- Joined

- Apr 9, 2007

- Messages

- 52,718

- Reaction score

- 24,769

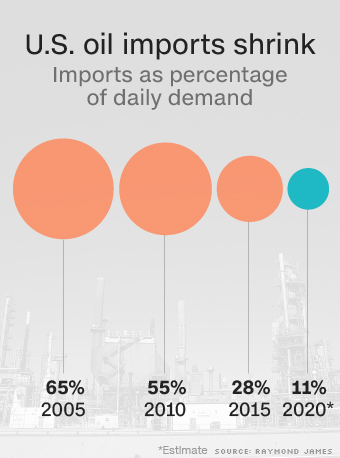

The last time the US was #1 was in 1973.

The US has been steadily increasing oil production for several years now, so this is no surprise.

https://money.cnn.com/2018/09/12/investing/us-oil-production-russia-saudi-arabia/index.html

-

But people will still say we support Saudi cause we need their oil. We support them for a whole host of reasons.

The US has been steadily increasing oil production for several years now, so this is no surprise.

https://money.cnn.com/2018/09/12/investing/us-oil-production-russia-saudi-arabia/index.html

-

But people will still say we support Saudi cause we need their oil. We support them for a whole host of reasons.

Last edited: