Here is some educational material for anyone looking for a home loan or doing a refi in the U.S.

Step0: Acronyms used.

- LO = Loan Officer

- LE = Loan Estimate

- LTV = Loan to Value (how much you owe / property worth)

- DTI = Debt to Income ration (how much you owe vs your monthly salary)

- PM = Price Match

- A+B+C+D+E+F+G+H+I+J = Step2

- LC = Loan Cabin (Lender listed below)

- WM = Watermark (Lender listed below)

Step1: The goal is to get a formal Loan Estimate (LE) from any lender you apply with and provide them your Social Security to do a Hard Pull. Note that for Mortgage related SS Hard pulls they are combined as a single inquiry and do not drop your credit score like individual credit card applications as this applies to Student Loan and Auto Loan shopping as well and is looked at a 14-45 day window.Reference:

https://www.myfico.com/credit-edu...-inquiries

Reference:

https://www.equifax.com/personal/...it-report/

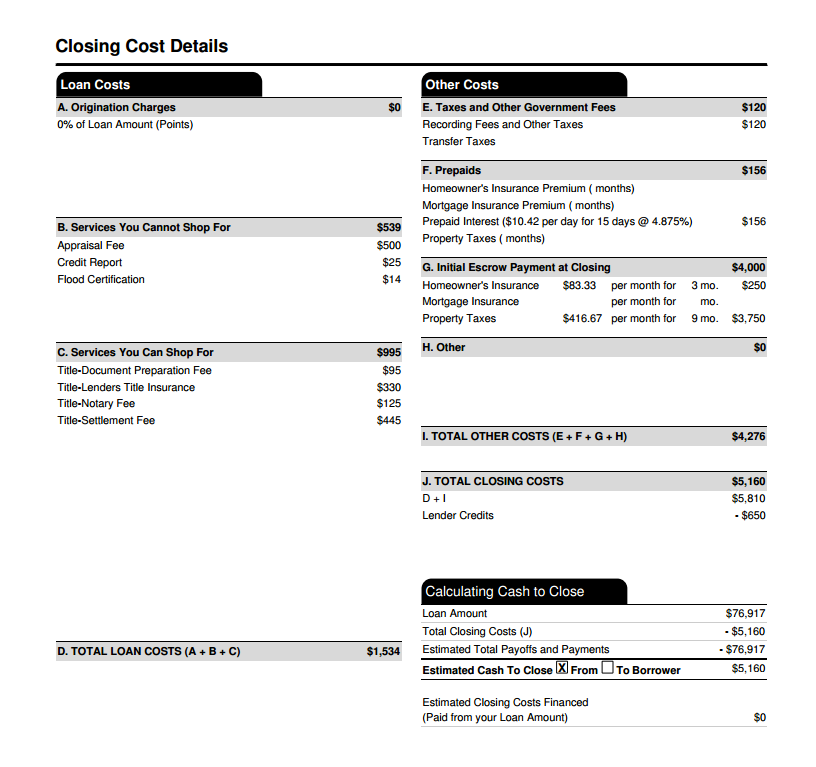

Step2: Understanding the Loan Estimate as they are overall in a standard format:A – Charges in this section are what the Lender charges you such as Origination; Points, App Fee etc. This is what you want to be Zero as most lenders will waive or give you credit toward this being zero.

B – Internal lender fees such as Credit Reporting Fee; Flood Certification fee. Again this is what the lender has to pay when you apply and in most cases the lender will not charge this while you are shopping and some will make you pay this upfront which is ok.

C – Title Costs – In most states (Excluding - FL, NY - CEMA cost, PA - High Title Costs, VA - Mortgage tax) the title costs are reasonable and this is what you generally pay for but you can shop this with other Title Companies and not just the one brought in by the Lender.

D = A+B+C

E – Taxes & Fees – Standard items you pay Uncle Sam

F – Prepaid – Generally will be interest until the end of the month or 1 extra month before your first payment is due. If you have premiums such as Insurance and City/School Taxes due soon or soon after closing a refi then they might be collected and put in this line item.

G – Escrows – Similar to above Lenders will collect this on your behalf to reduce the risk of you not paying them. Escrows can be waived but will cost you a 0.25% as it's a risk that you won't pay on time to most lender/Fannie etc.

H – Other – Generally listed and standard.

I = E+F+G+H

J – (D+I) + Any Lender Credit that is offered to offset any charges in A&B or a bigger credit towards closing your loan.

Step3: Closing Cost shopping:1. Lenders as of this writing are competing and are willing to have Zero Dollars charges in A&B from above and is considered a "No Cost" or "No Fee" loan.

2. All third party charges such as C=Title and Taxes and Escrows are in addition to this offering.

3. Many lenders will provide an even bigger credit than what the charges are in A&B as well as cover other items from C-I; this is termed "No Closing Costs" as it falls in 3 categories:

i. Negative Credit - Getting money left over from the credit to be used to either get up to a $2000 refund. Apply the remainder towards principle reduction (this changes your credit received as it changes the $$ you are borrowing as well.

ii. $0 – Most of the time you'll net very little left over or for you to pay out of pocket in this case. If you negotiated a "No Closing Cost" loan then the lender will should cover any unforeseen costs in A&B at the least.

iii. Cash required to close – In this scenario you'll have to bring additional funds to close the loan as after A-J would not cover all the closing costs.

