should have a meaningful impact on the global Aframax market, Poten predicted.

"Some of these Aframaxes will shuttle back and forth to the U.S. West Coast, while others will make the trip to the Far East. To better facilitate long-haul exports to Asia, we also expect to see a pickup in reverse lightering to enable the use of VLCCs," the consultancy forecast.

Poten: Canada's Trans Mountain Pipeline Will Shake Up Pacific Oil Markets

The Canadian government's new Trans Mountain Pipeline (TMX) expansion project is nearly complete, and it will load its first export cargo within m...

- Joined

- Aug 20, 2009

- Messages

- 40,875

- Reaction score

- 21,786

$34B Trans Mountain expansion pipeline begins filling with oil with first shipments before Canada Day

After 12 years and $34 billion, the Trans Mountain expansion project is nearing the finish line

Kyle Bakx · CBC News · Posted: Mar 21, 2024

The odyssey of developing and building the Trans Mountain expansion project in Western Canada is finally nearing the finishing line as sections of the pipeline begin filling with oil.

The first export shipment will happen before Canada Day, the federal Crown corporation said, although Alberta's premier expects it could become operational as soon as May.

The Trans Mountain is Canada's only oil pipeline to the West Coast. The project will transport oil from Alberta to the West Coast and triple the amount of crude that is shipped on an existing pipeline, from 300,000 barrels per day to 890,000 bpd.

Canadian oil prices are expected to increase once the new project is completed. Court challenges, regulatory hurdles, multiple protests and constant delays are all part of the history of the project, which began more than a decade ago.

Then there's the cost.

When the federal government stepped in to purchase the project six years ago and rescue it from life support, the estimated price tag was $7.4 billion. Today, expenses are $34 billion.

'What a long, strange trip it's been'

On stage Wednesday at the CERAWeek energy conference in Houston, Trans Mountain chief financial officer Mark Maki used a bit of humour when describing the project's past, knowing full well how eye-popping the cost escalation and multiple setbacks have been for Canadian taxpayers and the industry alike.

"I reflect on some lyrics from a Grateful Dead song: 'What a long, strange trip it's been.' Twelve years from beginning to in-service. That's too long," he said, drawing laughter from the crowd, before he proceeded to list the many challenges such as the regulatory process, the pandemic, floods and wildfires.

Currently, less than 25 per cent of the pipeline is filled with oil, said Maki, in sections of where construction took place several years ago.

He suggests there should be a post-construction cost review to see what lessons can be learned about developing large-scale projects in Canada.

"It is expensive to do the project right. That's what it costs to build infrastructure," he said, in an interview with CBC News in Houston.

Pipelines cross long distances, and can impact several Indigenous communities and develop previously untouched land.

"For all those reasons, we have to understand better, whoever you are, what it really is going to cost to build infrastructure."

The final price tag, he said, could still change as remaining work is completed. The company has said it will need approximately three months following the completion of construction before it can provide a definitive cost estimate.

On Wednesday, Bloomberg reported a Chinese state-owned company, Sinochem Group, had purchased one of the first crude cargoes to move through the new pipeline.

Construction crews have focused recently on overcoming difficulties drilling through rock in B.C.'s Fraser Valley between Hope and Chilliwack and pulling the pipe into the hole.

The final piece of pipe is expected to be installed in the next few weeks, said Maki. Next steps include work on some above ground facilities, the testing and inspection process, and satisfying some regulatory requirements.

Despite all the issues over the years, Maki is adamant the project will have a positive impact on the oilpatch, the economy, Indigenous communities and government coffers.

"We're happy. We're getting to the end and that's a reason to be proud and we're doing something that I think is good for the country," he said.

Opposition to the project

Some environmental critics have argued the project will impact waterways and marine animals, while promoting expansion of the oil industry. The national regulator has previously said the project would cause "significant adverse environmental effects" on the southern resident killer whale population, while also highlighting the potential of a pipeline leak or tanker spill.

The expansion is expected to result in a seven-fold increase in the number of oil tankers traveling through the waters around Vancouver and Victoria.

Trans Mountain has support from dozens of Indigenous communities along the pipeline route, but others have been strongly opposed, even launching years-long court challenges. At one point, the project was halted because of a lack of consideration of Indigenous concerns.

Expanding domestic oil production

This year, Canada is expected to lead the world in oil production growth.

"It's going to make a big difference to our producers. It's going to make a big difference to us as a government since we charge our royalties based on [oil prices]," said Alberta Premier Danielle Smith, in an interview in Houston.

