https://educationdata.org/average-cost-of-college

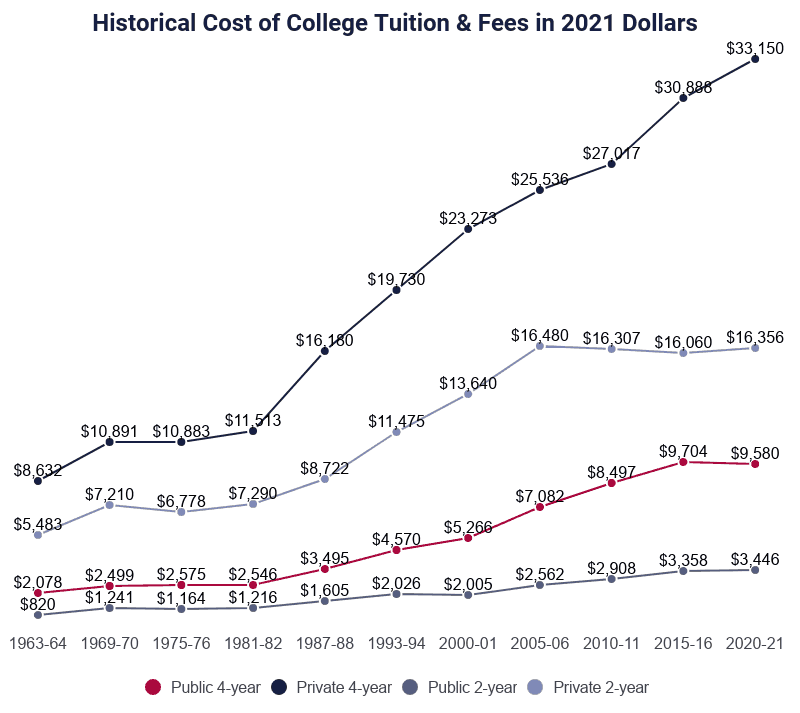

Real education costs have risen 560% for public 4 year colleges

https://www.inflationtool.com/us-dollar/1960-to-present-value

$1 in 1960 is worth $8.86 today, an increase of 886%

https://www.thebalance.com/causes-of-rising-healthcare-costs-4064878

Healthcare costs in 1960 were $147, they are now $11,172, an increase of 7700% with inflation

So real healthcare costs have gone up ~860%, or ~14.3% a year.

Case-Shiller National Home Price Index vs Consumer Price Index shows that repeat sales of homes always outpace

CPI by >0.45% every month since the index was established, and that number is growing at a rapid pace recently:

https://fred.stlouisfed.org/graph/?g=786h (make sure you slide it to 2021)

Note that that index only tracks resales of homes (which generally tend to sell for less than new constructions, so that number underrepresents home inflation). Also worth noting the housing crash in 2008 was pretty much the only reason we haven't skyrocketed further