4. Unless you LOCK the rate with the lender there are changes your numbers will change and so if the rates are low it's in your best interest to Lock.

5. Most lenders that I've shopped provide a "Float" option to further reduce your rate if there is a change of an 1/8 - ¼ % change in the rates. Many lenders are also willing to match other Lenders to match or beat the rates.

Applying:

Step4: Apply to 5-15 places to yield the best results when shopping. Apply to your local Banks but note that many smaller mortgage companies have a higher threshold for rates and credits in your favor. Applying means that you'll have to provide your Social Security# and some preliminary data in an application to get documents sent to you such as a Loan Estimate (LE). Note from above that Mortgage, Student & Car Loan Hard Pulls are groups as single hits and won't drop your credit score in most cases for 14-45 days. Below are the most competitive lenders that I've encountered for my scenario with my own feedback:

30 Year rates to use for other rate platforms and please note that my rate will not necessarily mean you'll get that rate as market and individual changes will determine that and even your negotiation pull will determine that:2.625% - WatermarkHomeLoans.com - Michael C - 949-577-9120 – Most Competitive and might take 2-3 days to response. Should be able to get either no Costs for A&B or some credit back towards closing in J

2.625% - Loancabin.com - Competitive rates but are looking at 3-4 days response time - Should be able to kick you back some credit ($1000 to $2000)

2.75% Loan Depot – Competitive rates for many but get a bit pushy to lock which is OK if the offer is good.

3% LenderFi – No longer taking new application but were competitive and should be checked.

3.375% Better.com- Will consider Lender Match to beat Competitors and combine with Amex cashback

Not all Lender will service your state so keep looking and look for other local smaller lenders and banks.

Step5: While applying take note to provide and send/upload all documents to the lender in as little of a time as possible as many lenders will drop your application if it's not received in 2 business days. Normal documentation:1. Last 2 Paystubs

2. Last 2 Bank Statements to show that you have money to pay during closing. Note; large transactions over certain dollar amount will get scrutinized and funds will need to come out of these bank account else you'll have trouble closing.

3. W2/Tax Filings from last 2 years. More years might be needed for some.

4. Home Owners Insurance – Declaration pages.

5. Current Lender Statement

6. Current Lender Payoff Statement

7. Driving License or other Government ID Scan.

Step6: Title Company. As noted above you are allowed to pick your own Title company and in many cases you'll find competitive rates here with large savings compared to the Lender's preferred Title Company. Title Companies I've used in the past with good success and others:1. Radian Title Services - 412-494-0400 -

[email protected] – Best rates I've found hands down in 12 years of shopping. Currently not taking consumer direct inquiries and will require your lender to be established with them so the lender will have to place the order using the above email/phone.

2. AltTitle – Competitive all-inclusive rates.

3. Fidelity Title – Competitive rates

Step7: Negative points.

Step8: Breakeven Calculations and understanding money factor

Credit Score Analysis for my case:

- -3 point drop - Dec into January for refinance and was probably just the hard pull hitting the scores.

- -12 point drop - March after the loan funded this is unusually high as before it has been only a 6 point drop so not sure what else caused this big drop.

- +6 point Gain - June right before another refinance start; probably just recovering with on time payments etc.

- -3 point drop - Refinance applications put for multiple lenders (dozen).

- -3 point drop - July early, I think this is attributed to me applying late to Watermark for example.

So based on the trends I'll see another drop once the loan is secured and on the books of 7-12 points. My credit was in 830+ and is currently hanging out at 815 from Transunion (will vary by company).

Putting it all together (thanks Zwitterion for the inspiration):

Lenders offer what's called a "Par Rate" which is their internal rate almost or no "points" or percentages on the loan amount. From there you can "Buy Down" the rate by paying points to get a lower rate or take a higher rate and get a "Credit" against the loan amount.

In standard scenario you want the best rate you can get without paying a lot of closing costs and getting the most credit towards your closing cost in section J of LE. The payoff calculation in standard scenarios is the net cost out of pocket after "Closing Costs" such as Origination Fee (Section A in LE), Credit Check, Flood Cert, MERs, Appraisal (Section B in in LE), Title Fees (Section C in LE) minus any Lender Credit from Section J in LE divided by the monthly payment difference between the original rate and the new rate is your breakeven point in months. Other costs in E-G section of the LE are considered costs you are paying for one way or another and shouldn't be calculated in your costs calculations. For example If you are paying $2000 in D (A+B+C=D) and getting aren't getting any credit in section J of LE it would take you 20 months to after which you will start saving on the interest of the loan if you are saving $100 a month between your higher original rate and the new refinance rate (e.g. Going from 3.75% to 2.75% and your monthly payments going from $1100 to $1000 = $100 a month savings). $2000 / $100 = 20 months = 1.6 Years

Here is the photo of how a LE looks like