You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

International Chinese Debt-Trap Diplomacy: Xi Jinping's Belt and Road Initiative Turns 10 Years Old

- Thread starter Arkain2K

- Start date

- Joined

- Jul 26, 2018

- Messages

- 8,873

- Reaction score

- 5

Ok.

I guess we'll agree to disagree and just watch.

I don't even want to come back here to say I told you so, because I hope I'm wrong.

Nah bro, we're on the same team here.

They are looking legit chinny as fuck right now by any objective view and this conflict hasn't even begun to get nasty. The US is no longer allowing them to just buy all of our natural resources and high-tech up, your boy Don has done an incredible job on that front thus far although he really should've canceled ZTE's contract when the opportunity was there. Few things cut more to heart of CCP legitimacy than loss of employment.

I don't have any ill will towards the citizens of China, but that regime in power is anathema to me. They have to be wrecked, or we risk forfeiting our own future and prosperity.

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

Worth mentioning that the Australian port was not acquired using a debt trap.

This was simple old fashioned incompetence, greased by a few brown envelopes.

The Socialist Republic of Vietnam was gonna do the same this year, until millions of Vietnamese protesters took it to the streets and delayed their government's plan to sellout to Beijing.

- Joined

- Jun 29, 2008

- Messages

- 5,494

- Reaction score

- 0

When it comes time to pay, people will finally see why America leaving the gold standard is a good thing (well, for us anyway).

All we have to do, is default on them and watch the world economic system come crashing down while the dollar stays the same. We have been buying most goods from outside our nation keeping our national resources where it is for when the shit hits the fan...and other nations are not going to turn to China for leadership when it comes down to picking sides either. China is a hollow giant...building cities to keep their economy up, cities for no people.

All we have to do, is default on them and watch the world economic system come crashing down while the dollar stays the same. We have been buying most goods from outside our nation keeping our national resources where it is for when the shit hits the fan...and other nations are not going to turn to China for leadership when it comes down to picking sides either. China is a hollow giant...building cities to keep their economy up, cities for no people.

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

Shortly before his first trip to China since taking office, Malaysian prime minister Mahathir Mohamad said in an interview that he would like to cancel a pair of Chinese projects he had earlier ordered suspended and probed for its ties to the scandal-ridden 1MDB state-development fund.

“We don’t think we need those two projects. We don’t think they are viable. So if we can, we would like to just drop the projects,” Mahathir told the Associated Press today (Aug. 13).

The projects include the $20 billion, 688-kilometer (430 miles) East Coast Rail Link, which would have linked ports on peninsular Malaysia’s east and west coasts, and was being built by the China Communication Construction Company. It was a key feature of the sprawling global infrastructure plan envisioned by China since 2013. Financed with loans and expected to take a decade to build, the project would have reduced China’s dependence on shipping via the narrowest reaches of the Malacca Strait for its energy needs. The other project involved a pair of gas pipelines to be funded by China’s Exim Bank.

Separately, Malaysia also scrapped a $27 billion high-speed railway to Singapore in June, with Mahathir saying at the time he was trying to stop his country from going bankrupt (paywall).

The projects were agreed upon under former prime minister Najib Razak, who signed Malaysia up for a number of big-ticket infrastructure projects while in office. Since Mahathir’s electoral upset in May, an investigation into the corruption at 1MDB was revived, and Malaysia’s finances have been found to be in disarray. The country’s new finance minister announced that government debt, including those related to 1MDB, had reached the equivalent of $250 billion. Najib, under whom the fund was created ostensibly to help Malaysia develop, has been arrested and charged with criminal breach of trust and money laundering. He has denied any wrongdoing.

Less than a month after the election, the Malaysian finance ministry in June called the gas pipeline projects a “scandal,” noting in a press release that nearly $2 billion in payments, or nearly 90% of the project value, had been disbursed, yet less than 15% of the work on either had been completed since construction was started by China Petroleum Pipeline Bureau. The entity overseeing the project was linked to 1MDB, the ministry noted, adding that Malaysia would consider seeking the help of China in its investigations of potential money laundering.

This is not the first time a China-funded project has been overturned by a change in leadership, but it is one of the biggest setbacks yet to China’s Belt and Road plans. Now observers are looking to see what happens in Pakistan, where former cricket star Imran Khan was elected prime minister last month. It’s home to the Belt and Road’s flagship China-Pakistan Economic Corridor, which involves a port, power plants, and other projects estimated to total nearly $60 billion.

https://qz.com/1354463/malaysias-mahathir-wants-to-drop-20-billion-in-chinese-projects/

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

Samoa rejects Tonga's China Pacific debt forgiveness call

Agence France-Presse | Aug 20, 2018

Agence France-Presse | Aug 20, 2018

Samoa’s prime minister has rejected a call for Pacific island nations to ask China to write-off debts granted under Beijing’s foreign aid programme in the region.

Tuilaepa Sailele Malielegaoi said asking for aid loans to be forgiven painted an “unfaithful picture” of the recipient nation.

Malielegaoi likened it to someone requesting assistance and receiving milk, then later coming back and asking for the entire cow.

“The bigger countries (will) become reluctant to give loans with minor interests because this is what will happen,” he told the Samoa Observer in remarks published Monday.

“A loan is granted with minor interest yet in five years time a request is put in to write it off. That is embarrassing.”

He was responding to a suggestion from his Tongan counterpart Akalisi Pohiva that Pacific island nations band together and ask Beijing to collectively forgive their debt.

Chinese aid in the Pacific has ballooned in recent years with much of the funds coming in the form of loans from Beijing’s state-run Exim Bank.

Pohiva raised concerns that small developing nations would struggle to repay the debt and could face asset seizure by Beijing.

He initially suggested they address the issue at next month’s Pacific Islands Forum in Nauru but later backtracked, issuing a statement praising the help China has given to his country.

Australia and New Zealand had raised concerns recently about China’s growing influence in the Pacific, ramping up their own aid efforts in response.

http://politics.com.ph/samoa-rejects-china-pacific-debt-forgiveness-call/

Last edited:

- Joined

- Nov 12, 2011

- Messages

- 35,945

- Reaction score

- 4,933

Meanwhile the geniouses in the Philippine government really wants to push hard for a joint energy exploration ith the Chinese.

http://news.abs-cbn.com/news/08/03/...t-exploration-with-china-follows-constitution

Palace: Proposed joint exploration with China follows Constitution

http://news.abs-cbn.com/news/08/03/...t-exploration-with-china-follows-constitution

Palace: Proposed joint exploration with China follows Constitution

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

Are you filled with confidence now @ShinkanPo ? :-D

Philippine lawmakers caution gov’t on China debt trap

By Hannah Torregoza | August 24, 2018

By Hannah Torregoza | August 24, 2018

The Duterte administration is being urged by several lawmakers to take its cue from Malaysia’s decision to withdraw from China-sponsored projects, saying it should prevent the Philippines from falling into a debt trap.

Sen. Leila de Lima, who chairs the Senate committee on social justice, welfare and rural development, said the government should be wary of these suspicious Chinese loans and look at the long-term repercussions of all the planned infrastructure projects and investments into the country that are funded by China.

“The Philippine government must take its cue from Prime Minister Mahathir who decided to cancel three China-backed projects amounting to US$22-billion to avoid his country from falling into a debt trap,” de Lima said in her latest statement.

“We need to take heed before it’s too late,” the detained senator stressed.

Malaysian Prime Minister Mahathir Mohamad earlier confirmed that three China-backed projects would be cancelled until Malaysia can find a way to pay its debts.

The projects include a railway connecting Malaysia’s east coast to southern Thailand and Kuala Lumpur, and two gas pipelines.

De Lima emphasized that entering into loan agreements, especially those that are not obtained through competitive procurement, “can put not only our country in dire debt and cripple our economy, but also undermine our sovereignty and national security.”

Sen. Joseph Victor “JV” Ejercito echoed de Lima’s sentiments, saying that from the start, he is already apprehensive on China being friendly and offering its assistance to the Philippine government to finance and undertake big infrastructure projects.

“For sure it will have strings attached. And knowing China, it will come at a heavy price too.” Ejercito said when also sought for comment.

“It is business for them and I don’t think they are really sincere to help,” he said.

Ejercito also frowned at China’s continuous efforts to build military infrastructure on disputed islands in the West Philippine Sea.

“Ginigisa tayo sa sariling mantika. Friendly kunwari pero inaagaw naman ang territoryo ng Pilipinas,” he said.

“I would trust Japan more than China. There is sincerity in their offer of assistance,” Ejercito further said.

Resolutions have been filed at the Senate seeking an inquiry into the various investment deals entered into by the Duterte administration with China.

Senator Gatchalian: Mechanisms in place to prevent the Philippines from falling into China debt trap

By Hannah Torregoza | August 27, 2018

By Hannah Torregoza | August 27, 2018

Senator Sherwin Gatchalian thumbed down proposals for the Philippines to follow the Malaysian government’s move and cancel its own big-ticket infrastructure deals with China.

Gatchalian said it would be premature for the government to cancel its own infrastructure projects with China simply because the Malaysian government has cancelled their own deals with Beijing.

“At this point, we do not know the details of the subject Malaysian-Chinese infrastructure deals,” Gatchalian pointed out.

But ultimately, the Philippine government should decide on its own whether or not to push through with the pending big-ticket infrastructure projects.

“Our government’s decision should be based on an objective assessment of the pros and cons of the deal,” he said.

“The decisions of regional allies concerning their own projects should not be a factor,” he added.

Besides, he said the country has enough mechanisms in place to avert any China-backed projects that may push the country to the brink of bankruptcy.

“We must also note that our country has processes in place to prevent the Philippines from falling into a debt trap,” he said.

“The Congress, the Monetary Board, the DBCC (Development Budget Coordination Committee) and other institutions are continuously exercising their respective prudential mandates to ensure that the government abides by responsible and sustainable fiscal policies,” Gatchalian stressed.

Gatchalian’s views on the matter echoed that of Sen. Aquilino “Koko” Pimentel III who also earlier rejected proposals for the government to copy Malaysia’s move.

“No two countries are 100-percent similarly situated. Let us decide for ourselves what best to do given our own situation and our own analysis,” Pimentel said.

“We should not blindly copy what other countries are doing,” he said.

Earlier, Senators Leila de Lima and Joseph Victor “JV” Ejercito urged the Duterte administration to emulate Malaysian Prime Minister Mahathir Mohamad, who withdrew from three China-backed projects that cost a total of P22-billion to avoid falling into a debt trap.

“Entering into loan agreements, especially those that are not obtained through competitive procurement, can put our country not only in dire debt and cripple our economy, but also undermine our sovereignty and national security,” De Lima had said.

Last edited:

- Joined

- Nov 12, 2011

- Messages

- 35,945

- Reaction score

- 4,933

Tun Mahattir for the win!

I want to hear from Mr.Gatchalian what are those mechanisms in place is it the current constitution the same constitution they want to abolish? Did he mention that the Chinese offer has considerable higher interest than the Japanese ones? I just see it as Mr.Gatchalian and Koko the Loco Pimentel as burying their heads in the sand. They are clearly shook that a long time anti Western Mahattir Mohamad of Malaysia went against the Chinese loans, they probably thought he will be another uber Pro China leader.

I want to hear from Mr.Gatchalian what are those mechanisms in place is it the current constitution the same constitution they want to abolish? Did he mention that the Chinese offer has considerable higher interest than the Japanese ones? I just see it as Mr.Gatchalian and Koko the Loco Pimentel as burying their heads in the sand. They are clearly shook that a long time anti Western Mahattir Mohamad of Malaysia went against the Chinese loans, they probably thought he will be another uber Pro China leader.

Last edited:

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

Up next: Pakistan.

Pakistan has received 12 bailouts from the International Monetary Fund since the late 1980s as a result of debt blowouts and balance-of-payment imbalances.

Now, the country’s 13th bailout from the IMF—expected to be the largest so far—is on the horizon. And China is a key player as former cricket star Imran Khan of Pakistan’s PTI party is set to become prime minister next week.

Despite some efforts to reform and liberalize its economy, Pakistan remains mired in chronic underdevelopment. According to the Index of Economic Freedom, the Pakistani economy is “mostly unfree,” ranking 131st out of 180 economies scored in the 2018 edition.

Excessive state involvement in the economy, an inefficient regulatory framework, and lingering corruption have systematically inhibited private business formation and expansion. Large budget deficits are chronic, with tax collection scandalously low.

Pakistan’s external debt burden has mounted to an unsustainable level, thus the likelihood of another IMF bailout.

What makes this latest rescue distinctive from previous ones is the China factor.

Pakistan has become overly dependent on billions of dollars in Chinese loans. It has run up a huge import tab bringing in construction equipment and building materials as part of a Chinese-funded master plan to revamp ports, roads, and railways.

That $62 billion plan, known as the China-Pakistan Economic Corridor (CPEC), has been touted as a long-term, strategic economic partnership that supposedly will increase trade and investment between the two countries.

CPEC is a classic example of China’s aggressive geopolitical outreach through its Belt and Road Initiative, or BRI, aptly dubbed “debt-trap diplomacy” by the editors of National Review:

Not surprisingly, the State Bank of Pakistan reported that Pakistan’s external debt has soared to a record $91.8 billion, an increase of nearly $31 billion in the past four years and nine months.

In a recent study, the IMF cited the China-Pakistan Economic Corridor as a factor in Pakistan’s elevated current-account deficit and rising external debt-service obligations.

In response to the looming bailout, Secretary of State Mike Pompeo noted July 30: “There’s no rationale for IMF tax dollars, and associated with that American dollars that are part of the IMF funding, for those to go to bail out Chinese bondholders or China itself.”

In the bigger picture, however, Pakistan’s incoming government must take steps to revive the nation’s economy.

It has been politically expedient for the government to blame this lack of economic progress entirely on Pakistan’s difficult security situation. In fact, the lack of sustained reforms in large part has hindered growth.

This is precisely what Khan’s new government must address.

https://www.dailysignal.com/2018/08/08/is-pakistan-about-to-be-caught-in-chinas-debt-trap-diplomacy/

Pakistan has received 12 bailouts from the International Monetary Fund since the late 1980s as a result of debt blowouts and balance-of-payment imbalances.

Now, the country’s 13th bailout from the IMF—expected to be the largest so far—is on the horizon. And China is a key player as former cricket star Imran Khan of Pakistan’s PTI party is set to become prime minister next week.

Despite some efforts to reform and liberalize its economy, Pakistan remains mired in chronic underdevelopment. According to the Index of Economic Freedom, the Pakistani economy is “mostly unfree,” ranking 131st out of 180 economies scored in the 2018 edition.

Excessive state involvement in the economy, an inefficient regulatory framework, and lingering corruption have systematically inhibited private business formation and expansion. Large budget deficits are chronic, with tax collection scandalously low.

Pakistan’s external debt burden has mounted to an unsustainable level, thus the likelihood of another IMF bailout.

What makes this latest rescue distinctive from previous ones is the China factor.

Pakistan has become overly dependent on billions of dollars in Chinese loans. It has run up a huge import tab bringing in construction equipment and building materials as part of a Chinese-funded master plan to revamp ports, roads, and railways.

That $62 billion plan, known as the China-Pakistan Economic Corridor (CPEC), has been touted as a long-term, strategic economic partnership that supposedly will increase trade and investment between the two countries.

CPEC is a classic example of China’s aggressive geopolitical outreach through its Belt and Road Initiative, or BRI, aptly dubbed “debt-trap diplomacy” by the editors of National Review:

The heart of the BRI is debt-trap diplomacy: China oversells the benefits of these infrastructure projects, offers credit for them on onerous terms, and, when the bill comes due and its debtors aren’t able to pay, demands control over the infrastructure and influence in the region to compensate.

The attempt to turn these countries into satellite states via the strategic construction of infrastructure is pure geopolitics. China has eyed a westward turn for years, and its desire to advance in Southeast Asia is no secret.

The attempt to turn these countries into satellite states via the strategic construction of infrastructure is pure geopolitics. China has eyed a westward turn for years, and its desire to advance in Southeast Asia is no secret.

Not surprisingly, the State Bank of Pakistan reported that Pakistan’s external debt has soared to a record $91.8 billion, an increase of nearly $31 billion in the past four years and nine months.

In a recent study, the IMF cited the China-Pakistan Economic Corridor as a factor in Pakistan’s elevated current-account deficit and rising external debt-service obligations.

In response to the looming bailout, Secretary of State Mike Pompeo noted July 30: “There’s no rationale for IMF tax dollars, and associated with that American dollars that are part of the IMF funding, for those to go to bail out Chinese bondholders or China itself.”

In the bigger picture, however, Pakistan’s incoming government must take steps to revive the nation’s economy.

It has been politically expedient for the government to blame this lack of economic progress entirely on Pakistan’s difficult security situation. In fact, the lack of sustained reforms in large part has hindered growth.

This is precisely what Khan’s new government must address.

https://www.dailysignal.com/2018/08/08/is-pakistan-about-to-be-caught-in-chinas-debt-trap-diplomacy/

- Joined

- Jul 20, 2011

- Messages

- 53,884

- Reaction score

- 30,888

Imran Khan strikes me as an interesting character, his win looking like another in the line of populist victories across the globe. Been thinking about making a thread on him, something about him being the Pakistani Trump due to his populism, but I have to admit I'm not that well informed on him or Pakistani politics in general.Up next: Pakistan.

Pakistan has received 12 bailouts from the International Monetary Fund since the late 1980s as a result of debt blowouts and balance-of-payment imbalances.

Now, the country’s 13th bailout from the IMF—expected to be the largest so far—is on the horizon. And China is a key player as former cricket star Imran Khan of Pakistan’s PTI party is set to become prime minister next week.

Despite some efforts to reform and liberalize its economy, Pakistan remains mired in chronic underdevelopment. According to the Index of Economic Freedom, the Pakistani economy is “mostly unfree,” ranking 131st out of 180 economies scored in the 2018 edition.

Excessive state involvement in the economy, an inefficient regulatory framework, and lingering corruption have systematically inhibited private business formation and expansion. Large budget deficits are chronic, with tax collection scandalously low.

Pakistan’s external debt burden has mounted to an unsustainable level, thus the likelihood of another IMF bailout.

What makes this latest rescue distinctive from previous ones is the China factor.

Pakistan has become overly dependent on billions of dollars in Chinese loans. It has run up a huge import tab bringing in construction equipment and building materials as part of a Chinese-funded master plan to revamp ports, roads, and railways.

That $62 billion plan, known as the China-Pakistan Economic Corridor (CPEC), has been touted as a long-term, strategic economic partnership that supposedly will increase trade and investment between the two countries.

CPEC is a classic example of China’s aggressive geopolitical outreach through its Belt and Road Initiative, or BRI, aptly dubbed “debt-trap diplomacy” by the editors of National Review:

The heart of the BRI is debt-trap diplomacy: China oversells the benefits of these infrastructure projects, offers credit for them on onerous terms, and, when the bill comes due and its debtors aren’t able to pay, demands control over the infrastructure and influence in the region to compensate.

The attempt to turn these countries into satellite states via the strategic construction of infrastructure is pure geopolitics. China has eyed a westward turn for years, and its desire to advance in Southeast Asia is no secret.

Not surprisingly, the State Bank of Pakistan reported that Pakistan’s external debt has soared to a record $91.8 billion, an increase of nearly $31 billion in the past four years and nine months.

In a recent study, the IMF cited the China-Pakistan Economic Corridor as a factor in Pakistan’s elevated current-account deficit and rising external debt-service obligations.

In response to the looming bailout, Secretary of State Mike Pompeo noted July 30: “There’s no rationale for IMF tax dollars, and associated with that American dollars that are part of the IMF funding, for those to go to bail out Chinese bondholders or China itself.”

In the bigger picture, however, Pakistan’s incoming government must take steps to revive the nation’s economy.

It has been politically expedient for the government to blame this lack of economic progress entirely on Pakistan’s difficult security situation. In fact, the lack of sustained reforms in large part has hindered growth.

This is precisely what Khan’s new government must address.

https://www.dailysignal.com/2018/08/08/is-pakistan-about-to-be-caught-in-chinas-debt-trap-diplomacy/

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

Congo is begging the IMF to bail them out before they are crushed by Chinese loans.

https://www.france24.com/en/20190428-chinas-vast-investment-africa-hits-snag-congo

China's vast investment in Africa hits a snag in Congo

28/04/2019

Chinese President Xi Jinping and his Republic of Congo counterpart Denis Sassou Nguesso, pictured in 2013. China has invested heavily in Congo-Brazzaville

28/04/2019

Chinese President Xi Jinping and his Republic of Congo counterpart Denis Sassou Nguesso, pictured in 2013. China has invested heavily in Congo-Brazzaville

China's investment strategy of throwing money at developing countries appears to have hit a snag in the Republic of Congo as the central African nation is seeking an IMF bailout.

While the funding it provided to Congo wasn't part of the Belt and Road Initiative (BRI), which China was promoting this week, it serves as a cautionary tale of the trouble Beijing could face with its plan for massive investments in maritime, road and rail projects across 65 countries from Asia to Europe and Africa.

When the plunge of global oil prices in 2014 blew a hole in the Congolese government's finances, it was China that stepped in to help.

But despite the recovery of oil prices, the country, also known as Congo-Brazzaville, has had trouble getting back on top of its finances and has asked the International Monetary Fund for help.

The IMF places conditions on its loans to force governments to take measures to boost their finances. In addition, as the IMF can only lend if it judges that a country's debt load is sustainable, a bailout may be accompanied by a restructuring of government debt.

"It's certainly the first time China has found itself confronted with this kind of situation," said a specialist in relations between China and Africa who asked her name not be used as the discussions with IMF were still underway.

"The Republic of Congo is seeking IMF protection in order to avoid a possible default on its payments," she added.

"China, which holds more than a third of its foreign debt, is not really comfortable with that."

- China lending full-tilt -

Julien Marcilly, chief economist at Coface, a firm that provides payment insurance for French companies, said that China "went full-tilt on lending in recent years, often to countries which produce and export raw materials, in particular oil."

It is only now that "Beijing is beginning to realise that problems can build up", in particular after Venezuela defaulted.

The situation is all the more worrying as the Republic of Congo in 2005 was one of the countries that benefited from an international debt relief initiative for the world's poorest countries.

Its foreign debt was bought down from 119 percent of annual economic output to just 33 percent.

But like other oil-producing nations, Congo-Brazzaville took a beating from the 2014 plunge in oil prices.

"It was an expected and very brutal drop in prices, which was ironically linked to a slowdown in China," noted Marcilly.

The drop in oil prices meant the nation's economic output dropped by 50 percent. As a consequence, its debt as a percentage of GDP soared to 110 percent in 2017.

About one-third of the country's debt is in Chinese hands, or about $2 billion, said the specialist in relations between China and Africa.

The Congolese government reached an agreement with IMF negotiators a year ago, but the terms need to be approved by the IMF's governing board.

One year later, the deal has yet to be approved.

A French source confirmed that the IMF programme is contingent on Congo-Brazzaville's debt becoming sustainable, which means that a deal has to be reached with China on cutting the amount owed or pushing back payments.

However it would be unusual for Beijing to do this. When Sri Lanka was unable to repay its loans it was forced to turn over a deep-sea port to China for 99 years.

The IMF and China both declined to comment when contacted by AFP.

https://www.france24.com/en/20190428-chinas-vast-investment-africa-hits-snag-congo

Last edited:

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

Sri Lanka wants its ‘debt trap’ Hambantota port back. But will China listen?

By Kinling Lo | 7 Dec, 2019

By Kinling Lo | 7 Dec, 2019

- Critics view the deal as a symbol of the problems associated with Chinese lending and the Belt and Road Initiative, but Beijing so far shows little sign of changing its mind

- Newly elected President Gotabya Rajapaksa promised on the campaign trail to revisit the agreement, but observers say he will need to offer China something else in return

Sri Lanka’s new government wants China to hand back a port it was given two years ago to cover its debts – but its chances of success appear slim.

The port, located at the heart of a busy shipping route in southern Sri Lanka, has been held up by critics as a symbol of the worst aspects of China’s “debt trap diplomacy” with many locals regarding it as a sign of subordination to Beijing.

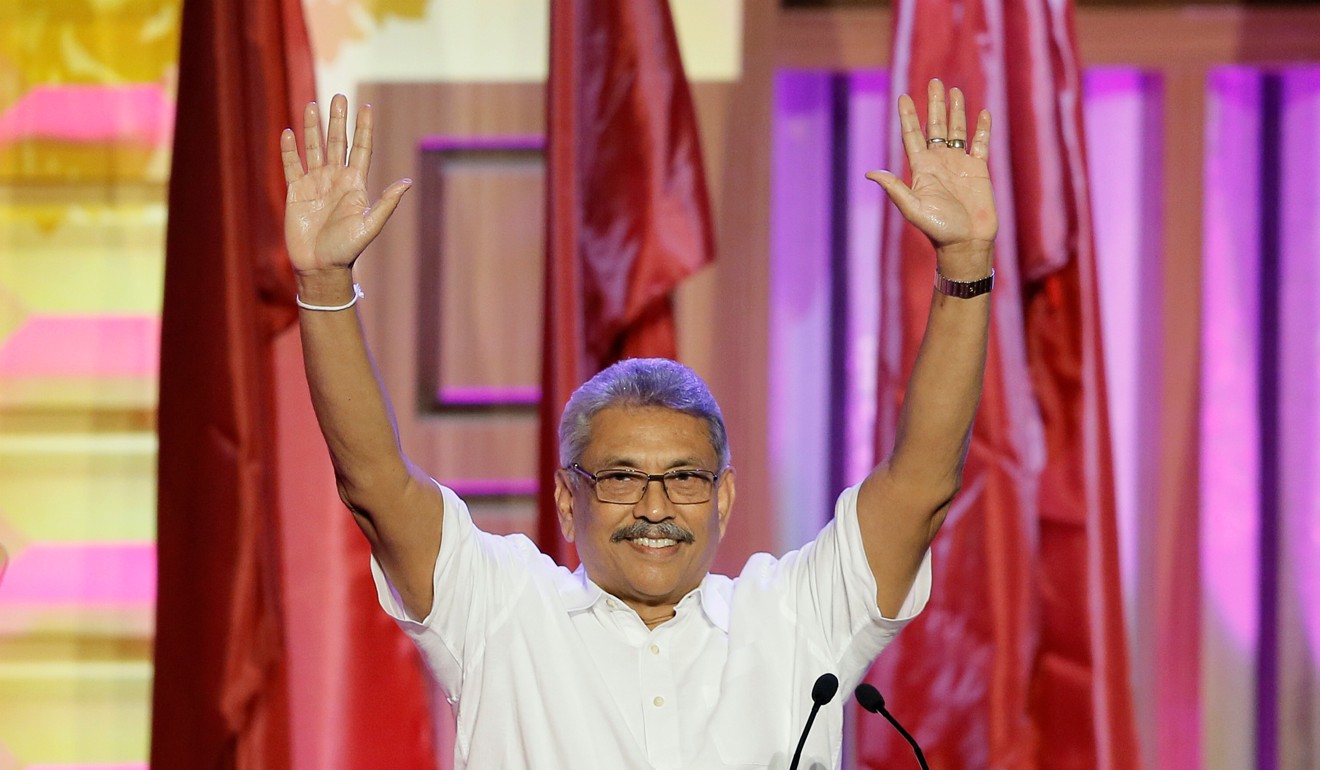

Gotabaya Rajapaksa, brother of the former leader Mahinda Rajapaksa, was elected president last month after a campaign where he promised to undo the port deal.

“The perfect circumstance is a return to the norm,” Ajith Nivard Cabraal, a former central bank governor under Mahinda Rajapaksa, who is now serving as prime minister.

“We pay back the loan in due course in the way that we had originally agreed without any disturbance at all.”

President Gotabaya Rajapaksa was sworn in last month.

But so far Beijing has given no indication that it will rethink its plans – instead suggesting that development plans for the port should be speeded up.

On Monday, Chinese diplomat Wu Jianghao met Gotabaya Rajapaksa to congratulate him on his election victory – but an account of the meeting by Xinhua indicated that the two countries should “speed up the implementation of cooperation on big economic projects, including the Colombo Port City and the Hambantota Port, under the existing consensus”.

Meanwhile, the president’s office did not go into details about the meeting, only describing it as a “cordial discussion”.

Sri Lanka is not the only country in South and Southeast Asia where a new government has tried to renegotiate deals agreed as part of China’s Belt and Road Initiative

.

But while Malaysia succeeded in renegotiating the contract to build the East Coast Rail Link, others such as Pakistan and Myanmar, have been less successful.

International observers said Sri Lanka’s ongoing reliance on international investment as it continues to rebuild after a lengthy civil war limited its scope to negotiate with China.

“The ability of a country to renegotiate deals would depend on its economic size, performance and strategic outlook,” said Amitendu Palit, an economist specialising in international trade and investment policies at the National University of Singapore said.

“Malaysia has been far superior in this regard. It is a middle-income country with a much stronger economy and is part of a stable regional order. Sri Lanka does not enjoy the same advantages

“Even 10 years after the end of the civil conflict, the Sri Lankan economy has not been able to achieve high growth and attract long-term private investments.”

Former president Mahinda Rajapaksa is now his brother’s prime minister.

