I saw pics of fake Lego and fake Hot Wheels where they shamelessly copy the look of the real logos and packaging.I had some shady shitheads trying to pass off counterfeit Chinese-made "silver" and "gold" bullion and bars a couple weeks back. 300 ounces of fake Silver Eagles, bars, and generic rounds and 10 ounces of fake gold Kruggerands. One look under a loupe and I could tell they were counterfeit.

Wasted a whole Saturday. Fucking Chinese counterfeiters, smh.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economy A Look at Chinese future manufacturing

- Thread starter PEB

- Start date

- Joined

- Mar 3, 2014

- Messages

- 57,511

- Reaction score

- 21,592

What about made in Hong Kong which I never see anymore these days since probably says made in China.

Good call.

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

@NoDak you act like I know what I'm talking about when it comes to semi conductors and hi tech.

January 2017:

- Joined

- Jan 20, 2004

- Messages

- 30,609

- Reaction score

- 19,659

US continues to lag behind Samsung and TWSC in production of 7nm and 10nm chips in volume already Samsung has surpassed Intel in sales an closing the gap in silicon sales to companies like Nvidia and AMD.

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

US continues to lag behind Samsung and TWSC in production of 7nm and 10nm chips in volume already Samsung has surpassed Intel in sales an closing the gap in silicon sales to companies like Nvidia and AMD.

Samsung is an electronics hardware and equipment mega-conglomerate which indeed, has a dominant share of the DRAM segment with SK Hynix and Micron rounding it out. TSMC can stay pretty lean as a pure play foundry, their entire business model is based on state of the art process technology to manufacture chips for fabless US design firms and they can pour everything into it.

Intel is an IDM that both designs and manufactures its own chips which is as difficult to do these days as it is incredible with double the strain and investment required. It provides the US and its economy geopolitical advantages, technology leadership, domestic capital investment, high wage job creation and industrial production in spades as the vast majority of its business is kept stateside. 95% of the world's top 500 supercomputers run on Intel processors, and it's still utterly dominant in both the PC and Data Center markets.

From Anandtech:

Intel’s 10 nm may be a short-living node as the company’s 7 nm tech is on-track for introduction in accordance with its original schedule.

For a number of times Intel said that it set too aggressive scaling/transistor density targets for its 10 nm fabrication process, which is why its development ran into problems. Intel’s 10 nm manufacturing tech relies exclusively on deep ultraviolet lithography (DUVL) with lasers operating on a 193 nm wavelength. To enable the fine feature sizes that Intel set out to achieve on 10 nm, the process had to make heavy usage of multi-patterning. According to Intel, a problem of the process was precisely its heavy usage of multipatterning (quad-patterning to be more exact).

By contrast, Intel’s 7 nm production tech will use extreme ultraviolet lithography (EUVL) with laser wavelength of 13.5 nm for select layers, reducing use of multipatterning for certain metal layers and therefore simplifying production and shortening cycle times. As it appears, the 7 nm fabrication process had been in development separately from the 10 nm tech and by a different team. As a result, its development is well underway and is projected to enter HVM in accordance with Intel’s unannounced roadmap, the company says.

Here in Arizona, Yay!

This was also a little eye brow raising.

Intel Readies The Nukes For ARMed Battle As It Leads Competitors To Barren Wasteland

Summary Wrap:

* Intel (INTC) has been the dominant force in semiconductor processor technology since before computers became a household item.

* Traditional methods for improving processor performance is nearing a plateau. Competitors are gaining on Intel, but it may be leading them to a nuclear wasteland as it looks to emerge as the front-runner in the next generation of computing technology.

* If Intel is indeed moving away from its current computing model, what could be the catalyst for this radical departure? Our theory is that they have foreseen and been planning for this day for a long time. There is one catalyst in particular that may have accelerated the plan.

* Intel is working on revolutionizing mainstream computing which should enable it to corner the processor market once again as it did with the X86 line. If successful, this will result in considerable upside potential for the stock. Our bet is on Intel succeeding.

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

Wow, thanks for the run down @NoDak , Samsung is def a huge and innovative SC company, but it's hard to keep track on where it's and other player's strengths are. Thanks

(1) = Pure Play Foundry (no in-house design)

(2) = Fabless Firm (no in-house manufacturing)

All the major US firms have different core areas of business that serve specific industry segments: Intel (µP), Micron (DRAM), Qualcomm (SoC), Texas Instruments (Analog ICs), NVIDIA (GPUs). Broadcom is more into SC software infrastructure products and just relocated their headquarters from Singapore in the hopes it would clear the Qualcomm deal (heh, hard no).

Samsung and SK Hynix are both predominantly in the DRAM market. TSMC is of course, a contract manufacturer as you know with all kinds of extensive production capabilities but they don't do chip design or engineering. Taiwan does have that though with MediaTek.

- Joined

- Dec 13, 2013

- Messages

- 13,054

- Reaction score

- 5,240

Technological dominance is not guaranteed. It requires constant innovation and massive investment in R&D. China is no doubt catching up fast, but it still lags behind US in terms of research output and R&D investment input. US will still have the lead for at least another two decades. I think the 2040's will be an interesting time period, as that particular decade will be one where China will finally reach a degree of economic, military and technological parity with US. That is assuming China maintains the current trajectory and don't suffer economic stagnation like Japan did in the 1990's.

- Joined

- Jan 20, 2004

- Messages

- 30,609

- Reaction score

- 19,659

(1) = Pure Play Foundry (no in-house design)

(2) = Fabless Firm (no in-house manufacturing)

All the major US firms have different core areas of business that serve specific industry segments: Intel (µP), Micron (DRAM), Qualcomm (SoC), Texas Instruments (Analog ICs), NVIDIA (GPUs). Broadcom is more into SC software infrastructure products and just relocated their headquarters from Singapore in the hopes it would clear the Qualcomm deal (heh, hard no).

Samsung and SK Hynix are both predominantly in the DRAM market. TSMC is of course, a contract manufacturer as you know with all kinds of extensive production capabilities but they don't do chip design or engineering. Taiwan does have that though with MediaTek.

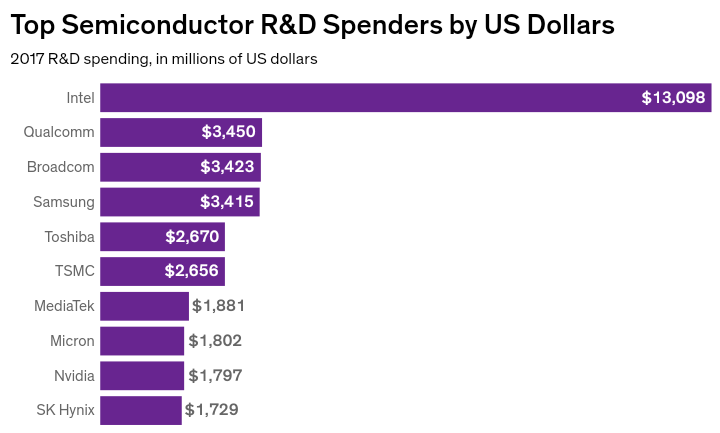

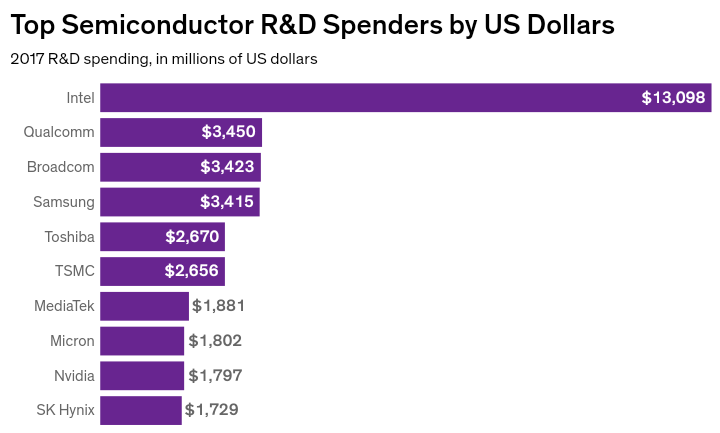

These numbers are a bit distorted because Samsung spent 10's of billion in 2015 to build additional chip production capacity. Intel saw a huge jump with the acquisition of MobileEye and increased investment in GPU development.

https://techcrunch.com/2017/03/13/r...for-up-to-16b-to-expand-in-self-driving-tech/

"

First they partnered, and now comes the acquisition: The computing giant Intel has confirmed that it is acquiring Mobileye, a leader in computer vision for autonomous driving technology, for $15.3 billion — the biggest-ever acquisition of an Israeli tech company.

Specifically, “Under the terms of the agreement, a subsidiary of Intel will commence a tender offer to acquire all of the issued and outstanding ordinary shares of Mobileye for $63.54 per share in cash, representing a fully-diluted equity value of approximately $15.3 billion and an enterprise value of $14.7 billion,” the company noted in a statement. The deal is expected to close in about nine months, Intel said."

https://www.scmp.com/tech/enterprises/article/2101315/samsung-opens-worlds-largest-chip-plant

- Joined

- May 1, 2005

- Messages

- 46,217

- Reaction score

- 20,457

Friggin eh nice post. Didn't realize Toshiba was still pumping that much into research. Go figure. You'd think with all the money they're spending Intel could make a competitive phone modem.

But thanks for the breakdown. I don't work with and never have worked with SCs so the terms often confuse me

https://www.fool.com/investing/2019/01/15/why-qualcomm-shareholders-should-be-furious.aspx man Qualcomm comes off as a bully who couldn't get his way. What a stupid move

But thanks for the breakdown. I don't work with and never have worked with SCs so the terms often confuse me

https://www.fool.com/investing/2019/01/15/why-qualcomm-shareholders-should-be-furious.aspx man Qualcomm comes off as a bully who couldn't get his way. What a stupid move

Last edited:

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

These numbers are a bit distorted because Samsung spent 10's of billion in 2015 to build additional chip production capacity. Intel saw a huge jump with the acquisition of MobileEye and increased investment in GPU development.

https://techcrunch.com/2017/03/13/r...for-up-to-16b-to-expand-in-self-driving-tech/

"

First they partnered, and now comes the acquisition: The computing giant Intel has confirmed that it is acquiring Mobileye, a leader in computer vision for autonomous driving technology, for $15.3 billion — the biggest-ever acquisition of an Israeli tech company.

Specifically, “Under the terms of the agreement, a subsidiary of Intel will commence a tender offer to acquire all of the issued and outstanding ordinary shares of Mobileye for $63.54 per share in cash, representing a fully-diluted equity value of approximately $15.3 billion and an enterprise value of $14.7 billion,” the company noted in a statement. The deal is expected to close in about nine months, Intel said."

https://www.scmp.com/tech/enterprises/article/2101315/samsung-opens-worlds-largest-chip-plant

What is distorted, buddy? Intel crushes everyone on R&D and accounts for nearly 25% of the entire industry's expenditures. It routinely blows away dozens of corporations with a revenue stream several times greater than theirs. Capital investment in production capacity is separate and Mobileye hardly registers as a fraction of its business, it's not even a $500 million subsidiary. Intel drops that on research and development at their Chandler fab (the "little" one) here alone and it isn't even fitted for that purpose.

Samsung's numbers are grossly distorted by an enormous surge in memory demand the last couple of years, the market jumped by 61.8 percent from 2016 to 2017 alone. Samsung's chip sales have gone from $44.3 billion ('16) to $65.2 ('17) to $83.3 ('18). That's why the other DRAM producers have also been through the roof, Micron leaped from $13.5 to $23.9 to $31.8 billion over the last three years alone. It's probably going to be bust cycle time soon.

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

Friggin eh nice post. Didn't realize Toshiba was still pumping that much into research. Go figure. You'd think with all the money they're spending Intel could make a competitive phone modem.

But thanks for the breakdown. I don't work with and never have worked with SCs so the terms often confuse me

It's just not part of their core business and one of the former CEO's botched the opportunity to make a serious effort. Intel is centered around designing and manufacturing µP's for personal computers and enterprise-grade industrial hardware, advancing process technology and has other R&D engaged in analytics, artificial intelligence and IoT.

It invented the world's first commercial microprocessor and currently still holds over 90%+ share of the PC and Data Center markets; the former is their bread-and-butter, latter the long-term growth generator and future. They can continue investing tens of billions into the US, especially my city and state. The late foray into cellular modems hasn't been that bad though, it nets around $850 million a quarter.

https://www.fool.com/investing/2019/01/15/why-qualcomm-shareholders-should-be-furious.aspx man Qualcomm comes off as a bully who couldn't get his way. What a stupid move

Hahah QCOM is really fucking catty, man. If "corporations are people" - @xcvbn - then Qualcomm is a woman. As Jerry Sanders once said before AMD ironically lost manufacturing capability themselves and sold out to China, "real men have fabs" and Qualcomm doesn't. They're insecure. In all seriousness though, they've been at war with Apple for a long time now and not too long ago accused Tim Cook of stealing their IP and passing it to Intel. Scandalous!

I'm glad this all didn't happen though.

In a letter to Broadcom CEO Hock Tan, Qualcomm claimed that the $146 billion offer made on Monday had once again “undervalued” the company. It cited what it said was a lack of value ascribed to Qualcomm’s acquisition of NXP, the resolution of licensing disputes and its opportunity in 5G.

It also claimed Broadcom had failed to address regulatory hurdles, which could cause “enormous” damage to Qualcomm if it committed to a deal which then did not go through due to being blocked by one of many regulators. Broadcom may beg to differ, arguing in its most recent bid that any takeover would be completed within a year and offering compensation if deadlines were missed.

- Joined

- Jun 29, 2008

- Messages

- 5,494

- Reaction score

- 0

About the only way China is going to improve their production is to take over Taiwan and claim it makes all Chinese products "better" because Taiwan is now China!

Be a man, do the right thing.

Be a man, do the right thing.

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

About the only way China is going to improve their production is to take over Taiwan and claim it makes all Chinese products "better" because Taiwan is now China!

Be a man, do the right thing.

- Joined

- Jun 29, 2008

- Messages

- 5,494

- Reaction score

- 0

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

Technological dominance is not guaranteed. It requires constant innovation and massive investment in R&D. China is no doubt catching up fast, but it still lags behind US in terms of research output and R&D investment input. US will still have the lead for at least another two decades. I think the 2040's will be an interesting time period, as that particular decade will be one where China will finally reach a degree of economic, military and technological parity with US. That is assuming China maintains the current trajectory and don't suffer economic stagnation like Japan did in the 1990's.

Also,

for not getting the ending.

TIMBEEEEER!

https://forums.sherdog.com/threads/...war-he’s-winning-chinas-losing.3895559/page-3

- Joined

- Jun 29, 2008

- Messages

- 5,494

- Reaction score

- 0

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

It would be folly to assume that the factory profiled in this video is in any way representative of Chinese manufacturing. I’ve toured dozens of factories all around China - particularly in the Pearl River Delta region where this was filmed. A couple important points on the subject:

* The vast majority of all manufacturing is done in positively dystopian conditions with workers living in dormitories on dirty factory grounds, double and tripled up in a room. A typical scene looks more like something from Blade Runner or a prison movie.

* To the extent that these big, pristine model factories exist, they are almost always state controlled/owned. The party loves putting them forth as an example to the world but they only look the way they do because of massive state support.

* Featuring a Shenzhen factory is another part of that media strategy mentioned above. The entire city is essentially a giant CCP brag to the rest of the world. What’s not said is that most regional manufacturing is done in places like neighboring Dongguan (which you never see). Only 45 miles away from Shenzhen but dirty, bleak place with brown air and a destitute citizenry.

That video is almost pure propaganda.

This deconstruction was so brutiful and swift.

IGIT

Silver Belt

- Joined

- Jan 10, 2005

- Messages

- 10,046

- Reaction score

- 940

Yes is a youtube video but it's about how China is reinventing the future of manufacturing and how workplaces are still extremely difficult for employees but seems to have improved but still stressful an difficult. But it shows you how many people are working hard to become leaders in innovation in the future. it shows also how far behind many companies are at competing with the Chinese.

hi there PEB,

nice video, though a bit frightening.

its weird reading through a few of these comments, lol. folks talking about China in much the same way US manufacturing spoke of Japan in the 1970s.

back then, it was like, "these Japs can't make a thing, all their manufacturing is crap". it must have been comforting to believe that "good 'ol american know-how" was a uniquely US ability. a decade later, the Japanese inhaled the big three for lunch.

most of the Nikons and the Mac gear at my business are made in China, and i've got no complaints.

viewed through the lense of the video, i get the sense that US is going to get keelhauled by the Chinese in the coming decade. there's a focus there that's kind of scary.

- IGIT

Similar threads

- Replies

- 3

- Views

- 245

Sup?

Sup?