- Joined

- May 12, 2010

- Messages

- 24,621

- Reaction score

- 1,315

lol.. trump's midwestern base getting btfo

Not really

lol.. trump's midwestern base getting btfo

I'm not that good at economy. You need Jack for that.

Those are solid policy goals that I think rational people agree on, but there's no evidence that I've seen that shows it's working (did they stop stealing intellectual property?). No one wants to see China stealing intellectual property or undercutting industries.

I am not opposed to using tough tactics to achieve these goals either. But the way this administration is carrying out this strategy is haphazard and poorly thought out. Has this administration even laid out a plan as to how the goals are achieved through tariffs? I certainly haven't seen it. And I have a huge problem with a clumsy strategy that drags down the world economy without a clear path to achieving our goals. I think the reality is that Trump is a nationalist doing nationalist stuff and he doesn't fucking care who gets hurt, unless they vote for him (see farm subsidies handed out as a result of collateral damage).

Just a side note, your response was much more articulate and thought out than the Trumpster who's claiming we're winning (which is who my post was aimed at).

The broad policy goals are for China to cease engaging in writ large currency manipulation, overbuilding, subsidization, product dumping, lack of reciprocity, forced technology transfers and the state directed intransigent strategy for the outright theft of intellectual property and trade secrets that violate their WTO free trade agreements and undercut US output, competitiveness, employment, investment, research, development, innovation and strategic domestic industries (a few of which America literally brought into existence) invaluable to our sustained economic growth and national security.

The problem is, the PRC isn't going to willingly cease doing any of that because those are fundamental tenants of their development model and a significant factor in how they've managed to build themselves up to present day status; asking nicely whilst maintaining the shitty status quo isn't exactly working out and the relationship we have with them isn't free trade.

So there's a number of things the US either can, has and/or should do to punish them for those activities including but not limited to: blocking all foreign investment in US tech assets (Lattice, Xcerra, Qualcomm), choking off access to US components critical to the global operations of Chinese corporations (ZTE, Fujian Jinhua), banning the sale of products in the US (Huawei) and controversially implementing tariffs on imports. However...

Does this actually hurt us more than what has been outlined in the Administration spanning, bipartisan accounts detailed in the 2011 USITC, 2016 USTR, 2017 USTR or 2017 IP Commission reports? I'd sincerely welcome the input of @Gandhi, @Trotsky, @japman40, @Rational Poster, @Edison Carasio, @Darth_Inv1ctu5 here as well, all posters I respect and agree with on a number of other domestic political issues from browsing topics on here.

This is where we are right now and as noted it can change, although I'm going to have some difficulty buying any feigned sympathy for a large chunk of Trump's base being the most affected. The US is the world's largest agriculture exporter by a considerable distance and it was a given that the sector - less than 1% of US GDP output - would be collateral damage.

https://www.bloomberg.com/amp/news/...g-for-most-of-trump-s-trade-war-research-says

President Donald TrumpThe United States of America is succeeding in making China pay most of the cost ofhisthe trade war it has been begging for.

That’s the conclusion of a new paper from EconPol Europe, a network of researchers in the European Union. U.S. companies and consumers will only pay 4.5 percent more after the nation imposed 25 percent tariffs on $250 billion of Chinese goods, and the other 20.5 percent toll will fall on Chinese producers.

According to Zoller-Rydzek and Felbermayr, the tariffs will do what Trump has longed for: They will cut American imports of affected Chinese goods by more than a third, and lower the bilateral trade deficit by 17 percent.

The Trump administrationRobert Lighthizer (ND: as if Trump is running the show here) selected products with the highest “price elasticity,” or high availability of substitutes. The Chinese products hit by US tariffs can mostly be replaced by other goods, forcing exporters to cut selling prices to keep buyers.

“Through its strategic choice of Chinese products, the U.S. government was not only able to minimize the negative effects on U.S. consumers and firms, but also to create substantial net welfare gains in the U.S.,” the researchers wrote.

For China to cease being the only country in the world in which all of the above is a profound problem, something which virtually all of America's Western and East Asian allies are in agreement with. There are reasons Dem leadership is backing the DJT Admin actions, the EU is looking to establish its own incarnation of CFIUS, Germany moved to block multiple state-backed Chinese acquisitions of national assets and Australia has banned the likes of Huawei and ZTE from its telecom industry.

Well, at least I have you. I miss Homer, man.

Let's see him hit Apple (for example) with a 25% tarrif. There are many consumer goods he hasn't touched by yet, and for good reason.