Sri Lanka’s debt is currently 78 per cent of its GDP – one of the highest ratios in South and Southeast Asia.

Between 2010 and 2015, China lent the country about US$5 billion for infrastructure projects including Mattala Airport – which has been widely criticised as a white elephant – and the Hambantota port.

By 2018, Chinese lending to the country had reached US$8 billion, according to the International Monetary Fund.

Sufian Jusohm, an international trade and investment professor at the National University of Malaysia, said the Sri Lankan government would need to offer China an alternative if it wanted to revise the deal.

“Sri Lanka may revoke the lease but risks paying compensation to the Chinese company for expropriating the port. In addition, this will result in a diplomatic conflict between the country and China,” he said,

“In any event, Sri Lanka may be able to persuade China to agree to a review if it can offer an alternative deal.”

An 85 per cent stake in the Hambantota port was handed over to China Merchants Port Holdings Company in December 2017 in return for US$1.1 billion.

However, the deal has caused concern in India, which is worried that its geopolitical rival will be able to use it for military purposes.

Swaran Singh, a diplomacy professor based in New Delhi, said it was becoming the norm for incoming governments to try to renegotiate belt and road deals with China.

He said new leaders “seek to renegotiate BRI projects in the name of the national interest” but also want to put their “personal stamp on projects to highlight their contribution towards building their nation”.

Du Youkang, a professor specialising in South Asia at Shanghai’s Fudan University, said the Rajapaksa’s desire to revisit the deal was driven more by domestic politics than economic concerns.

“But no matter how the deals are revised, it is obvious that the direction of these countries’ diplomatic tactics with China will not change. This is because they need these Chinese investments,” he said.

It was also possible for governments to offer China an alternative deal, he said, adding that it was “too early to say” whether attempts to renegotiate would harm relations or hinder the belt and road plan.

The Rajapaksa family has a long history with the Hambantota port project, which was one of the flagship projects during Mahinda’s presidency between 2005 and 2015 and is located in their political heartland.

But despite a promise that it would become “the biggest port constructed on land in the 21st century” it has largely underperformed economically.

To fund the project, Sri Lanka borrowed US$301 million from China at an interest rate of 6.3 per cent. For comparison, the interest rates on soft loans from the World Bank and Asian Development Bank are usually between 0.25 and 3 per cent.

The port project has also been dogged by allegations of corruption, which the Rajapaksas deny.

Mahinda was placed under investigation following his defeat by Maithripala Sirisena in the 2015 presidential election.

A New York Times report in 2018 also claimed that Chinese state-owned company China Harbour Engineering had given US$7.6 million to his election campaign.

Several other members of the Rajapaksa family – including Mahinda’s son and his two brothers – were also under investigation over claims billions of dollars of public money had been misused.

The new president Gotabaya, who was formerly defence secretary, had also been accused of fraud in arms deals, and in the purchase of military and civilian aircraft. But the charges were dropped on the day he was sworn in as president because the head of state is immune from prosecution.

During Mahinda’s administration, Sri Lanka borrowed heavily from China and allowed two Chinese submarines to dock in Colombo in 2014, alarming Western countries and India.

His younger brother has already visited India following his election but has accepted an invitation from China as well.

https://www.scmp.com/news/china/dip...its-debt-trap-hambantota-port-back-will-china

- Joined

- Jul 10, 2013

- Messages

- 17,249

- Reaction score

- 4,100

Give China some more time and they'll be doing the same if not worse. They get a little bit of power and they're already trying to claim the south china sea as their own because it has China in its name.

It was at this moment that American McGee thought “things could be worse”.

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

If we didn't bomb the shit out of other countries maybe they'd be more willing to partner up with us. To them China is the lesser of two evils.

Specifically which third-world debt-trap victim listed in the OP and discussed in this thread fits this bizarre narrative of yours?

- Joined

- Dec 6, 2010

- Messages

- 33,422

- Reaction score

- 5,683

The Chinese will ensure that the puppet government they installed won't collapse they will use the threat of military force against coup plotters or against external interference just like what they did with Maldives.

The Maldives is running to India for help now that they're cornered with a mountain of debts they can't pay, and India will probably have to help since all those islands are stragetically spaced in the Indian ocean. If any of them falls into China's hand, they don't even need to build artificial islands to house weapons right next to their neighbors like in the South China Sea.

China, Maldives clash over mounting Chinese debt as India warms up to Male

Maldives owes China $3.4 billion as repayment for loans for projects undertaken during Yameen's rule.

By IANS | Jul 08, 2019

Maldives owes China $3.4 billion as repayment for loans for projects undertaken during Yameen's rule.

By IANS | Jul 08, 2019

Former Maldivian President Mohammed Nasheed has clashed with his country's Chinese envoy over Male's "alarming levels" of Chinese debt, which stands at $3.4 billion, even as India has regained ground in the strategically important Indian Ocean atoll nation with the exit of pro-Beijing former president Abdulla Yameen.

