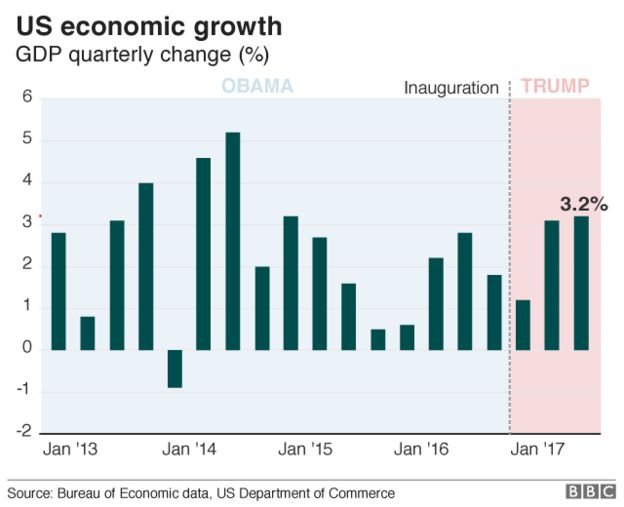

- The Trump economy may be doing something not seen since 2005 —growth at a 3 percent or better pace for three quarters in a row.

- Economists were ratcheting up fourth quarter growth to 3 percent or better after strong fourth quarter retail sales and strong revisions to prior months.

- The question is whether the trend can continue into the first quarter, which is typically weak and is vulnerable to weather impacts.

In the year since President

Donald Trump has been in office, the economy has done something it has been unable to do since 2005 — maintain 3 percent growth for three quarters in a row.

While the final numbers aren't in, economists Friday were ratcheting up growth projections to 3 percent or better for the fourth quarter, after December's strong retail sales and revisions to prior months.

"It could even grow at 3 percent for the year. The numbers are very strong," said Joseph LaVorgna, chief economist Americas at Natixis. He forecasts an above consensus growth pace of over 4 percent for the fourth quarter.

Economists in

CNBC/Moody's Analytics Survey upped their median fourth-quarter GDP forecast Friday by a median 0.4 to 3 percent. NatWest Markets raised fourth-quarter GDP to 3.5 percent from 2.7 percent, based on a stronger view of the consumer, and the

Atlanta Fed GDPNow shows fourth-quarter growth now at a pace of 3.3 percent, from 2.8 percent earlier in the week.

When the White House said it expected 3 percent growth,

economists were skeptical and many growth forecasts held to growth in the 2 percent range.