Lives,Jobs,Spratleys!

#Obosen!

DDS pa din. Lol.

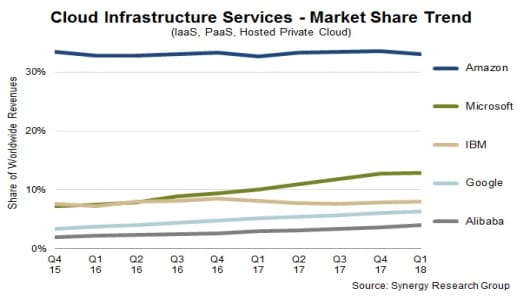

Remember when Chinese billionaire Jack Ma said Alibaba would no longer be bringing those "1 million jobs" stateside that were "promised" and everyone was supposed to be upset about that? Yeah, nevermind US exports to China would've had to rise by around $205 billion to deliver on the "pledge" (per US Commerce Department) and that's it's more than what was exported to the PRC in total goods and services last year...

Jack Ma Confirmed As Chinese Communist Party Member

<45>

https://www.cnbc.com/amp/2018/11/26...nt-tariffs-on-iphones-laptops-from-china.html

President Donald Trump suggested he could place a 10 percent tariff on iPhones and laptops imported from China, in an interview with the Wall Street Journal published Monday. He also said it's "highly unlikely" that he would delay an increase in tariffs from 10 percent to 25 percent on Jan. 1, just four days before a summit with Chinese President Xi Jinping.

Trump said he expects he will increase tariffs on $200 billion of Chinese goods to 25 percent. He will also add $267 billion worth of tariffs onto goods that are not already subjected to existing tariffs if the two countries don't make a deal.

Apple's products are currently exempt from the tariffs. It previously announced that the tariffs would affect the Apple Watch, AirPods and other products, but were spared when the tariffs were announced. Although iPhones are assembled in China, several parts come from the U.S.

Apple could not immediately be reached for comment.

Ok, that interview was embarrassing.

You call that neutral?

"Looks like a bunch of plots that show the upward trends set in motion by Obama have continued under Trump."

If you're a Dem this proves Trump hasn't improved the trend and if you're a Trumper this proves Trump hasn't ruined it.

To anyone who understands English this is so neutral it makes Switzerland look like Darth Vader.

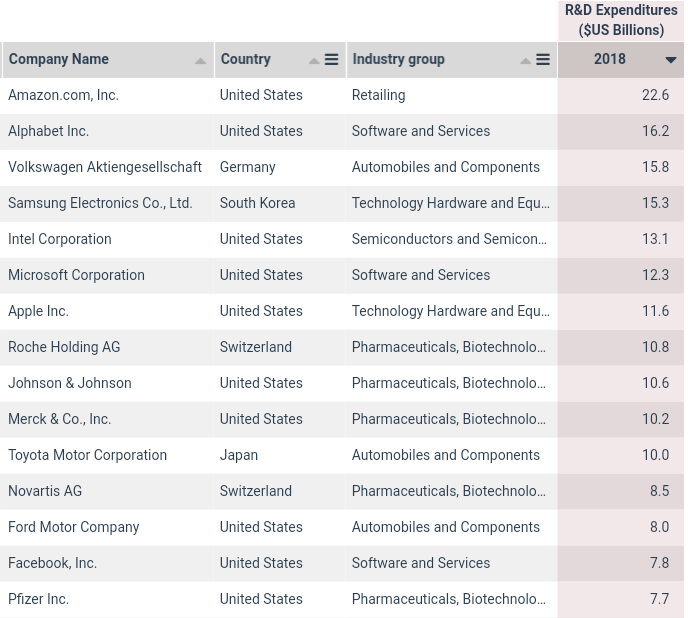

The broad policy goals are for China to cease engaging in writ large currency manipulation, overbuilding, subsidization, product dumping, lack of reciprocity, forced technology transfers and the state directed intransigent strategy for the outright theft of intellectual property and trade secrets that violate their WTO free trade agreements and undercut US output, competitiveness, employment, investment, research, development, innovation and strategic domestic industries (a few of which America literally brought into existence) invaluable to our sustained economic growth and national security.

The problem is, the PRC isn't going to willingly cease doing any of that because those are fundamental tenants of their development model and a significant factor in how they've managed to build themselves up to present day status; asking nicely whilst maintaining the shitty status quo isn't exactly working out and the relationship we have with them isn't free trade.

So there's a number of things the US either can, has and/or should do to punish them for those activities including but not limited to: blocking all foreign investment in US tech assets (Lattice, Xcerra, Qualcomm), choking off access to US components critical to the global operations of Chinese corporations (ZTE, Fujian Jinhua), banning the sale of products in the US (Huawei) and controversially implementing tariffs on imports. However...

Does this actually hurt us more than what has been outlined in the Administration spanning, bipartisan accounts detailed in the 2011 USITC, 2016 USTR, 2017 USTR or 2017 IP Commission reports? I'd sincerely welcome the input of @Gandhi, @Trotsky, @japman40, @Rational Poster, @Edison Carasio, @Darth_Inv1ctu5 here as well, all posters I respect and agree with on a number of other domestic political issues from browsing topics on here.

This is where we are right now and as noted it can change, although I'm going to have some difficulty buying any feigned sympathy for a large chunk of Trump's base being the most affected. The US is the world's largest agriculture exporter by a considerable distance and it was a given that the sector - less than 1% of US GDP output - would be collateral damage.

https://www.bloomberg.com/amp/news/...g-for-most-of-trump-s-trade-war-research-says

President Donald TrumpThe United States of America is succeeding in making China pay most of the cost ofhisthe trade war it has been begging for.

That’s the conclusion of a new paper from EconPol Europe, a network of researchers in the European Union. U.S. companies and consumers will only pay 4.5 percent more after the nation imposed 25 percent tariffs on $250 billion of Chinese goods, and the other 20.5 percent toll will fall on Chinese producers.

According to Zoller-Rydzek and Felbermayr, the tariffs will do what Trump has longed for: They will cut American imports of affected Chinese goods by more than a third, and lower the bilateral trade deficit by 17 percent.

The Trump administrationRobert Lighthizer (ND: as if Trump is running the show here) selected products with the highest “price elasticity,” or high availability of substitutes. The Chinese products hit by US tariffs can mostly be replaced by other goods, forcing exporters to cut selling prices to keep buyers.

“Through its strategic choice of Chinese products, the U.S. government was not only able to minimize the negative effects on U.S. consumers and firms, but also to create substantial net welfare gains in the U.S.,” the researchers wrote.

For China to cease being the only country in the world in which all of the above is a profound problem, something which virtually all of America's Western and East Asian allies are in agreement with. There are reasons Dem leadership is backing the DJT Admin actions, the EU is looking to establish its own incarnation of CFIUS, Germany moved to block multiple state-backed Chinese acquisitions of national assets and Australia has banned the likes of Huawei and ZTE from its telecom industry.

Well, at least I have you. I miss Homer, man.

Do you even understand the concept of what a trade war is? It is one party saying we don't want to buy the good made by those who have a competitive advantage. It would be comparable to driving over to the rich part of town to get your haircut instead of getting it in a run of the mill shop in the middle of a poorer area.

You talk about devaluing their currency is a big sin. Guess what, we and everyone else in the world does the exact same thing to increase exports. Devaluing your currency is like forcing a paycut on everyone in your country. You can't bitch about it. That is just the way it is. Everyone does it. China just has a preference to be a net exporter. You can't stop someone from wanting to make and sell goods cheaply. If they do that, just go find something else that you have a comparative advantage in and do that instead. It isn't rocket science. If a movie theater started selling their tickets for $1.00, you wouldn't go about bitching about them selling their tickets so cheaply. You would buy the ticket and make a note not to get into the movie theater business.

But Obama was working on the problem and making real progress. And of course the TPP, which got demagogued to shit, was also part of the strategy. The thing is, the issue you're referring to is something that requires a delicate mix of diplomacy and power moves, but Trump has the subtlety of a costume designer for a rap video, and a trade war hurts us while we hope for a solution.

The long term consequence is that Chinese companies will do their best to avoid any reliance on US suppliers. Potentially other countries may look to do the same.

However, most of the world's rare-earth processing facilities are in China, which also produces more than 90 percent of the world's rare-earth minerals. To develop its metals as cheaply as possible, Mountain Pass has first been shipping its ore to China, where the processed metals are then sold on the world market to makers of smartphones, laptops, and magnets that go into electric car motors and giant wind turbines.

But in September, President Trump placed a 25 percent tariff on Chinese goods entering the US, and China reacted by placing a tariff on US goods entering China. That means Mountain Pass is paying much more to have its ore made into useable products.

Now, the WSJ writes, the tariffs are eating into Mountain Pass' profit margins. "And that eats into the money Mountain Pass would be reinvesting into upgrading the facility so that it can actually process the rare earths itself, the only way to lessen dependence on the Chinese processors."