In a story being played out in other countries too, including African nations, where China has a massive presence in the infrastructure sector, Nasheed, who is now Parliament speaker and is close to India, said that Maldives owes China $3.4 billion as repayment for loans for projects undertaken during Yameen's rule.

Speaking at a think tank meeting last week, Nasheed said that the cost of Chinese projects was extremely high and that from 2020 onwards 15 per cent of Male's budget will have to be spent on paying back the debt owed to various Chinese companies.

"They came in; they did the work and sent us the bill. So it's not the loan interest rates as such but the costing itself. They over-invoiced us and charged us for that and now we have to repay the interest rate and the principal amount," Nasheed was quoted as saying.

He said the present Ibrahim Solih government was working on paying back the cost as well as the interest, according to Maldivian media reports.

"I can't see how our development can be rapid enough to have the amount of savings to re-pay China," he said, adding that as a solution, Maldives would renegotiate the payment structure with China.

Nasheed also said that India's GMR Group had proposed to finance the Sinamale' Bridge project (China-Maldives Friendship bridge) for $77 million, while the China Communication and Contracting Company (CCCC) presented a higher price. He said Yameen's government gave the contract to the Chinese company, due to which Maldives now owes $300 million to CCCC.

Responding to Nasheed on Saturday, the Chinese Ambassador Zhang Lizhong in a series of Twitter posts said that the cost of the bridge project was $200 million, of which 57.5 per cent was funded by a Chinese grant aid.

He said that the Maldivian government had to pay back $100 million only, which was half of the project cost, spread over a 20 year period after completing a five-year grace period. Zhang said the total amount owed by Maldives to China was $1.529 billion, which included $872 million in concessional loans and $657 million in preferential loans up to November last year.

In response, Nasheed tweeted: "Maldives total foreign debt includes the active sovereign guaranteed debt and not just government to government loans. The extent of Maldives sovereign guarantees to Chinese banks are at potentially alarming levels. We must all be mindful for the future. @AmbassadorZhang."

Retorting to Nasheed's tweet, Zhang asked him to refrain from spreading "continuous unverified and misleading information to the public", which could harm bilateral ties.

Before President Solih took office in November last year, most of the infrastructure projects had been given to China by the Yameen government, leaving the nation in massive debt.

Maldivian Finance Minister Ibrahim Ameer had earlier said: "We believe that most of these projects are at inflated prices, and so we are looking at them."

One of the projects awarded to China was a hospital in Male that had run up a cost of $140 million, much more than a rival offer of $54 million, that had been originally made, Ameer said.

As part of its string of pearls encirclement of India, which China pitched as the Belt and Road connectivity corridor project, Beijing has built ports, bridges and highways in India's neighbours, including Bangladesh, Nepal, Sri Lanka and Pakistan.

After Yameen's ouster, Prime Minister Narendra Modi had attended President Solih's inauguration and said that India stood ready to help Maldives tide over its financial problems.

Modi visited Maldives in June - his first trip to a foreign country after taking over as prime minister for the second term - signalling the close cooperation between the two nations.

During the visit, the two countries agreed to start a regular passenger-cum-cargo ferry service between Kochi in Kerala and Kulhudhuffushi and Male in the Maldives.

Maldives is also reported to be planning to scrap an agreement with China to build an Indian Ocean observatory in Makunudhoo, which would have given Beijing access to a critical space in the Indian Ocean both from the commercial shipping and strategic point of view.

President Solih had also made India his first official stop abroad.

Signalling Male's strategic importance, India has allocated Rs 576 crore to Maldives for development aid in the 2019-20 budget, higher than the Rs 440 crore allocated in the last budget.

In Sri Lanka too, where Beijing has expanded its presence, Colombo handed over its southern port of Hambantota to the Chinese on a 99-year lease, after it failed to repay its debts.

According to former diplomat Sheel Kant Sharma: "China's policies are very different from what we normally understand by economic cooperation and trade relations, in the sense that when we (India) do these things, there is no strategic component. But in the case of China, these things are very integral to their strategic vision, and even the Chinese companies are part of the government, or are very closely connected with the government."

Sharma, who was former Secretary General of the South Asian Association for Regional Cooperation (SAARC), told IANS: "In bilateral economic relations, China's whole attitude is to buy influence, and it is not because of altruistic reasons. They have never been like that ever. And this is natural when they come to Maldives, where the speciality is they have hundreds of small islands spread into the Indian Ocean.

"And if China can buy off some of the islands, they don't have to create artificial islands like they are doing in the South China Sea. So they have a strategic interest in the Indian Ocean, as some of the trade sea routes straddle this area. So Chinese are doing everything in the manner of an imperial power, and it is very difficult to segregate them from their normal economic activity," he said.

https://m.economictimes.com/news/in...warms-up-to-male/amp_articleshow/70127479.cms

Last edited:

Similar threads

International

China removes Israel from its digital maps

- Replies

- 54

- Views

- 2K

- Replies

- 19

- Views

- 624

Latest posts

-

-

-

Social Students walk out of Utah middle school to protest ‘furries’

- Latest: fedoriswar37