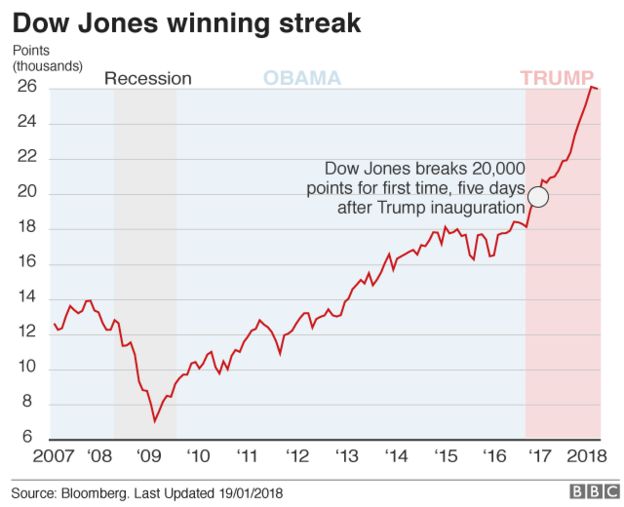

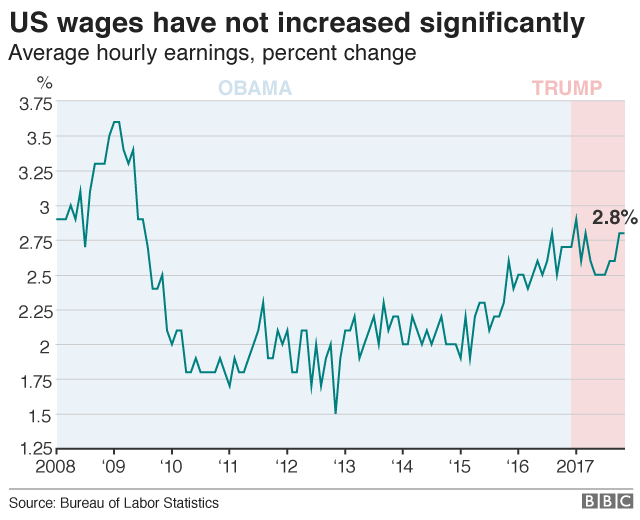

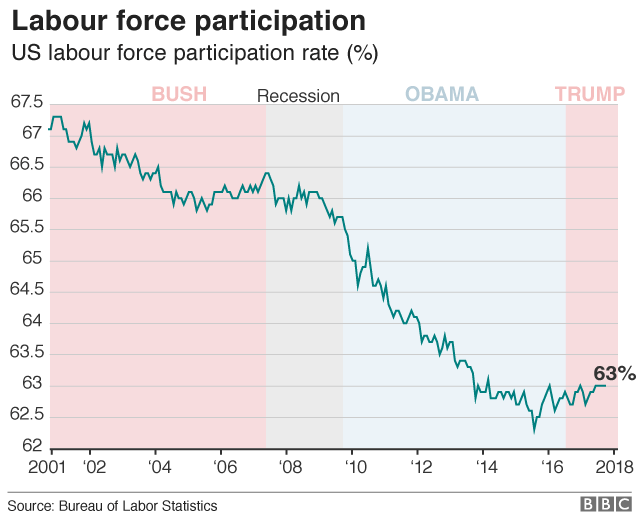

Economists say the White House can take some credit for consumer confidence, but in reality, the consumer was already spending before Trump and the GOP took control a year ago, and the labor market was already strong. However, the improvement in business attitudes and spending is a direct result of the changing of the guard in Washington and may be contributing to a more consistent growth pattern.

"I think the policies matter. In particular, business investment which was lagging badly through much of the expansion and really started to pickup in the last year, I think that does have a lot to do with the attitude about regulation," said Stephen Stanley, chief economist at Amherst Pierpont. "Aside from just the reality of a tough regulatory environment, I think there was a fear of the unknown. I think there was a perception in the business community, and people can debate whether it was merited or not, that they were subject to what were considered arbitrary, adverse regulatory decisions. So I think there was a hunkering down."

Stanley said since the election, attitudes improved and now with tax law changes, he anticipates a pick up in business spending over the next several years.

While growth did come close to 3 percent for three quarters in a row ending in 2015, Stanley said that period was more typical with growth varying more, with higher peaks and lower valleys in the growth rate. On absolute levels, the last time three quarters each had 3 percent or more growth was in the period ending in the first quarter of 2005.

Growth was 3.2 percent in the third quarter of 2017, and 3.1 percent in the second quarter. Fourth quarter GDP is reported on Jan. 26.

"It certainly is the best economy of this cycle. It's the strongest we've seen. We had been averaging around 2 percent. It is unusual to get three [3 percent] in a row because typically you get get big swings. I think what you're seeing for the first time in the expansion is growth that's being driven by all the key components," he said.

Stanley said growth in prior quarters was impacted by swings in inventories or trade. "When the string is broken, it's going to be one of those categories rather than demand falling apart," he said.

The question also is what will happen in the first quarter, which has been traditionally slow growing and is vulnerable to weakness from weather impacts.

Barclays chief U.S. economist Michael Gapen said he raised his tracking GDP estimate for the fourth quarter to 3 percent from 2.6 percent.

Retail sales for December rose 0.4 percent, and November sales were revised to a gain of 0.9 percent from an increase of 0.8 percent. Sales, excluding autos and gas, were revised higher by a tenth to 0.5 percent for October and 0.4 to 1.2 percent in November.

"There were solid upward revisions to core retail sales. We were tracking 3.1 on consumption [for the quarter] going into the release, and we're tracking 3.6 percent coming out of it," he said.

LaVorgna notes his forecast is an outlier, but he says the fourth quarter could even hit as high as 5 percent, and he sees the 3 percent pace continuing into 2018.

"What's hurting us for the year was weak Q1. Three of the last four years, the first quarter has been weak. That's one thing that I see tempering 2018 is the residual problem of Q1," LaVorgna said.

"My guess is the optimism is going to continue. My big fear is what the

Fed is going to do in reaction to it," he said.

https://www.cnbc.com/2018/01/12/tru...th-pace-unlike-anything-seen-in-13-years.html