Prime Minister Justin Trudeau made the right decision to purchase the project six years ago, she said.

"I'm pleased that they stepped in to de-risk and finish the project," said Smith, adding how Ottawa ideally would have supported other pipelines to ensure they, too, were built, such as Energy East and Northern Gateway.

A complete Trans Mountain expansion will increase the amount of pipeline export capacity, although industry leaders say any spare space will be filled.

"Some were wondering, 'When TMX is done, will Enbridge not have as much supply going through its pipes?' We're hitting records. I expect that you'll see all of our assets continue to be used," said Enbridge's CEO Greg Ebel.

Some analysts have said the country's export pipelines could be full again in a few years, continuing the growing oil production in Western Canada.

It's interesting to see a conservative Alberta premier give credit to Justin Trudeau for anything.

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

More Canadian Oil Heads to California Ahead of TMX Pipeline Launch

By Irina Slav - Mar 28, 2024

Canadian oil shipments to Los Angeles hit the highest in four years this month ahead of the formal launch of the expanded Trans Mountain pipeline that is expected to boost export volumes further.

According to Vortexa data cited by Bloomberg, three tankers carrying a combined 1.74 million barrels departed from the port of Vancouver this month bound for LA. At least two of these were purchased by Marathon Petroleum, which has a refinery in LA.

Bloomberg notes that Marathon Petroleum has reserved capacity on the expanded TMX, meaning this increased tanker traffic from Vancouver to Los Angeles may be a sign of things to come.

In fact, the report cited a note from Poten & Partners as saying Canadian crude for Californian refineries could replace Iraqi, Saudi, and Latin American crude when TMX comes online.

The expansion of the Trans Mountain pipeline from Alberta to British Columbia has been plagued by delays, environmentalist opposition, including in court, and a significant increase in the price tag.

Opposition from environmentalist organizations and the government of British Columbia was so fierce at one point that the original owner of the pipeline, Kinder Morgan, gave up on the project and the federal government of Canada had to buy it, spending some $$3.3 billion. After the purchase, Ottawa had to make Trans Mountain work by any means necessary, which led to additional expenses of as much as $23 billion.

Despite all these, the expansion is nearing its completion which would result in its total capacity rising to 890,000 bpd. Alberta oil producers are looking forward to the completion of the pipeline and already boosting production in anticipation of the sizeable additional offtake capacity. In November 2023, the oil province booked a record output of over 4 million barrels daily—a rate that was maintained in December, too.

More Canadian Oil Heads to California Ahead of Trans Mountain Pipeline Launch | OilPrice.com

Canadian oil shipments to Los Angeles hit the highest level in four years ahead of the formal launch of the expanded Trans Mountain pipeline.

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Trans Mountain Pipeline: Canada's Oil Gamechanger?

By Thomas Westwater | April 1, 2024

An expansion project over a decade in the making is finally nearing completion, and it could change the way the North American oil market operates.

The Trans Mountain Pipeline expansion will increase the system’s capacity from 300,000 barrels per day (bpd) to 890,000 bpd.

In late March, the Trans Mountain Corp. announced it would begin line fill—a final process to bring a pipeline into operation—which appears to be underway as of March 28. The new pipeline carries heavy crude oils from Alberta’s oil sand fields to British Columbia’s Burrard Inlet. The existing pipeline runs alongside the new one and carries refined products and light crude oil.

The expanded pipeline project, or TMX, has been in the making for over a decade and hit several roadblocks along the way. In 2018, the Canadian government bought the pipeline from Kinder Morgan (KMI). While costs soared during the pipeline’s buildout, Canadian politicians have remained supportive of the project because of benefits it creates both in the short term and long term, including jobs, increased taxes and making Canada more competitive on the global energy stage.

What the expansion means for the North American oil market

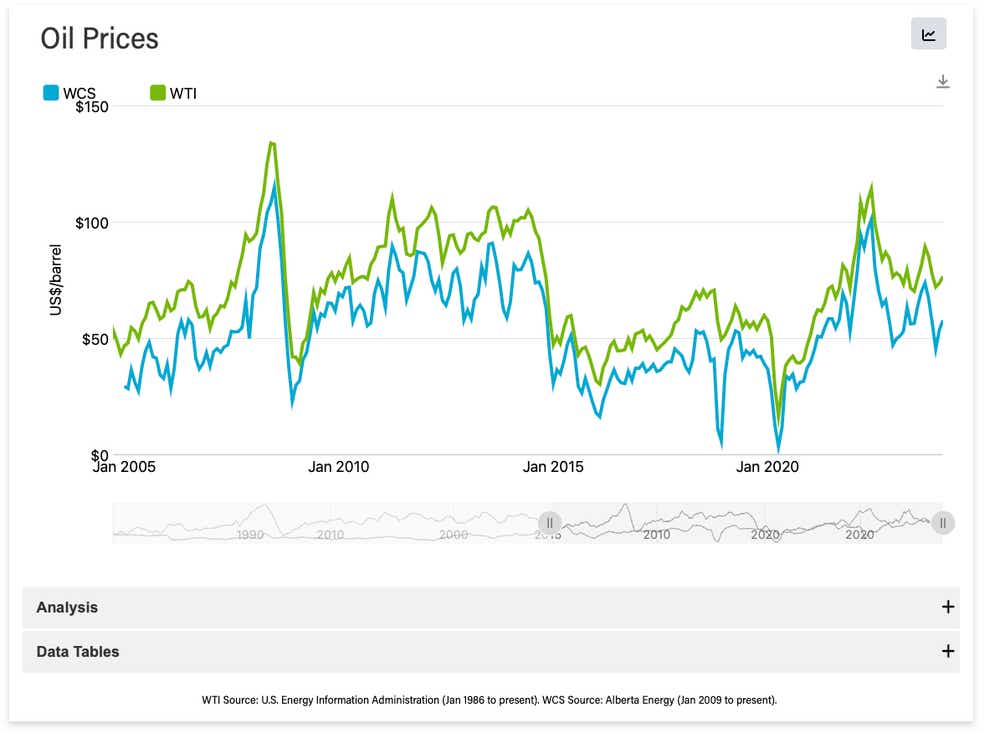

Canada has historically sold most of its oil to the United States, specifically moving it into the U.S. Midwest by rail and truck.The inability to move oil produced in Alberta to the Pacific seaboard forced this dynamic and because of it, Canada’s oil has regularly been sold at a discount to global benchmarks. The relationship between West Texas Intermediate (WTI) and oil from Alberta, otherwise referred to as Western Canada Select (WCS), can be seen in the chart below.

With the new pipeline, Canada will be able to demand better prices for its oil, which will be shipped via the Pacific Tidewater terminal in the Burrard Inlet. That will improve margins for Canadian refiners and allow the additional 590 thousand barrels per day (k/bpd) to fetch a price more aligned with global benchmarks.

Possible new customers

Observers expected new customers for those seabound exports were seen to be Asian Pacific countries initially, but some of that oil will likely continue going to the United States. The oil from Vancouver to Los Angeles surged to four-year highs in March, according to a Bloomberg report citing data from Vortexa.Canada having a more efficient system to export its crude oil means more potential customers, which brings increased competition for its oil. That said, the discount Canada sells its oil to WTI should tighten once the pipeline is fully operational. And that could mean reduced margins for U.S. refiners, all else equal. Midstream Canadian oil companies—firms that store and transport oil--such as Cenovus Energy (CVE) should benefit. In the end though, increased options are usually always a good thing for markets.

Canada's New Oil Pipeline Flows Start: What Does it Means for Oil Traders?

The Trans Mountain Pipeline expansion will increase the system’s capacity from 300,000 barrels per day (bpd) to 890,000 bpd.

www.tastylive.com

- Joined

- Jan 17, 2010

- Messages

- 4,522

- Reaction score

- 5,483

- Good thing of joining Sherdog, it's that i used to think we had the worlds biggest scammers in Brazil!

You guys surpass us!

You guys surpass us!

- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Trans Mountain to finish final segment of oil pipeline expansion in April

By Rod Nickel | April 2, 2024

WINNIPEG, Manitoba, April 2 (Reuters) - Trans Mountain will finish building the final segment of its Canadian oil pipeline expansion in April, according to a construction schedule the corporation filed on Monday with a regulator.

The Canadian government-owned C$34-billion ($25.07 billion)pipeline expansion will nearly triple the flow of crude from Alberta to Canada's Pacific Coast to 890,000 barrels per day, but has been plagued by years of delays, construction problems and cost overruns.

Spread 5-B is the last segment to complete and Trans Mountain's schedule filed to the Canada Energy Regulator shows construction and testing wrapping up this month.

Trans Mountain said last month it has started filling its expanded pipeline in a staged process, but still faced technical challenges.

The pipeline, scheduled to be in service in the second quarter, is expected to raise Canadian crude prices just as producers boost production.

Latest posts

-

Wild how many of you wrote off bo nickel, for no reason really..

- Latest: checktheknuckles

-

-

-