They are talking more about Bogle. He believed that most managers don't beat the market and the few ones who do, like Peter Lynch who he named, are such stars. So unless you have Peter Lynch, buy index funds.

I mean it is hard for big money to beat the market because they ARE the market. So they get a market return which ends up being less than market return for you because of fees.

Lynch fuckin destroyed the S and P.

at

Fidelity Investments between 1977 and 1990, Lynch averaged a 29.2% annual return,

[3] consistently more than doubling the

S&P 500 market index and making it the best performing mutual fund in the world.

[4][5] During his tenure, assets under management increased from $18 million to $14 billion.

[6]

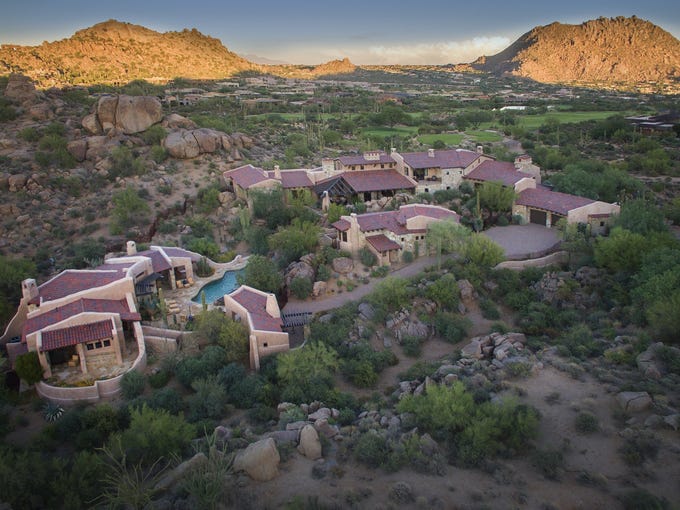

Lynch is selling his house if you are interested: