- Joined

- Sep 23, 2020

- Messages

- 8,483

- Reaction score

- 10,444

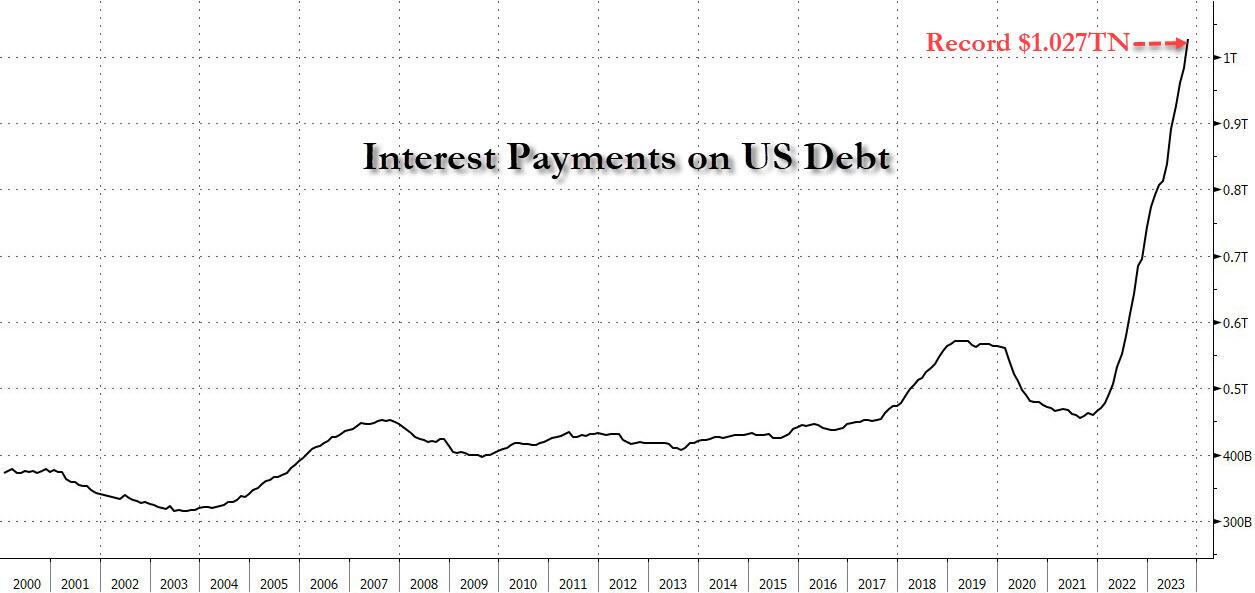

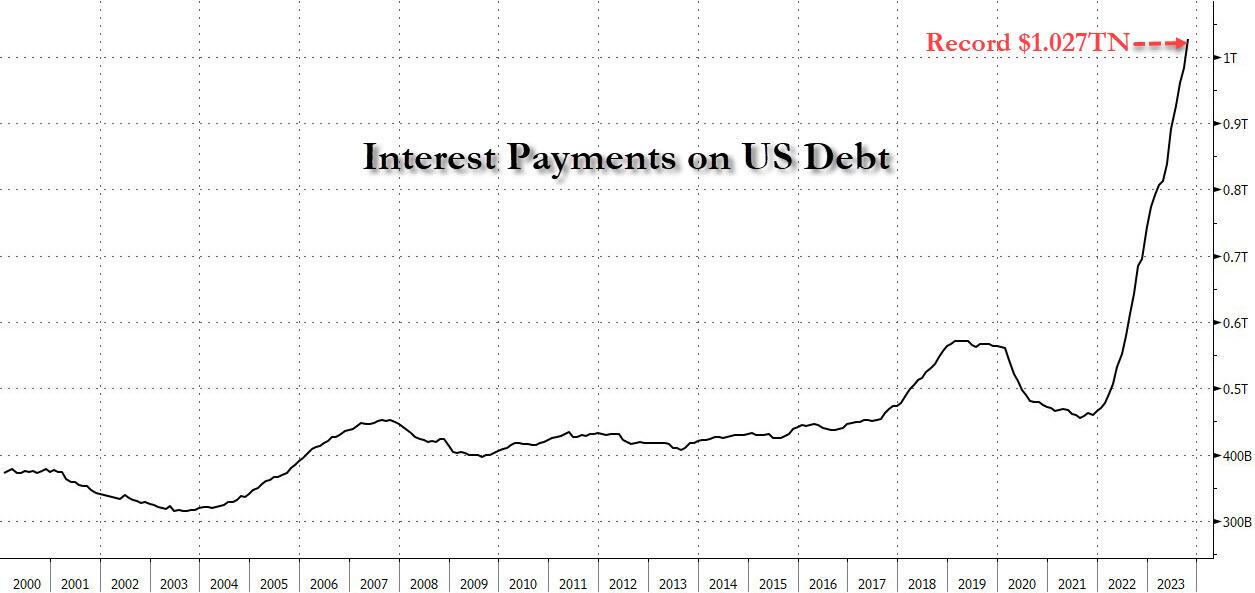

The interest on the national debt just hit 1 trillion for the first time. This will guarantee prices will continue to rise. The borders are for all practical purposes open so this will guarantee prices will continue to rise. The U.S. is funding wars in Ukraine and the Middle East so you guessed it, prices will rise. Bitcoin is the 11th most valuable asset in the world with Berkshire Hathaway at number ten and Tesla at number twelve. Bitcoin is worth more than companies like Visa, Walmart, JPMorgan and Exxon Mobil. Bitcoin is worth more than Disney, Costco and Coca-Cola combined. As the world economy continues to crumble will more people embrace so-called alternative assets like bitcoin or continue to believe in the paper currencies they were taught to be money?

U.S. debt....... ~33 trillion including unfunded liabilites....... over 100 trillion

U.S. debt to GDP ratio:

1960....52%

1980...34%

2000....54%

Currently....124%

U.S. debt....... ~33 trillion including unfunded liabilites....... over 100 trillion

U.S. debt to GDP ratio:

1960....52%

1980...34%

2000....54%

Currently....124%

Last edited: