Luis Videgaray is in a seemingly unenviable position.

The Mexican foreign minister arrived Tuesday evening in Washington with the task of renegotiating Nafta with a Trump administration that has staked much of its reputation on a pledge to reshape the trade deal and shift jobs back to the U.S. from Mexico. Given just how much Mexico has benefited from the 1994 pact -- its annual

trade surplus with the U.S. has soared to over $60 billion -- there’s the general sense that Videgaray has little leverage in the talks, that he will be mostly ceding ground to his American counterparts.

But Videgaray can be a formidable dealmaker. A 48-year-old MIT-trained economist, he’s long been considered in Mexico to be the master strategist behind President Enrique Pena Nieto’s rise to power. He’s also forged strong relationships with both Trump, who has referred to him as a “wonderful man,” and Trump’s son-in-law and senior adviser, Jared Kushner. What’s more, he may have a card to play in talks that’s been overlooked: security.

If Mexico were to, say, end cooperation with the U.S. on anti-drug trafficking or counter-terrorism efforts, it could hamstring an administration that’s made border security another of its top priorities, having even chosen to unveil its plan to build a new wall just as the Mexican contingent was getting to work in Washington. Videgaray hinted at his strategy Monday, telling the Televisa TV network that “this can’t be a negotiation where we only discuss trade."

“There are many areas in which the U.S. needs the cooperation of Mexico, such as security and immigration," he said.

Comeback Kid

That Videgaray has even made it to this point underscores the kind of shrewd operator he is. Back in August, during the height of the bitter U.S. campaign, he

invited Trump to Mexico City to meet with Pena Nieto. In many parts of Mexico, this was wildly unpopular. After all, Trump had used disparaging comments about Mexican immigrants to help launch his candidacy. Pena Nieto’s administration came under such criticism that Videgaray was forced to resign from the cabinet position he held at the time, finance minister.

But when Trump pulled off the election-day shocker two months later, Videgaray was suddenly summoned back to the presidential palace and appointed foreign minister so he could oversee the Nafta renegotiation talks.

He met with National Security Adviser Michael Flynn on the first day of his two-day trip and is scheduled to meet with Kushner on Thursday, according to a White House aide who asked not to be identified. Mexico’s Foreign Ministry has said it also expects U.S. trade adviser Peter Navarro and Trump’s chief of staff, Reince Priebus, to be involved in the talks. Videgaray has been accompanied by Economy Minister Ildefonso Guajardo.

Summit Cancelled

The meetings were to be a prelude to a summit planned for next between between the two presidents. Pena Nieto scuttled the face-to-face talk with Trump in a Twitter message after the U.S. leader blasted him in a tweet Thursday morning for saying Mexico would refuse to pay for a barrier on the U.S. southern border. “If Mexico is unwilling to pay for the badly needed wall, then it would be better to cancel the upcoming meeting,” Trump wrote.

Pena Nieto responded in his tweet: “This morning we’ve informed the White House that I won’t attend the working meeting scheduled for next Tuesday with @Potus.”

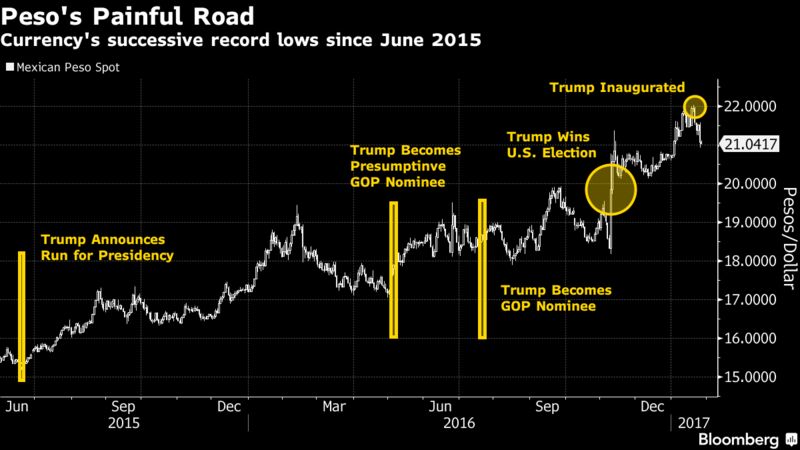

While Trump’s announcement of the border-wall plan Wednesday rankled many in Mexico and triggered calls for Pena Nieto himself to cancel his trip, the hope among his supporters is that visiting Trump within days of his inauguration will lead to a quick understanding of the general guidelines for revising Nafta. That, in turn, could help stabilize the Mexican peso, which has sunk repeatedly to new record lows amid concern the accord could undergo major revisions. Canada, the third partner in Nafta, is sitting out the talks for now.

"Trump is a negotiator, so he’s setting the bar high," said Alejandro Schtulmann, president of Mexico City-based political-risk advisory firm Empra. "Videgaray is skillful, but it remains to be seen what he can offer."

Internet, Energy

Beyond Videgaray’s security comments Monday, Mexican officials have been tight-lipped in their negotiating plans, and they remained so after the first day of meetings in Washington. In the past, they’ve signaled that they’re prepared to broaden the accord to include industries like internet commerce and energy.

Trump has been more direct about his goal. He’s spoken repeatedly about manufacturing, saying that investments in Mexico by U.S. companies seeking lower labor costs have deprived cities like Detroit and Cleveland of thousands of jobs. Trump used Twitter to

threaten a 35 percent tax on General Motors Co. and Toyota Motor Corp’s imports and cut a deal with Carrier Corp. to keep the company from moving some jobs south of the border. (His White House aide would only say that this week’s talks would focus primarily on trade but could also touch on the wall.)

Trump may demand

changes that effectively boost the share of auto manufacturing in the U.S., either through tariffs or regulations that require more of the inputs for vehicles to come from North America. Pena Nieto and Videgaray have been adamant that North America should remain free of tariffs, and Trump’s plans could endanger an auto industry that has taken off in Mexico in recent years.

Videgaray’s challenge is to preserve the benefits Mexico gets from Nafta while also satisfying Trump’s desire to rebalance the relationship, Schtulmann said. If successful, it may just be enough to further propel his political comeback, perhaps leading to a gubernatorial or even presidential run one day, said Duncan Wood, director of the Mexico Institute at the Woodrow Wilson International Center for Scholars in Washington.

"He’s somebody who doesn’t back down,” Wood said. “He has extraordinary intellect that should not be discounted."