- Joined

- Oct 30, 2004

- Messages

- 92,557

- Reaction score

- 28,336

High levels of taxation hamper economic growth. It doesn't take an expert to see the obvious. Of course, many experts do agree with the statement I made.

No experts will agree with the statement you actually made. You know it was pure hackery.

Here's the top google return from a quick search. It may be unorthodox among your colleagues, but clearly many economists think in terms very similar to those I expressed.

This was your comment: "But if taxes are too high they hamper economic growth, and that's where we found ourselves. The tax cuts were good because they allowed the economy to begin to thrive in a way it hadn't for a decade."

Not, "in theory, corporate taxes specifically could slow growth," or even "the U.S. could grow faster if corporate taxes were lower." Those would be defensible.

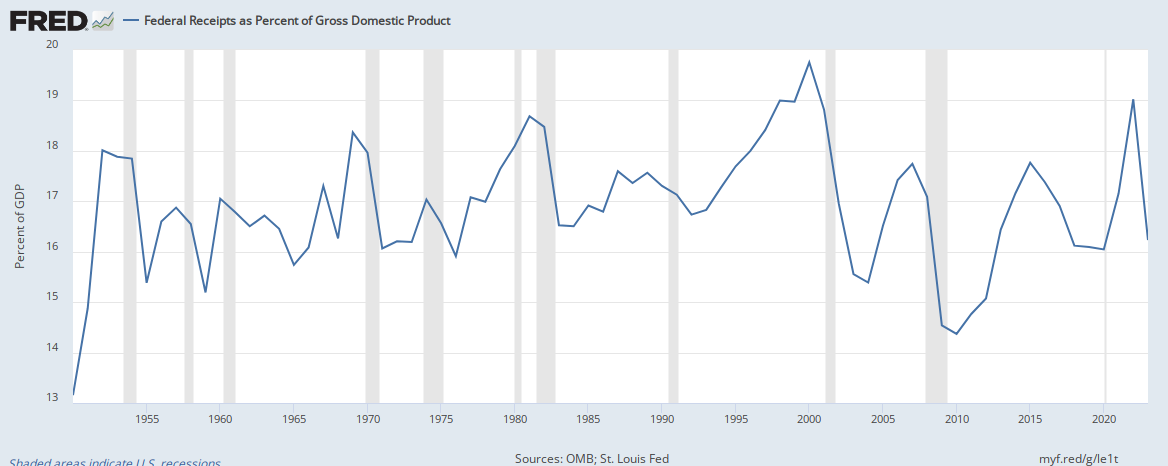

Here's tax levels from 1950 to 2017:

Any evidence that taxes were high before the cuts, much less that high taxes were hampering economic growth? No, of course not.

Your argument here is an argument from authority, which aside from commonly leading to logical fallacies here breaks down because you do not accurately describe the views of the experts.

An argument from authority is only a fallacy if it's made as a logical argument, in the form of "an authority says X; therefore X is true." It's not a fallacy if you point out that authorities tend to understand stuff better than amoral hacks like you.

The US debt stood at 10.6 trillion dollars in Jan 2009. By 2016 that increased to 19.7 trillion dollars. (https://money.cnn.com/2016/10/19/news/economy/debt-obama-trump/index.html) An increase of 9.1 trillion over 10.6 can be reasonably generalized as doubling. If the imprecision bothers you, can we agree that during Obama's tenure as president the national debt increased 86% rather than 100%?

We can agree that "during Obama's tenure as president ..." But what you said was "Obama doubled the debt," which is false. And that Obama did not promote pro-growth policies, which is also false. The whole point of the ARRA was to grow the economy, and by all measures, it exceeded expectations.

Look at GDP over the past 10 years.

You can see in the chart where the ARRA started.

And the deeper problem here isn't that you're getting things wrong; it's that you have utterly no interest in getting them right. As usual, you just lie for propaganda purposes, and then you lie about your own comments when they are challenged.